A Fresh Look at Precision Tsugami (China) (SEHK:1651) Valuation Following Profit Surge on Manufacturing Rebound

Reviewed by Simply Wall St

Precision Tsugami (China) (SEHK:1651) just released an earnings update, reporting a 48% jump in profit for the past six months. This surge was driven by China’s manufacturing rebound and increased demand from sectors such as new energy vehicles and AI.

See our latest analysis for Precision Tsugami (China).

Precision Tsugami (China)’s surge in profitability has caught the market’s attention. Its 1-day share price return was 7.24%, pushing the stock to $37.64. The stock has notched an eye-popping 216.84% share price return year-to-date, with a 1-year total shareholder return of 260.04%, showing strong momentum and growing investor confidence in its growth prospects.

If you’re interested in discovering what else is fueling rapid growth stories, now’s the perfect time to broaden your perspective and explore fast growing stocks with high insider ownership

With profits and shares soaring at a record pace, the big question now is whether Precision Tsugami (China) remains undervalued or if the market has already factored in its future growth. Could there still be a buying opportunity?

Price-to-Earnings of 16.4x: Is it justified?

At a price-to-earnings (PE) ratio of 16.4x, Precision Tsugami (China) trades above both the industry and peer averages, despite its strong share price momentum. This multiple suggests that the market is willing to pay a premium for the company’s earnings, likely reflecting its standout growth profile and recent performance surge.

The price-to-earnings ratio compares a company's current share price to its earnings per share and is commonly used to assess valuation in profit-generating businesses. For a manufacturing company experiencing high growth, a higher PE can be justified if the market believes those earnings will expand quickly.

While the company's earnings have grown aggressively, far outpacing industry averages, this PE is not just expensive compared to peers (industry average: 12.9x, peer average: 14.1x), but it also remains below our calculated fair value PE of 19.9x. This gap could indicate potential for further upward re-rating if execution and growth expectations are met.

Explore the SWS fair ratio for Precision Tsugami (China)

Result: Price-to-Earnings of 16.4x (ABOUT RIGHT)

However, persistent industry competition and any slowdown in China’s manufacturing recovery could quickly derail Precision Tsugami (China)’s impressive growth trajectory.

Find out about the key risks to this Precision Tsugami (China) narrative.

Another View: What Does Our DCF Model Say?

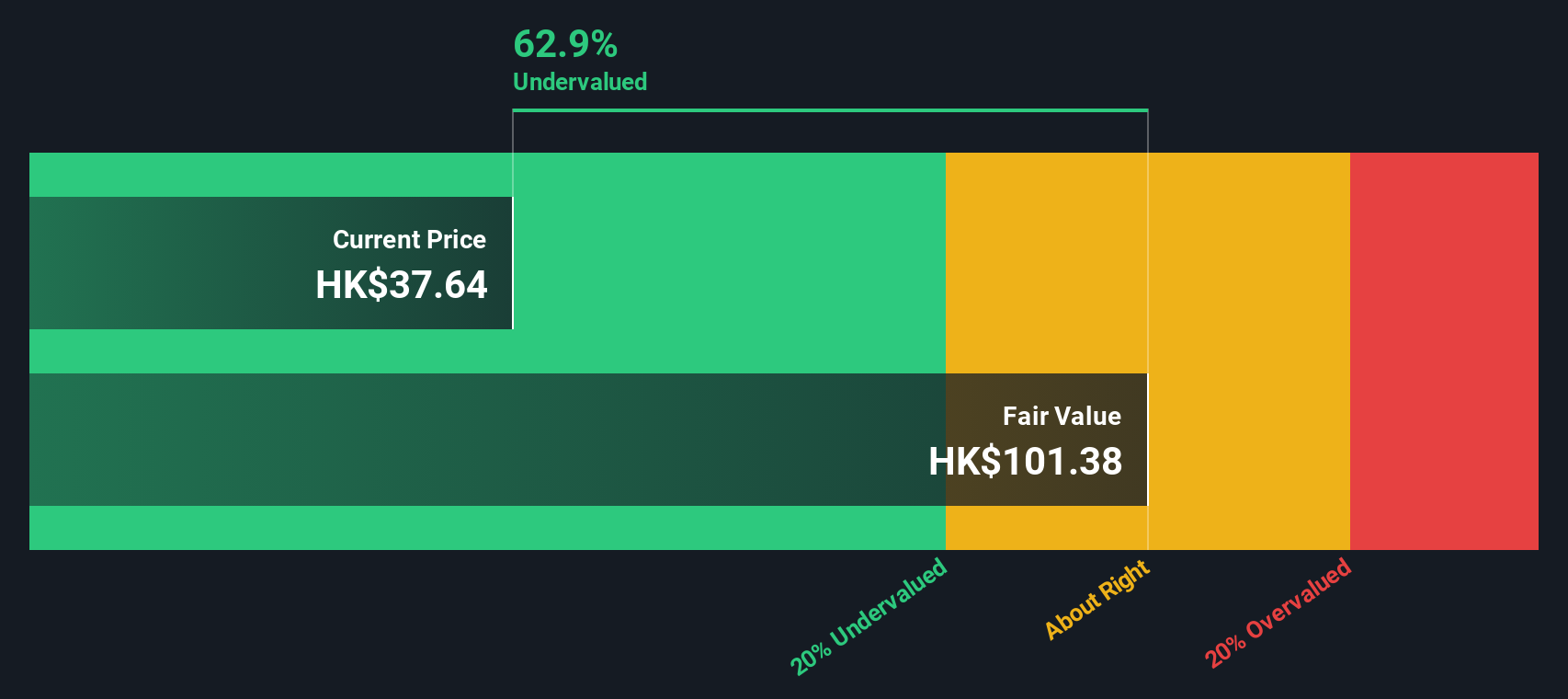

Taking a different approach, the SWS DCF model suggests Precision Tsugami (China) is significantly undervalued at its current price of HK$37.64, with a fair value estimated at HK$101.38. This sharp gap challenges the premium implied by current multiples, but which perspective will the market ultimately follow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Precision Tsugami (China) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Precision Tsugami (China) Narrative

If you think there’s more to this story or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Precision Tsugami (China) research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout stocks slip by. Expand your strategy and put your money to work in high-potential opportunities spotted by the Simply Wall Street Screener.

- Tap into tomorrow’s financial disruptors with these 80 cryptocurrency and blockchain stocks, featuring innovative companies advancing blockchain and digital payment systems.

- Uncover untapped growth with these 877 undervalued stocks based on cash flows, where you’ll find stocks trading below their true worth based on future cash flows.

- Secure steady returns by checking out these 17 dividend stocks with yields > 3%, highlighting companies with reliable yields over 3% for income-driven investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1651

Precision Tsugami (China)

An investment holding company, manufactures and sells computer numerical control machine tools primarily in Mainland China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives