Strong First-Half Earnings Could Be a Game Changer For Precision Tsugami (China) (SEHK:1651)

Reviewed by Sasha Jovanovic

- Precision Tsugami (China) Corporation Limited recently announced its half-year earnings, reporting sales of CNY 2,496.9 million and net income of CNY 502.25 million for the period ended September 30, 2025, both of which were higher than the prior year.

- The company's substantial increases in both revenue and earnings per share highlight ongoing momentum in its operational performance and profitability.

- We'll explore how this robust earnings growth shapes Precision Tsugami (China)'s investment narrative moving forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Precision Tsugami (China)'s Investment Narrative?

For those considering Precision Tsugami (China), the story hinges on whether you believe robust earnings growth can be sustained amid evolving industry conditions. The latest half-year results were particularly strong, with revenue and net income growth both exceeding the company’s own guidance issued just weeks prior. This outperformance directly impacts the near-term catalyst around earnings quality, and may prompt a refreshed look at the company’s value, especially as the market had already priced in substantial gains year-to-date. Short-term, enthusiasm following these results could boost confidence in ongoing share buybacks and dividend potential. However, such strong momentum also raises questions about the sustainability of margins and the lingering risks tied to board independence and dividend sustainability. After these results, the immediate risk landscape may shift from earnings consistency to whether the company can keep pace with elevated expectations. But here’s a different angle: board independence is still a concern despite impressive numbers.

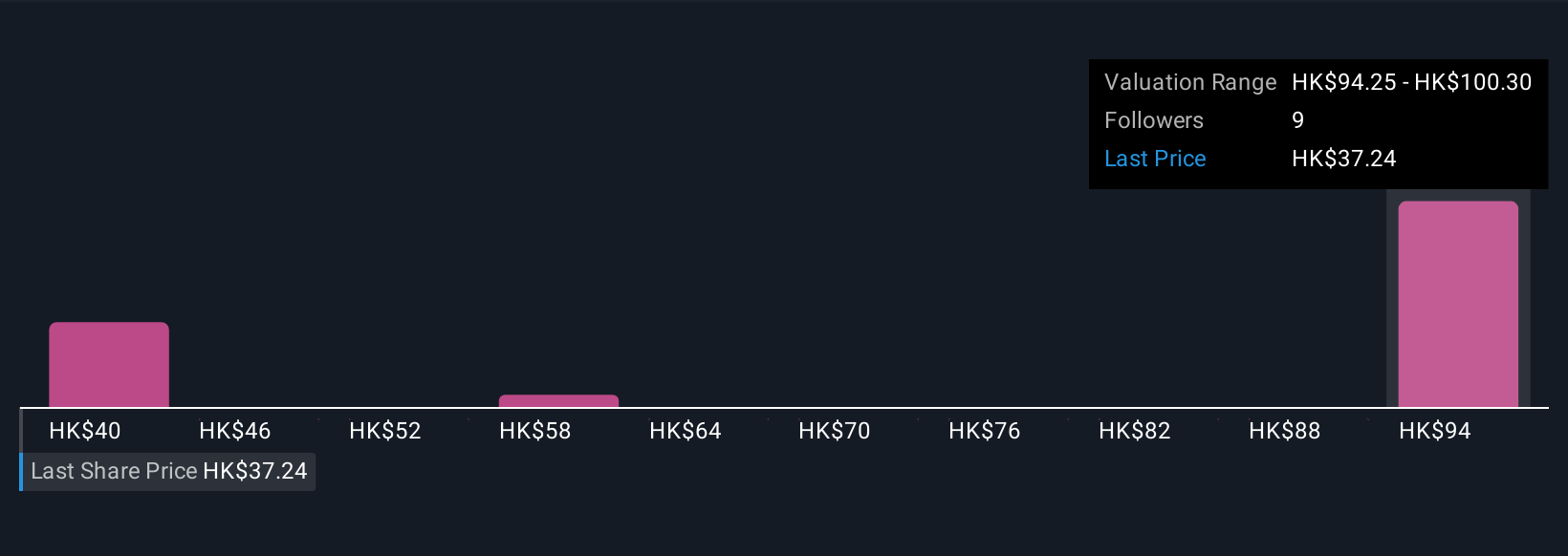

Precision Tsugami (China)'s shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Precision Tsugami (China) - why the stock might be worth over 2x more than the current price!

Build Your Own Precision Tsugami (China) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precision Tsugami (China) research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Precision Tsugami (China) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precision Tsugami (China)'s overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1651

Precision Tsugami (China)

An investment holding company, manufactures and sells computer numerical control machine tools primarily in Mainland China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives