As Hong Kong's Hang Seng Index experiences a significant rally, buoyed by China's recent stimulus measures, investors are eyeing small-cap stocks for potential opportunities amidst the broader market optimism. In this environment, identifying stocks with solid fundamentals and growth potential becomes crucial for capitalizing on the positive sentiment sweeping through the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Uju Holding | 21.23% | -4.96% | -15.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Poly Property Group (SEHK:119)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Poly Property Group Co., Limited is an investment holding company involved in property investment, development, and management across Hong Kong, the People's Republic of China, and internationally, with a market capitalization of HK$7.60 billion.

Operations: The primary revenue stream for Poly Property Group comes from its property development business, generating CN¥35.59 billion. The company also earns revenue from property investment and management at CN¥1.87 billion and hotel operations at CN¥377.21 million.

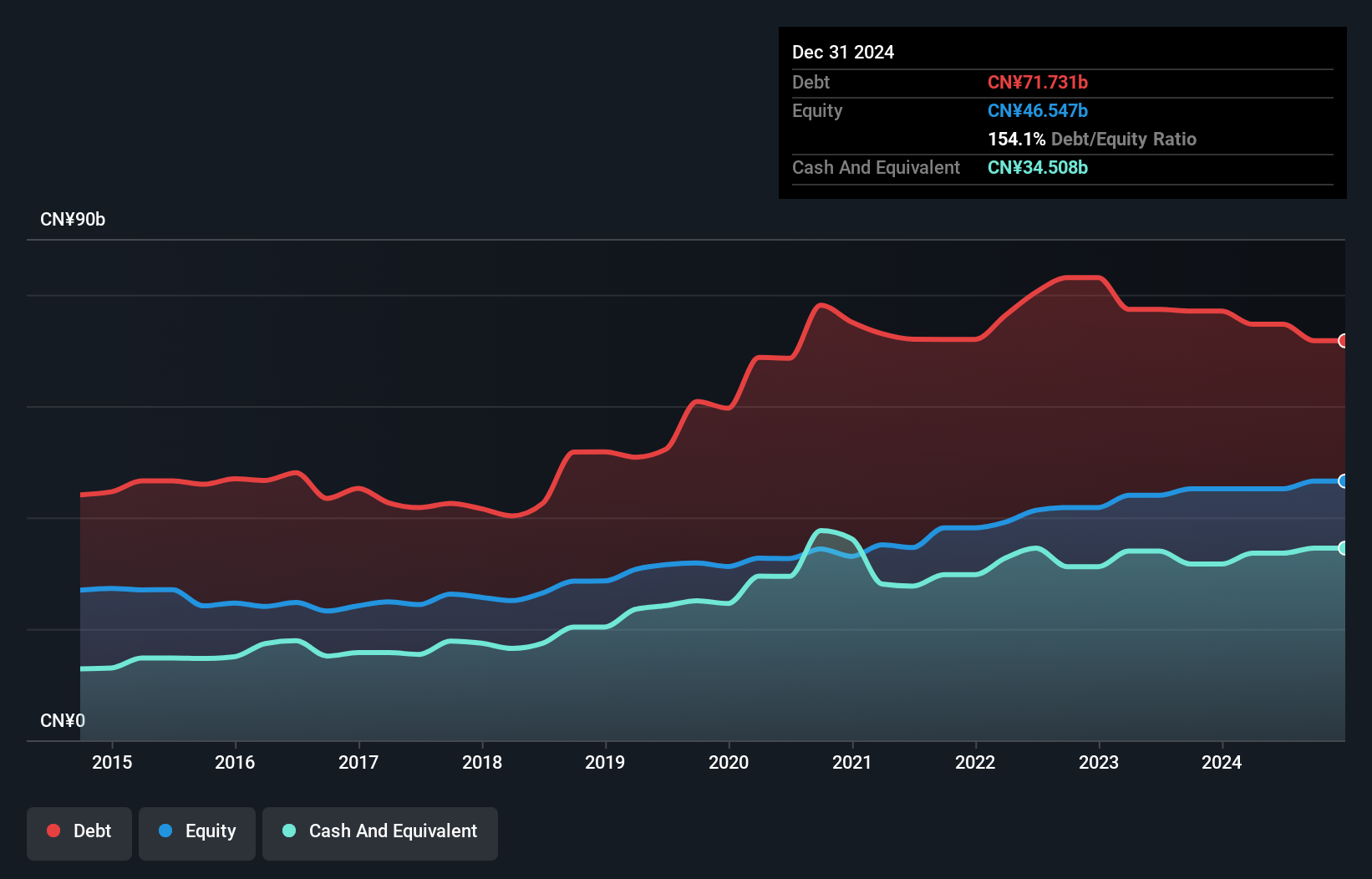

Poly Property Group, a smaller player in the real estate sector, recently reported a significant earnings growth of 531% over the past year. However, their net debt to equity ratio remains high at 91.1%, raising some concerns about financial leverage. Despite this, they are trading at an attractive valuation compared to industry peers and have generated positive free cash flow lately. Recent unaudited sales figures show contracted sales of RMB 36.8 billion by August 2024, with an average selling price of RMB 25,628 per sq.m., indicating robust market activity despite broader industry challenges.

- Navigate through the intricacies of Poly Property Group with our comprehensive health report here.

Evaluate Poly Property Group's historical performance by accessing our past performance report.

Carote (SEHK:2549)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carote Ltd is an investment holding company that offers kitchenware products to brand-owners and retailers under the CAROTE brand, with a market cap of HK$4.82 billion.

Operations: Carote Ltd generates revenue primarily from its Branded Business, contributing CN¥1.58 billion, and its ODM Business, which adds CN¥210.80 million. The company focuses on these two segments for its income streams.

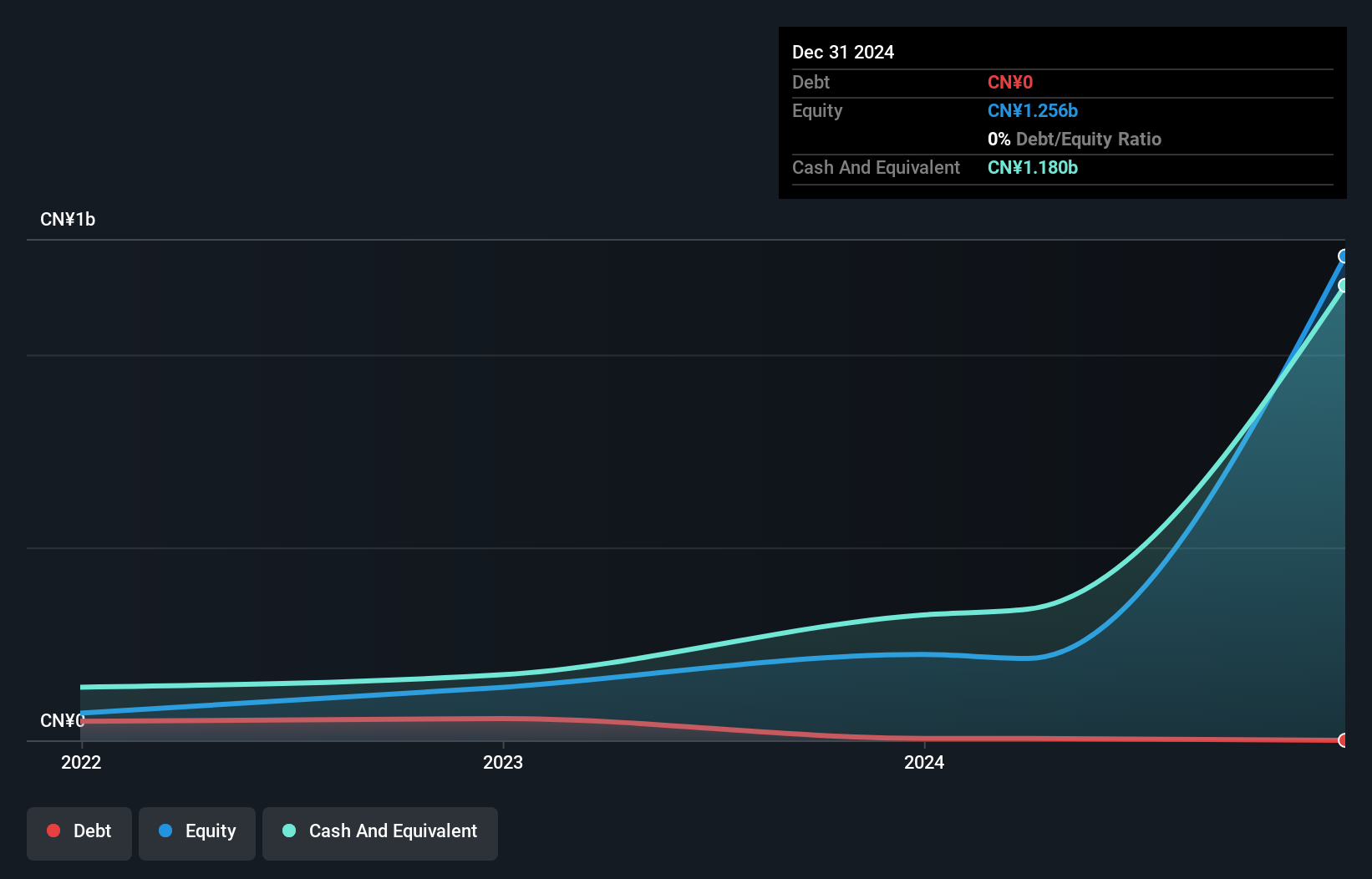

Carote, a budding player in Hong Kong's market, recently completed an IPO raising HK$750.62 million by offering shares at HK$5.78 each. The company has shown remarkable earnings growth of 92% over the past year, outpacing the Consumer Durables industry average of 20%. With high-quality earnings and trading at a significant discount to its estimated fair value, Carote presents an intriguing opportunity despite its illiquid shares and insufficient long-term debt data.

- Click to explore a detailed breakdown of our findings in Carote's health report.

Assess Carote's past performance with our detailed historical performance reports.

Harbin Bank (SEHK:6138)

Simply Wall St Value Rating: ★★★★★☆

Overview: Harbin Bank Co., Ltd. offers a range of banking products and services mainly in China, with a market capitalization of HK$4.73 billion.

Operations: Harbin Bank generates revenue primarily through its Retail Financial Business, which contributes CN¥2.99 billion, followed by its Corporate and Interbank Financial Businesses with CN¥1.02 billion and CN¥1.14 billion respectively. The bank's diverse revenue streams highlight its focus on retail banking while maintaining significant contributions from corporate and interbank operations.

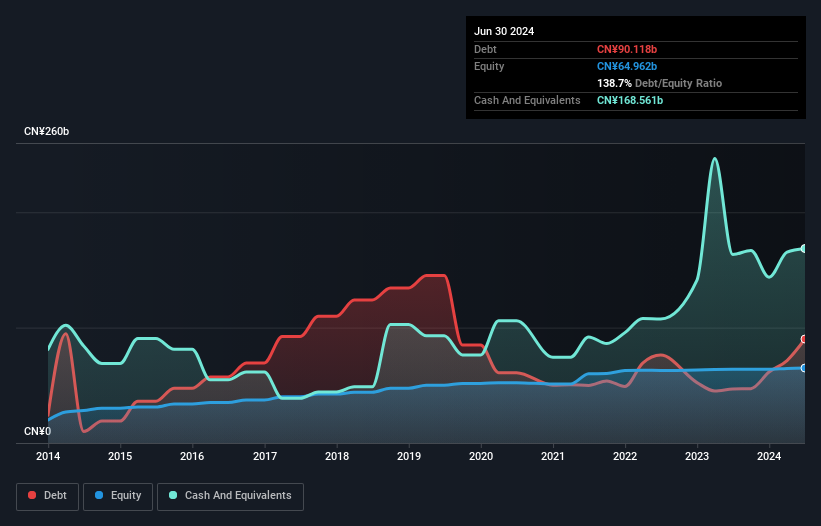

Harbin Bank, with total assets of CN¥882.8 billion and equity of CN¥65.0 billion, seems to be a promising player in the financial sector. It boasts a sufficient allowance for bad loans at 203%, while its non-performing loan ratio stands at 2.7%. Total deposits are CN¥704.0 billion against total loans of CN¥358.1 billion, reflecting a solid balance sheet structure supported by primarily low-risk funding sources accounting for 86% of liabilities.

- Click here and access our complete health analysis report to understand the dynamics of Harbin Bank.

Review our historical performance report to gain insights into Harbin Bank's's past performance.

Next Steps

- Reveal the 168 hidden gems among our SEHK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6138

Harbin Bank

Provides various banking products and services primarily in China.

Excellent balance sheet with proven track record.