- Hong Kong

- /

- Electrical

- /

- SEHK:1133

Harbin Electric's (HKG:1133) Performance Is Even Better Than Its Earnings Suggest

Harbin Electric Company Limited's (HKG:1133) earnings announcement last week was disappointing for investors, despite the decent profit numbers. We did some digging and actually think they are being unnecessarily pessimistic.

See our latest analysis for Harbin Electric

Examining Cashflow Against Harbin Electric's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

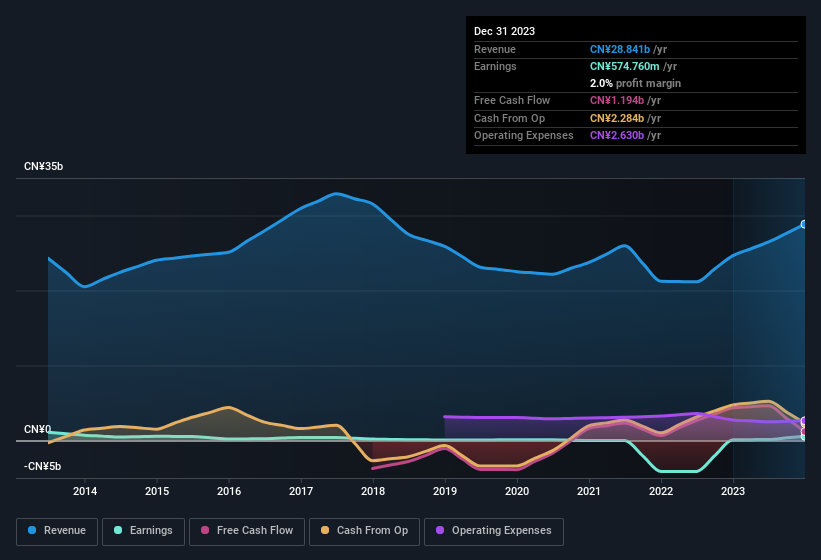

Harbin Electric has an accrual ratio of -0.32 for the year to December 2023. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. In fact, it had free cash flow of CN¥1.2b in the last year, which was a lot more than its statutory profit of CN¥574.8m. Harbin Electric's free cash flow actually declined over the last year, which is disappointing, like non-biodegradable balloons. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Harbin Electric expanded the number of shares on issue by 31% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Harbin Electric's historical EPS growth by clicking on this link.

A Look At The Impact Of Harbin Electric's Dilution On Its Earnings Per Share (EPS)

Harbin Electric was losing money three years ago. On the bright side, in the last twelve months it grew profit by 483%. But EPS was less impressive, up only 439% in that time. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Harbin Electric shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Harbin Electric's Profit Performance

At the end of the day, Harbin Electric is diluting shareholders which will dampen earnings per share growth, but its accrual ratio showed it can back up its profits with free cash flow. Considering all the aforementioned, we'd venture that Harbin Electric's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. If you want to do dive deeper into Harbin Electric, you'd also look into what risks it is currently facing. For example - Harbin Electric has 2 warning signs we think you should be aware of.

Our examination of Harbin Electric has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1133

Harbin Electric

Manufactures and sells power plant equipment in the People’s Republic of China, the rest of Asia, Africa, Europe, and the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026