- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1539

Despite lower earnings than five years ago, Unity Group Holdings International (HKG:1539) investors are up 66% since then

Unity Group Holdings International Limited (HKG:1539) shareholders have seen the share price descend 19% over the month. Looking further back, the stock has generated good profits over five years. Its return of 66% has certainly bested the market return! While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 34% in the last three years.

While the stock has fallen 10% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

We've discovered 2 warning signs about Unity Group Holdings International. View them for free.Given that Unity Group Holdings International only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last half decade Unity Group Holdings International's revenue has actually been trending down at about 1.9% per year. Despite the lack of revenue growth, the stock has returned a respectable 11%, compound, over that time. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

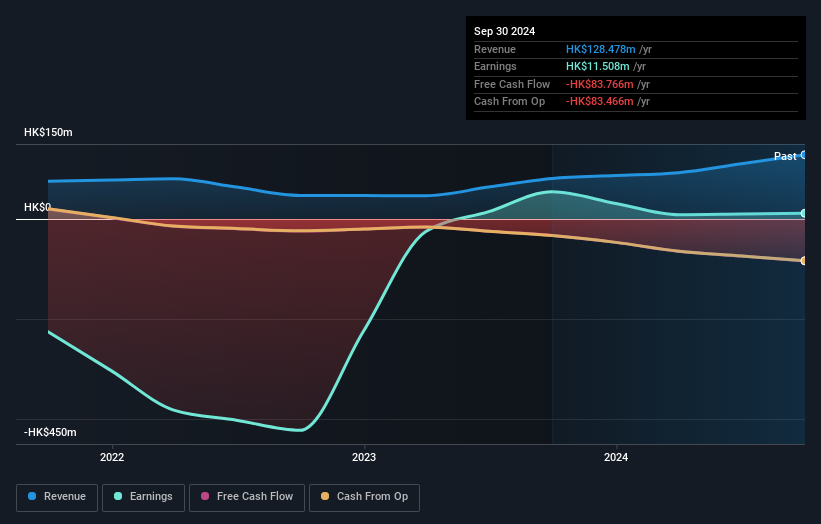

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Unity Group Holdings International provided a TSR of 2.6% over the last twelve months. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 11% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Unity Group Holdings International you should be aware of, and 1 of them doesn't sit too well with us.

Unity Group Holdings International is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1539

Unity Group Holdings International

An investment holding company, engages in the leasing and trading of energy saving products.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives