- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1001

Here's Why We Think Hong Kong Shanghai Alliance Holdings (HKG:1001) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Hong Kong Shanghai Alliance Holdings (HKG:1001), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Hong Kong Shanghai Alliance Holdings' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Hong Kong Shanghai Alliance Holdings managed to grow EPS by 11% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

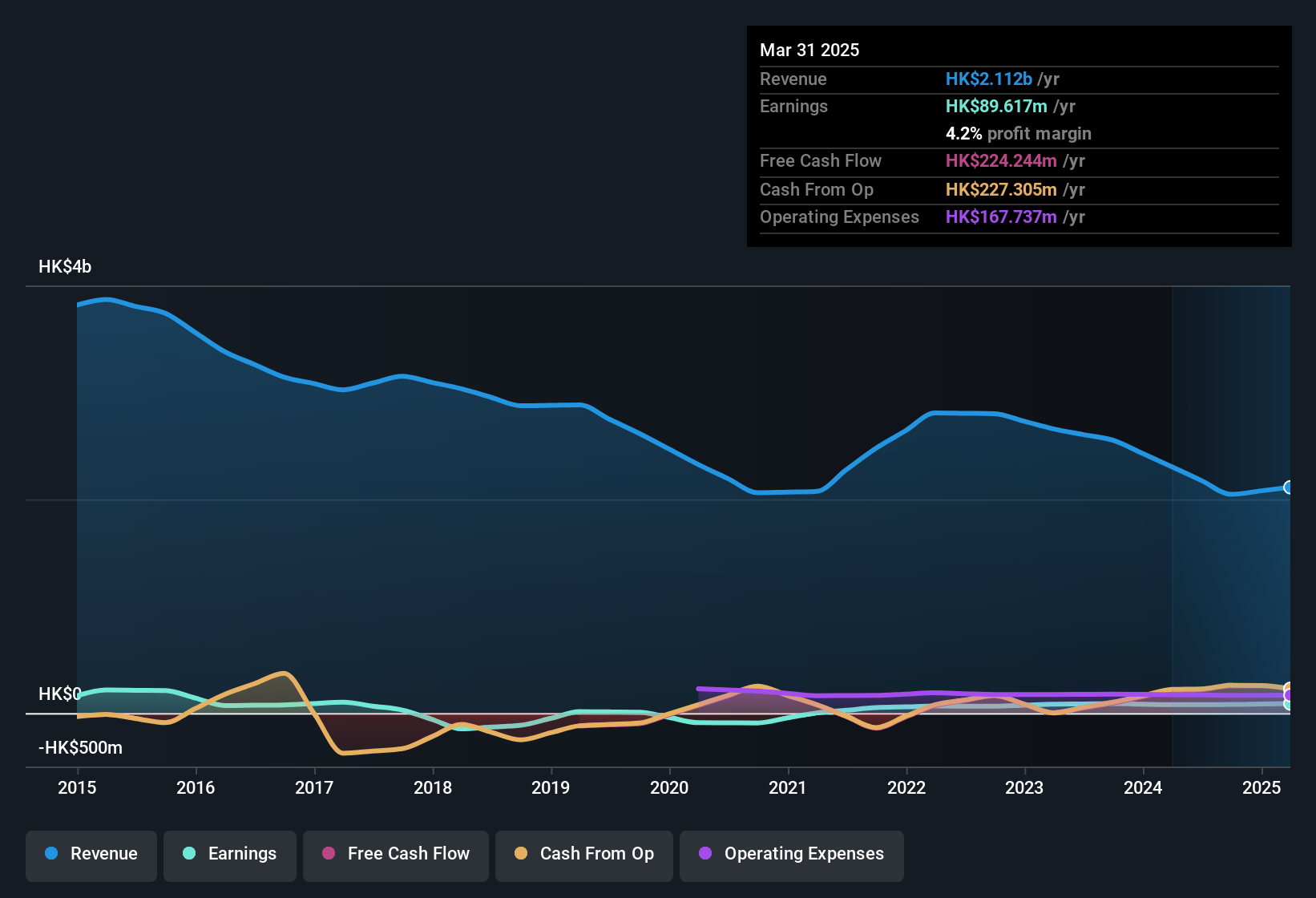

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite consistency in EBIT margins year on year, Hong Kong Shanghai Alliance Holdings has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

See our latest analysis for Hong Kong Shanghai Alliance Holdings

Hong Kong Shanghai Alliance Holdings isn't a huge company, given its market capitalisation of HK$229m. That makes it extra important to check on its balance sheet strength.

Are Hong Kong Shanghai Alliance Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in Hong Kong Shanghai Alliance Holdings in the previous 12 months. With that in mind, it's heartening that Cho-Fai Yao, the Executive Chairman & CEO of the company, paid HK$66k for shares at around HK$0.33 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Hong Kong Shanghai Alliance Holdings.

Should You Add Hong Kong Shanghai Alliance Holdings To Your Watchlist?

One important encouraging feature of Hong Kong Shanghai Alliance Holdings is that it is growing profits. It's not easy for business to grow EPS, but Hong Kong Shanghai Alliance Holdings has shown the strengths to do just that. The icing on the cake is that an insider bought shares during the year; a point of interest for people who will want to keep a watchful eye on this stock. You should always think about risks though. Case in point, we've spotted 4 warning signs for Hong Kong Shanghai Alliance Holdings you should be aware of, and 1 of them is significant.

Keen growth investors love to see insider activity. Thankfully, Hong Kong Shanghai Alliance Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Shanghai Alliance Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1001

Hong Kong Shanghai Alliance Holdings

Engages in the distribution and processing of construction materials in Hong Kong and Mainland China.

Good value average dividend payer.

Market Insights

Community Narratives