- Hong Kong

- /

- Construction

- /

- SEHK:1757

Affluent Foundation (SEHK:1757): Net Profit Margin Falls to 0.3%, Challenging Bullish Narratives

Reviewed by Simply Wall St

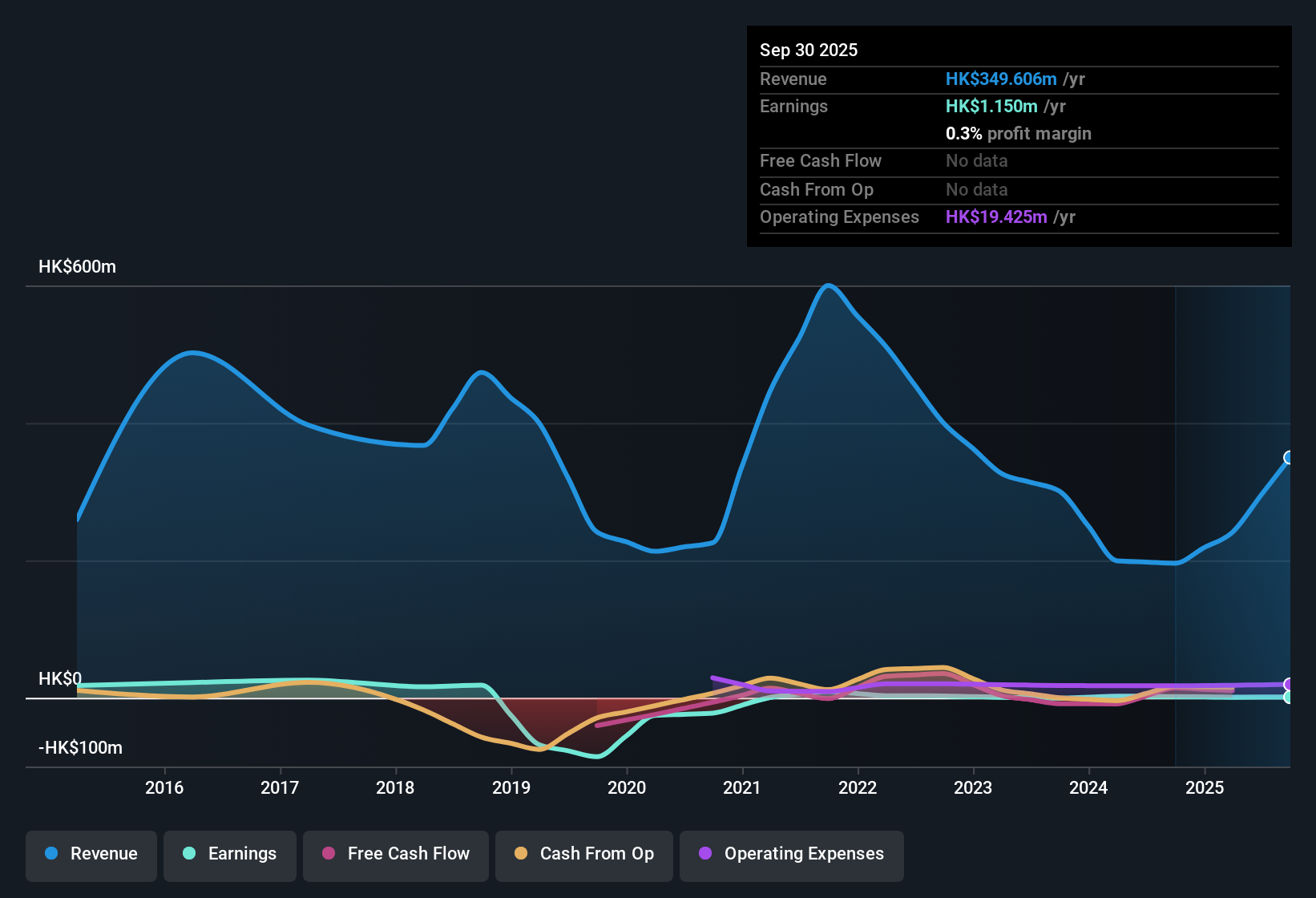

Affluent Foundation Holdings (SEHK:1757) just released its H1 2026 results, posting total revenue of $115.3 million HKD and basic EPS of 0.000799 HKD. Looking back, the company saw revenue trend from $70.4 million HKD in H2 2024 to $125.4 million HKD in H1 2025, before landing at $115.3 million HKD in this latest update. EPS moved from 0.001429 HKD to 7.8e-05 HKD during the same periods. Margins were tight across these results, with profitability metrics flashing a caution light for investors focused on the sustainability of earnings.

See our full analysis for Affluent Foundation Holdings.Next up, we will see how this latest financial snapshot matches up with what the market has been saying, and where the data may shake up some common narratives.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slips to 0.3%

- Affluent Foundation Holdings’ net profit margin over the last twelve months was 0.3%, a drop from the prior year’s 0.9%, according to the latest analysis.

- What stands out is the contraction in profitability after several years of growth, suggesting recent operations are not translating as efficiently into profits.

- The bearish case is heavily supported by the shrinking margin, which points to current financial challenges and a reversal of the previous five-year earnings growth rate of 33%.

- Bears emphasize that managing cost pressures or identifying new growth drivers is crucial, since higher single-digit margins in the past have given way to a far slimmer percentage.

Expensive Price-to-Sales Ratio Stands Out

- Valuation appears stretched with a price-to-sales ratio of 3.2x, compared to 0.9x for peers and 0.4x for the Hong Kong construction sector.

- This elevated multiple challenges the market narrative that Affluent is attractively priced, especially as recent results do not suggest a strong growth or profitability premium.

- The current share price of 0.94 HKD is above the DCF fair value of 0.18 HKD, raising questions about the sustainability of this premium.

- With no evidence of outperformance versus industry, investing at a sizable multiple may leave little margin for error in future earnings or sentiment shifts.

Volatility Rises as Insider Selling Increases

- The last three months saw a sharp spike in share price volatility, combined with significant insider selling.

- Consensus narrative notes that these patterns add to perceived risk, as short-term confidence appears undermined by selling from those closest to the business.

- Frequent swings in share price, when coupled with declining profit margins, reinforce a cautious approach by analysts and market observers.

- High insider activity, especially selling, may be read as a lack of near-term optimism from management or major shareholders.

If you want the full breakdown of how this risk/reward tradeoff looks in the eyes of the market, check the numbers and see how the consensus narrative stacks up. 📊 Read the full Affluent Foundation Holdings Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Affluent Foundation Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Affluent Foundation Holdings faces shrinking profit margins, high valuation multiples without supporting growth, and increased insider selling. These factors point to elevated risk and overvaluation concerns.

If you're looking for investment ideas with more attractive pricing and potential upside, check out these 926 undervalued stocks based on cash flows for companies trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1757

Affluent Foundation Holdings

An investment holding company, provides services related to foundation works in Hong Kong.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success