Will China Construction Bank’s Dividend Move Shape Its Capital Strategy Outlook (SEHK:939)?

Reviewed by Simply Wall St

- China Construction Bank Corporation recently reported its half-year earnings for 2025, posting net interest income of CNY 289.36 billion and net income of CNY 162.08 billion, while also announcing a proposed interim cash dividend of RMB 1.858 per ten shares, subject to shareholder approval.

- While the company's earnings and net interest income showed only slight changes year-over-year, the proposed dividend represents 30.0% of net profit and introduces shareholder decisions around dividend currency election.

- We’ll explore how the latest earnings results and dividend proposal could influence China Construction Bank’s investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

China Construction Bank Investment Narrative Recap

Investors in China Construction Bank generally need to believe in the long-term resilience of China’s banking sector, stable net interest margins, and ongoing demand for high-quality financial services. With the latest half-year results showing modest year-over-year changes in net interest income and earnings, the most important short-term catalyst, confidence in a stable net interest margin, remains largely unaffected, while exposure to pressures from lower interest rates is still a prominent risk.

Among recent announcements, the proposed interim dividend of RMB 1.858 per ten shares stands out given its link to the bank's current profit level and shareholder returns. While this dividend payout aligns with prior distributions and reinforces the company’s reliable dividend policy, it also draws attention to how dividend sustainability may become a focal point if profitability trends weaken amid ongoing economic and interest rate pressures.

However, investors should also be aware that if China’s accommodative monetary policy persists, it could pressure net interest margins and lead to ...

Read the full narrative on China Construction Bank (it's free!)

China Construction Bank's narrative projects CN¥839.5 billion revenue and CN¥362.6 billion earnings by 2028. This requires 11.9% yearly revenue growth and a CN¥37.6 billion earnings increase from CN¥325.0 billion.

Uncover how China Construction Bank's forecasts yield a HK$8.90 fair value, a 17% upside to its current price.

Exploring Other Perspectives

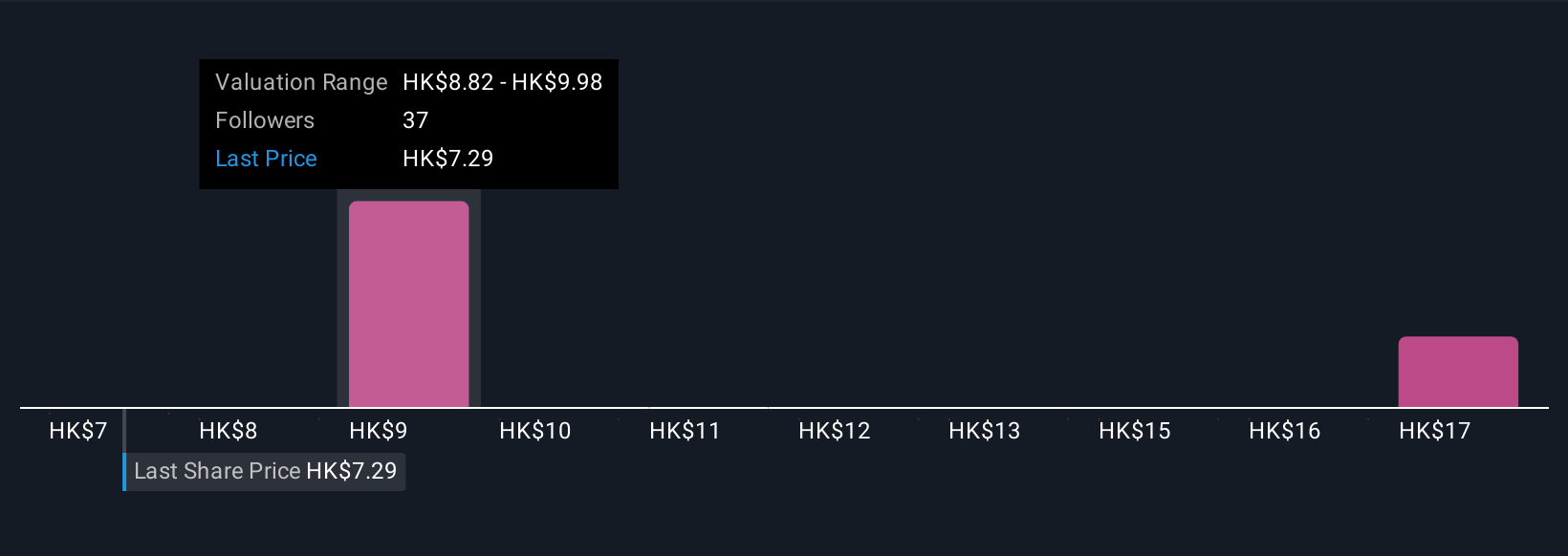

The Simply Wall St Community’s four fair value estimates for China Construction Bank range widely from HK$6.50 to HK$18.31 per share. While opinions differ, keep in mind the bank’s net interest margin is still a key risk for future returns, highlighting the need to consider multiple perspectives when evaluating value and performance.

Explore 4 other fair value estimates on China Construction Bank - why the stock might be worth over 2x more than the current price!

Build Your Own China Construction Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Construction Bank research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free China Construction Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Construction Bank's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:939

China Construction Bank

Engages in the provision of various banking and related financial services to individuals and corporate customers in the People's Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives