- Hong Kong

- /

- Construction

- /

- SEHK:1472

The Non-Executive Director of Sang Hing Holdings (International) Limited (HKG:1472), Chi Kin Fung, Just Sold 100% Of Their Holding

Investors may wish to note that the Non-Executive Director of Sang Hing Holdings (International) Limited, Chi Kin Fung, recently netted HK$206k from selling stock, receiving an average price of HK$0.21. That might not be a huge sum but it was 100% of their personal holding, so we find it a little discouraging.

See our latest analysis for Sang Hing Holdings (International)

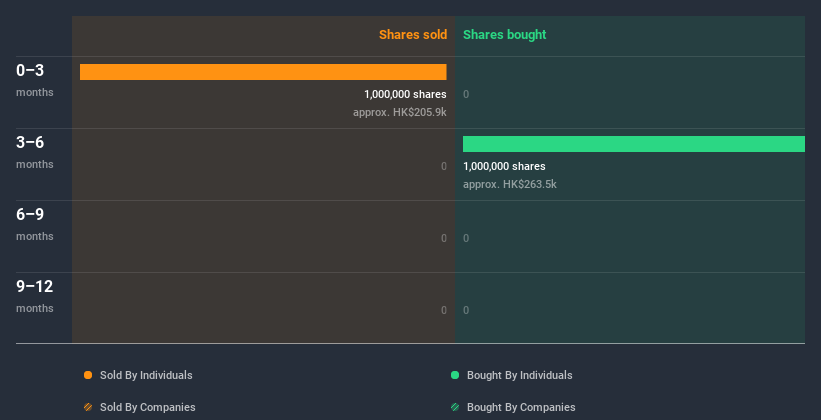

Sang Hing Holdings (International) Insider Transactions Over The Last Year

Notably, that recent sale by Non-Executive Director Chi Kin Fung was not the only time they traded Sang Hing Holdings (International) shares this year. Earlier in the year, they spent HK$210k to buy shares at HK$0.26 per share. That means that even when the share price was higher than HK$0.21 (the recent price), an insider wanted to purchase shares. Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares is very important. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. The only individual insider to buy over the last year was Chi Kin Fung. Notably Chi Kin Fung was also the biggest seller.

Chi Kin Fung bought 1.00m shares over the last 12 months at an average price of HK$0.26. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Sang Hing Holdings (International) is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership of Sang Hing Holdings (International)

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It's great to see that Sang Hing Holdings (International) insiders own 75% of the company, worth about HK$161m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About Sang Hing Holdings (International) Insiders?

An insider hasn't bought Sang Hing Holdings (International) stock in the last three months, but there was some selling. On the other hand, the insider transactions over the last year are encouraging. On top of that, insiders own a significant portion of the company. So the recent selling doesn't worry us. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. You'd be interested to know, that we found 4 warning signs for Sang Hing Holdings (International) and we suggest you have a look.

But note: Sang Hing Holdings (International) may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Sang Hing Holdings (International) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1472

Sang Hing Holdings (International)

An investment holding company, provides civil engineering and related services in Hong Kong.

Flawless balance sheet low.

Market Insights

Community Narratives