Will Surging Profit Guidance and Industry Demand Shift Precision Tsugami (China)'s (SEHK:1651) Narrative?

Reviewed by Sasha Jovanovic

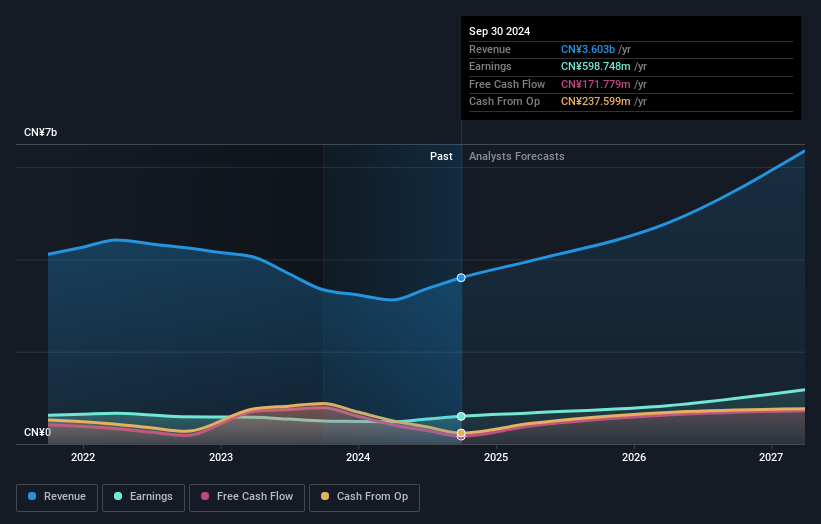

- On October 17, 2025, Precision Tsugami (China) announced that it expects to report a profit attributable to owners of approximately RMB 502 million for the half-year ended September 30, 2025, representing a substantial increase compared to the prior-year period.

- The anticipated improvement reflects rising demand in sectors such as new energy vehicles and artificial intelligence, as well as operational efficiencies boosting profitability.

- We'll explore how strengthening demand from emerging industries is shaping Precision Tsugami (China)'s investment narrative going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Precision Tsugami (China)'s Investment Narrative?

To be a shareholder in Precision Tsugami (China), you have to believe in the ongoing transformation of China’s manufacturing sector and the company's ability to capture new growth in advanced industries like new energy vehicles and artificial intelligence. The latest guidance, a roughly 48% jump in half-year profits to RMB 502 million, raises the stakes for short-term catalysts, especially as it underscores strong end-market demand and internal efficiencies that boost profitability. This news might shift views around near-term risks: instead of concerns about a cyclical slowdown or sector over-exposure, the focus arguably pivots to whether this growth surge is sustainable as operating conditions or policy tailwinds change. With robust revenue and earnings growth expected, and the stock trading well below consensus fair value before this update, recent results could inject momentum but may also prompt scrutiny around possible overreactions or whether expectations have become stretched.

By contrast, a key risk remains board independence, which investors can't afford to ignore.

Exploring Other Perspectives

Explore another fair value estimate on Precision Tsugami (China) - why the stock might be worth just HK$58.86!

Build Your Own Precision Tsugami (China) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precision Tsugami (China) research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Precision Tsugami (China) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precision Tsugami (China)'s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1651

Precision Tsugami (China)

An investment holding company, manufactures and sells computer numerical control machine tools primarily in Mainland China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives