Amid heightened global trade tensions and economic uncertainty, Asian markets are navigating a complex landscape shaped by recent tariff announcements. In this context, penny stocks—often representing smaller or newer companies—are drawing attention for their potential to offer growth at lower price points. While the term 'penny stocks' might seem outdated, these investments can still present valuable opportunities when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.28 | THB1.78B | ✅ 4 ⚠️ 5 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.31 | SGD125.64M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.17 | SGD33.87M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.92 | SGD7.59B | ✅ 5 ⚠️ 0 View Analysis > |

| Oiltek International (Catalist:HQU) | SGD0.895 | SGD127.98M | ✅ 4 ⚠️ 3 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$2.70 | HK$1.11B | ✅ 4 ⚠️ 3 View Analysis > |

| Newborn Town (SEHK:9911) | HK$4.95 | HK$6.84B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.03B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$675.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$0.96 | HK$1.6B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,191 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Newton Resources (SEHK:1231)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Newton Resources Ltd is an investment holding company involved in the sourcing and supply of iron ores and other commodities both in Mainland China and internationally, with a market cap of HK$1.06 billion.

Operations: The company generates revenue of $309.94 million from its resources business, focusing on iron ores and other commodities.

Market Cap: HK$1.06B

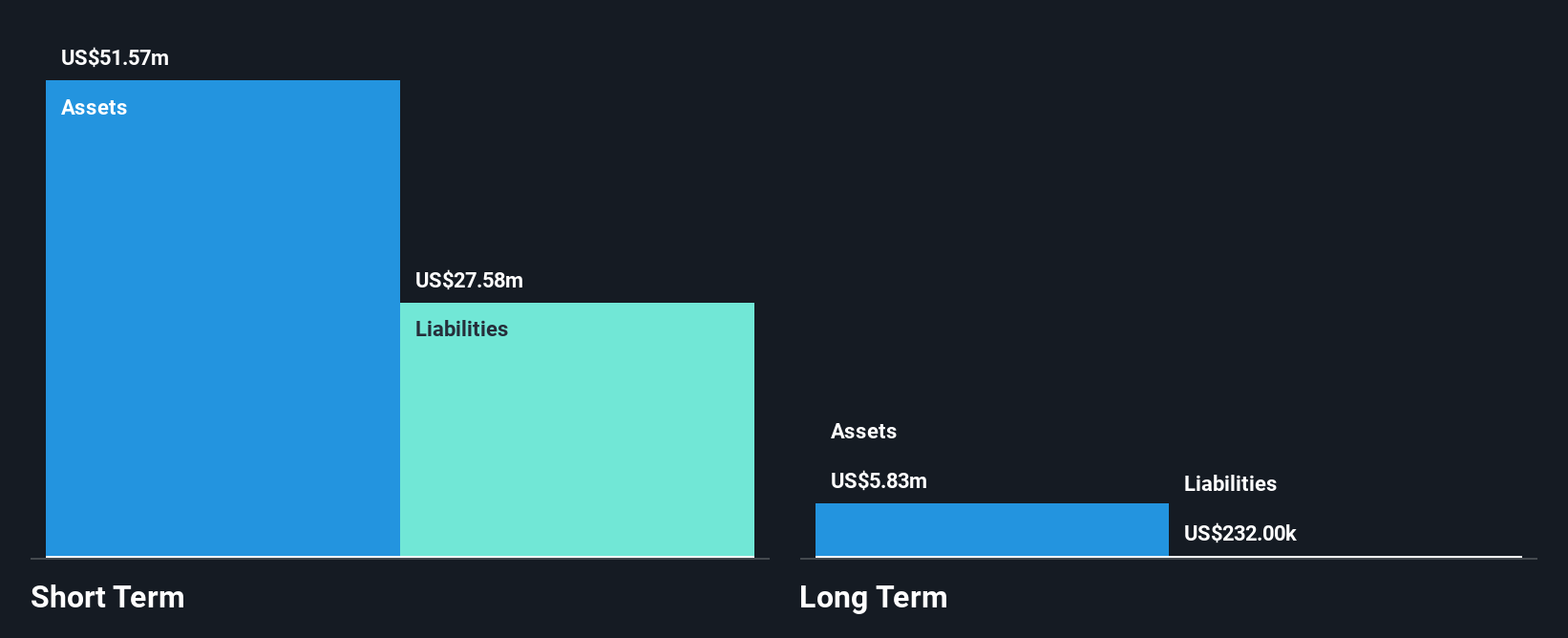

Newton Resources Ltd, with a market cap of HK$1.06 billion, reported a decline in sales to US$309.94 million for 2024, resulting in a net loss of US$0.287 million compared to the previous year's profit. Despite being unprofitable, the company has reduced its losses over five years and maintains strong liquidity with short-term assets surpassing liabilities. The board is experienced with an average tenure of 8.5 years, and the company has successfully decreased its debt-to-equity ratio significantly over five years while maintaining more cash than total debt, indicating prudent financial management amidst volatility challenges.

- Get an in-depth perspective on Newton Resources' performance by reading our balance sheet health report here.

- Examine Newton Resources' past performance report to understand how it has performed in prior years.

Acme International Holdings (SEHK:1870)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acme International Holdings Limited is an investment holding company offering design and build solutions for building maintenance unit (BMU) system works in Hong Kong, Macau, and internationally, with a market cap of HK$177.84 million.

Operations: Acme International Holdings generates revenue primarily from its BMU Systems Business, which accounts for HK$158.36 million, and its Green New Energy Business, contributing HK$42.27 million.

Market Cap: HK$177.84M

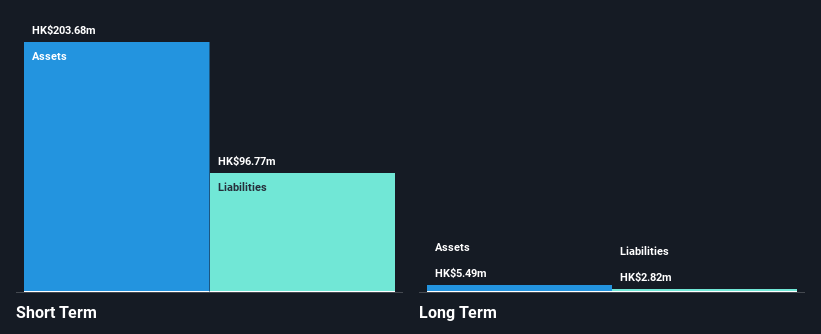

Acme International Holdings, with a market cap of HK$177.84 million, primarily generates revenue from its BMU Systems and Green New Energy businesses. Despite reporting sales of HK$200.63 million for 2024, net income significantly dropped to HK$4.44 million from the previous year’s HK$20.05 million, reflecting challenges in maintaining profitability amidst volatile earnings growth and declining profit margins. The company's debt is well covered by operating cash flow, and short-term assets exceed liabilities, indicating financial stability despite increased debt levels over five years. Recent insider selling may raise concerns about future prospects as the company plans a follow-on equity offering of HKD 47.58 million.

- Click to explore a detailed breakdown of our findings in Acme International Holdings' financial health report.

- Review our historical performance report to gain insights into Acme International Holdings' track record.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd is involved in the research, development, production, and sale of food and beverage products both in China and internationally, with a market cap of CN¥5.43 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥5.43B

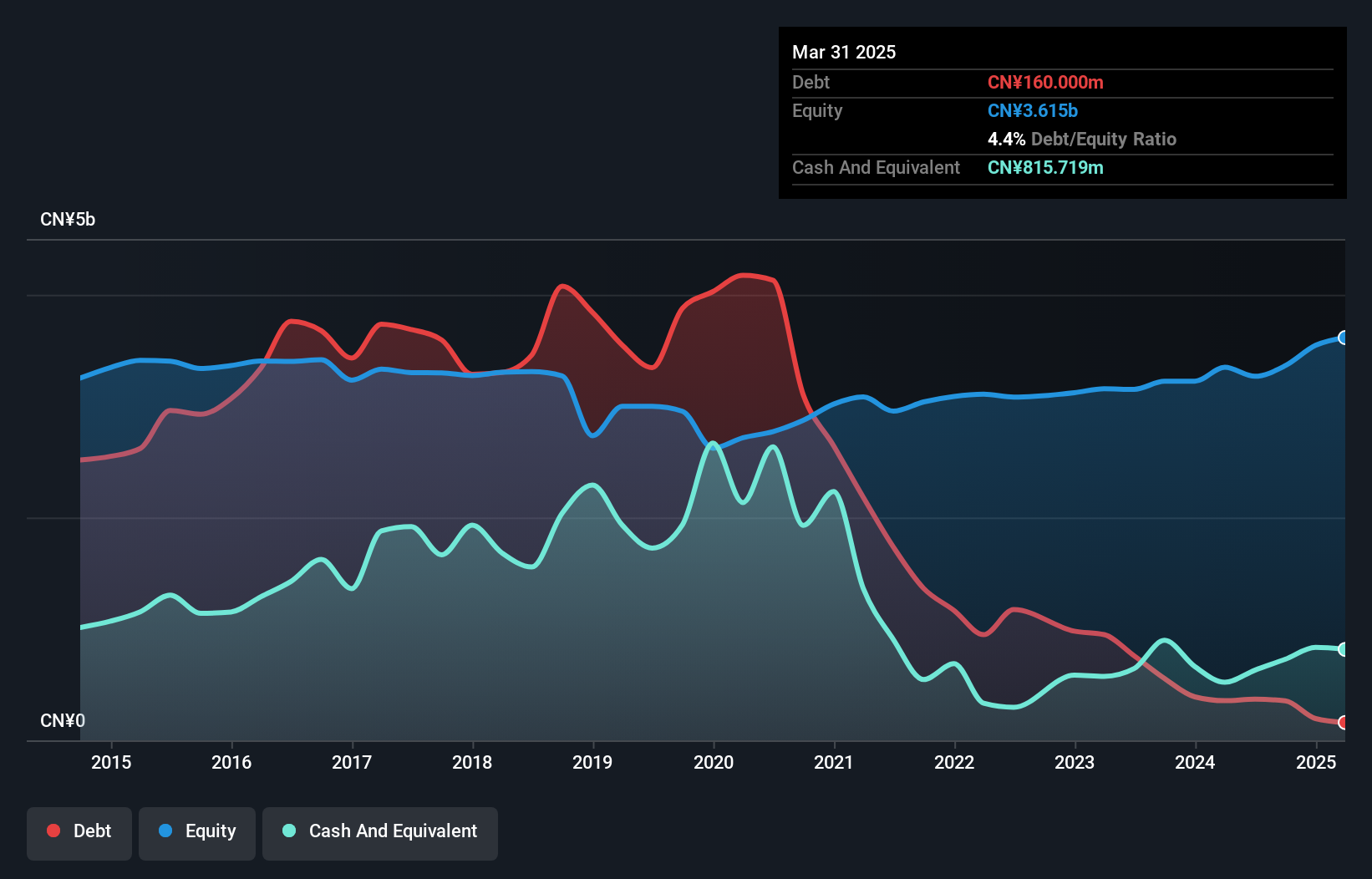

V V Food & Beverage Co., Ltd, with a market cap of CN¥5.43 billion, has demonstrated significant earnings growth of 146% over the past year, surpassing its five-year average. The company's short-term assets (CN¥1.8 billion) comfortably cover both its short-term and long-term liabilities, indicating strong liquidity. Despite a low return on equity at 9.5%, the debt level is well-managed with more cash than total debt and reduced leverage over five years. However, recent financials were impacted by a large one-off gain of CN¥149.6 million, which may not reflect ongoing operational performance accurately.

- Click here and access our complete financial health analysis report to understand the dynamics of V V Food & BeverageLtd.

- Assess V V Food & BeverageLtd's previous results with our detailed historical performance reports.

Where To Now?

- Take a closer look at our Asian Penny Stocks list of 1,191 companies by clicking here.

- Want To Explore Some Alternatives? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600300

V V Food & BeverageLtd

Engages in the research, development, production, and sale of food and beverage products in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives