Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Wan Kei Group Holdings Limited (HKG:1718) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Wan Kei Group Holdings

What Is Wan Kei Group Holdings's Net Debt?

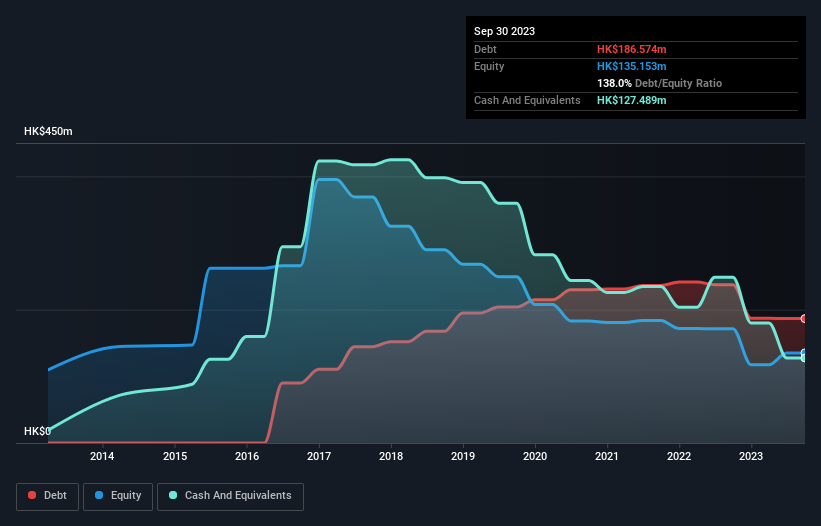

The image below, which you can click on for greater detail, shows that Wan Kei Group Holdings had debt of HK$186.6m at the end of September 2023, a reduction from HK$237.4m over a year. On the flip side, it has HK$127.5m in cash leading to net debt of about HK$59.1m.

How Strong Is Wan Kei Group Holdings' Balance Sheet?

According to the last reported balance sheet, Wan Kei Group Holdings had liabilities of HK$236.3m due within 12 months, and liabilities of HK$3.09m due beyond 12 months. Offsetting these obligations, it had cash of HK$127.5m as well as receivables valued at HK$231.4m due within 12 months. So it can boast HK$119.5m more liquid assets than total liabilities.

This surplus liquidity suggests that Wan Kei Group Holdings' balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Wan Kei Group Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Wan Kei Group Holdings saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, Wan Kei Group Holdings had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost HK$9.2m at the EBIT level. Having said that, the balance sheet has plenty of liquid assets for now. That will give the company some time and space to grow and develop its business as need be. While the stock is probably a bit risky, there may be an opportunity if the business itself improves, allowing the company to stage a recovery. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Wan Kei Group Holdings (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Wan Kei Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1718

Wan Kei Group Holdings

An investment holding company, provides foundation construction and ground investigation field works to public and private sectors in Hong Kong and Mainland China.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives