- Hong Kong

- /

- Electrical

- /

- SEHK:1133

Investors Still Aren't Entirely Convinced By Harbin Electric Company Limited's (HKG:1133) Earnings Despite 28% Price Jump

Despite an already strong run, Harbin Electric Company Limited (HKG:1133) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days were the cherry on top of the stock's 514% gain in the last year, which is nothing short of spectacular.

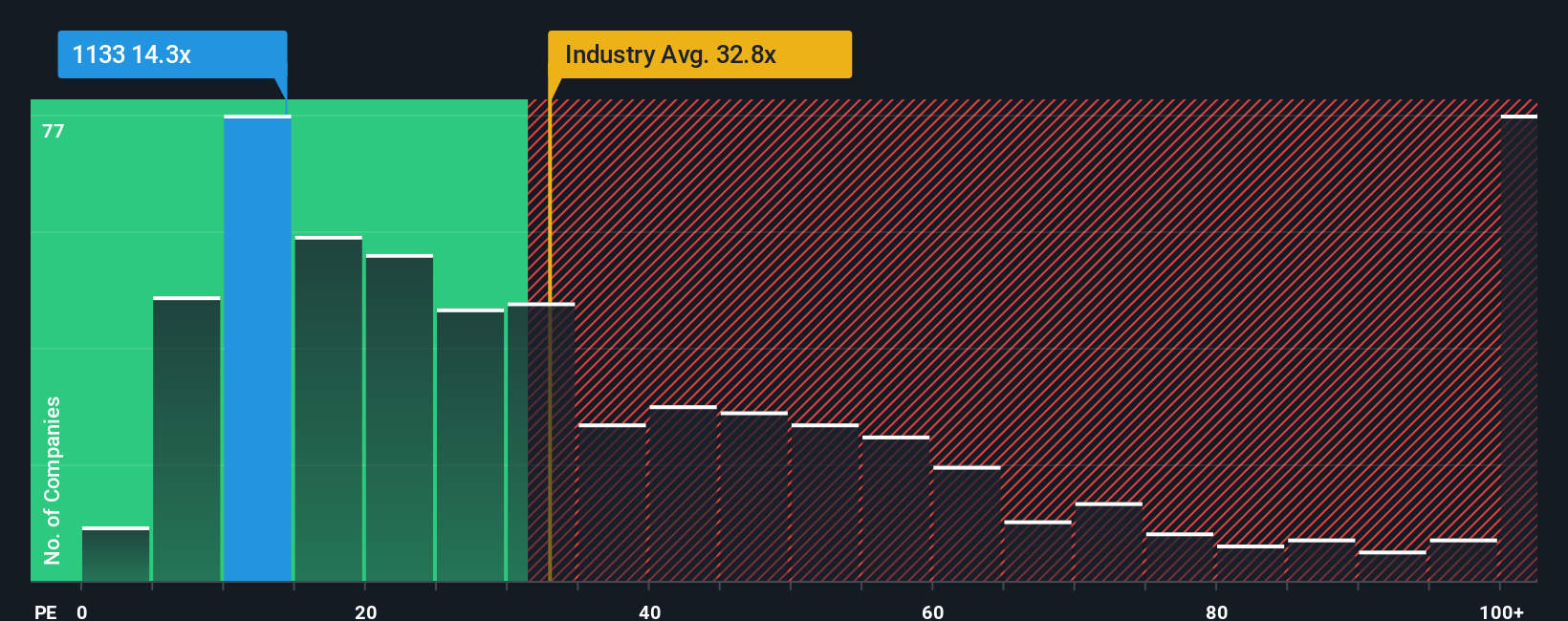

Although its price has surged higher, there still wouldn't be many who think Harbin Electric's price-to-earnings (or "P/E") ratio of 14.3x is worth a mention when the median P/E in Hong Kong is similar at about 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Harbin Electric has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Harbin Electric

Does Growth Match The P/E?

In order to justify its P/E ratio, Harbin Electric would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 106% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader market.

With this information, we find it interesting that Harbin Electric is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Harbin Electric's P/E

Harbin Electric's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Harbin Electric's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Harbin Electric with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Harbin Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1133

Harbin Electric

Manufactures and sells power plant equipment in the People’s Republic of China, the rest of Asia, Africa, Europe, and the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives