Precision Tsugami (China) (HKG:1651) Has Announced That It Will Be Increasing Its Dividend To HK$0.25

Precision Tsugami (China) Corporation Limited (HKG:1651) will increase its dividend on the 3rd of September to HK$0.25. This will take the annual payment to 3.5% of the stock price, which is above what most companies in the industry pay.

Check out our latest analysis for Precision Tsugami (China)

Precision Tsugami (China)'s Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, based ont he last payment, Precision Tsugami (China) was earning enough to cover the dividend pretty comfortably. The business is returning a large chunk of its cash to shareholders, which means it is not being used to grow the business.

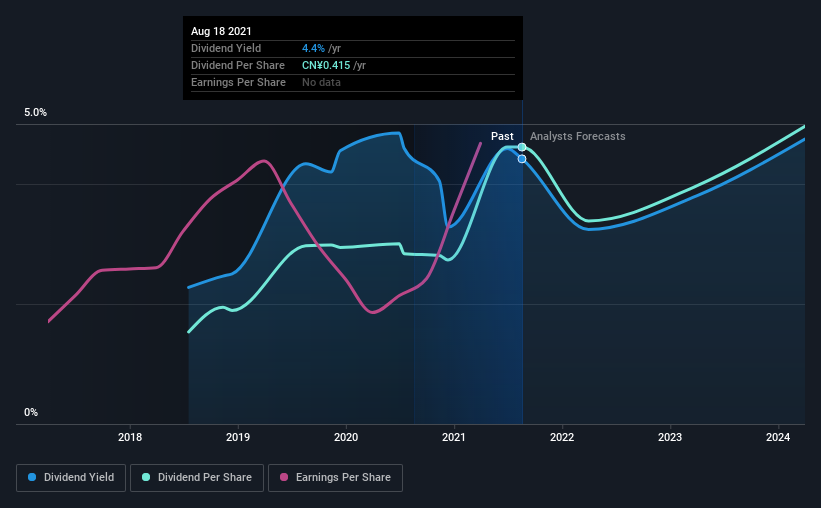

Over the next year, EPS is forecast to expand by 18.8%. If the dividend continues along recent trends, we estimate the payout ratio will be 33%, which is in the range that makes us comfortable with the sustainability of the dividend.

Precision Tsugami (China) Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The dividend has gone from CN¥0.14 in 2018 to the most recent annual payment of CN¥0.42. This works out to be a compound annual growth rate (CAGR) of approximately 44% a year over that time. Precision Tsugami (China) has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. We are encouraged to see that Precision Tsugami (China) has grown earnings per share at 22% per year over the past three years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Precision Tsugami (China) that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1651

Precision Tsugami (China)

An investment holding company, manufactures and sells computer numerical control machine tools primarily in Mainland China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives