- Hong Kong

- /

- Diversified Financial

- /

- SEHK:628

How Much Did Gome Finance Technology's(HKG:628) Shareholders Earn From Share Price Movements Over The Last Five Years?

Gome Finance Technology Co., Ltd. (HKG:628) shareholders should be happy to see the share price up 22% in the last month. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 64% after a long stretch. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

See our latest analysis for Gome Finance Technology

Given that Gome Finance Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Gome Finance Technology grew its revenue at 21% per year. That's well above most other pre-profit companies. Unfortunately for shareholders the share price has dropped 10% per year - disappointing considering the growth. It's safe to say investor expectations are more grounded now. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

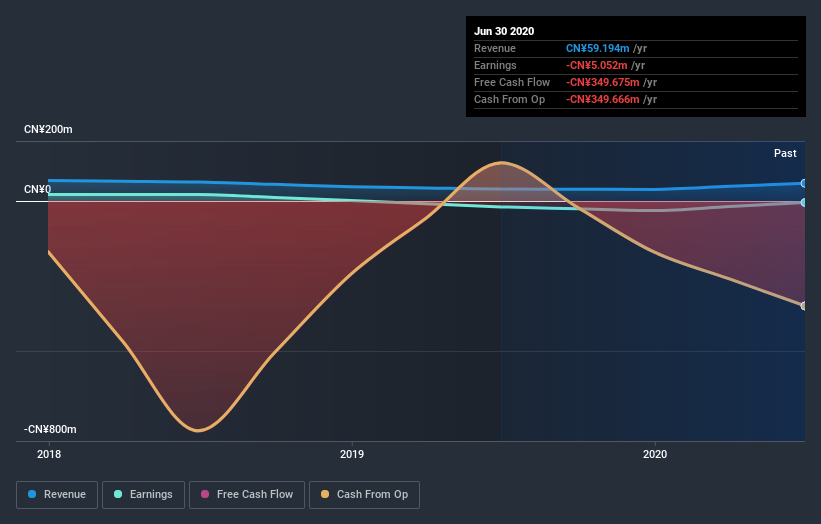

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Gome Finance Technology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Gome Finance Technology shareholders are down 1.6% for the year, but the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Gome Finance Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tong Tong AI Social Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:628

Tong Tong AI Social Group

An investment holding company, engages in the provision of commercial factoring and financial services in the People's Republic of China.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives