A Look at Huishang Bank (SEHK:3698) Valuation Following Major Governance Overhaul Proposal

Reviewed by Simply Wall St

Huishang Bank (SEHK:3698) has held a board meeting to discuss major governance changes, including the potential abolishment of its board of supervisors and amendments to key corporate documents. These developments are likely to pique investor interest.

See our latest analysis for Huishang Bank.

Huishang Bank’s recent governance shake-up comes as its shares show strong momentum, with a year-to-date share price return of 45% and a 1-year total shareholder return nearing 68%. The latest meeting indicates the bank’s appetite for reform, which could attract increased investor attention as sentiment shifts following a 30-day share price gain of nearly 8%.

If you’re curious what other fast-moving opportunities might be out there, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

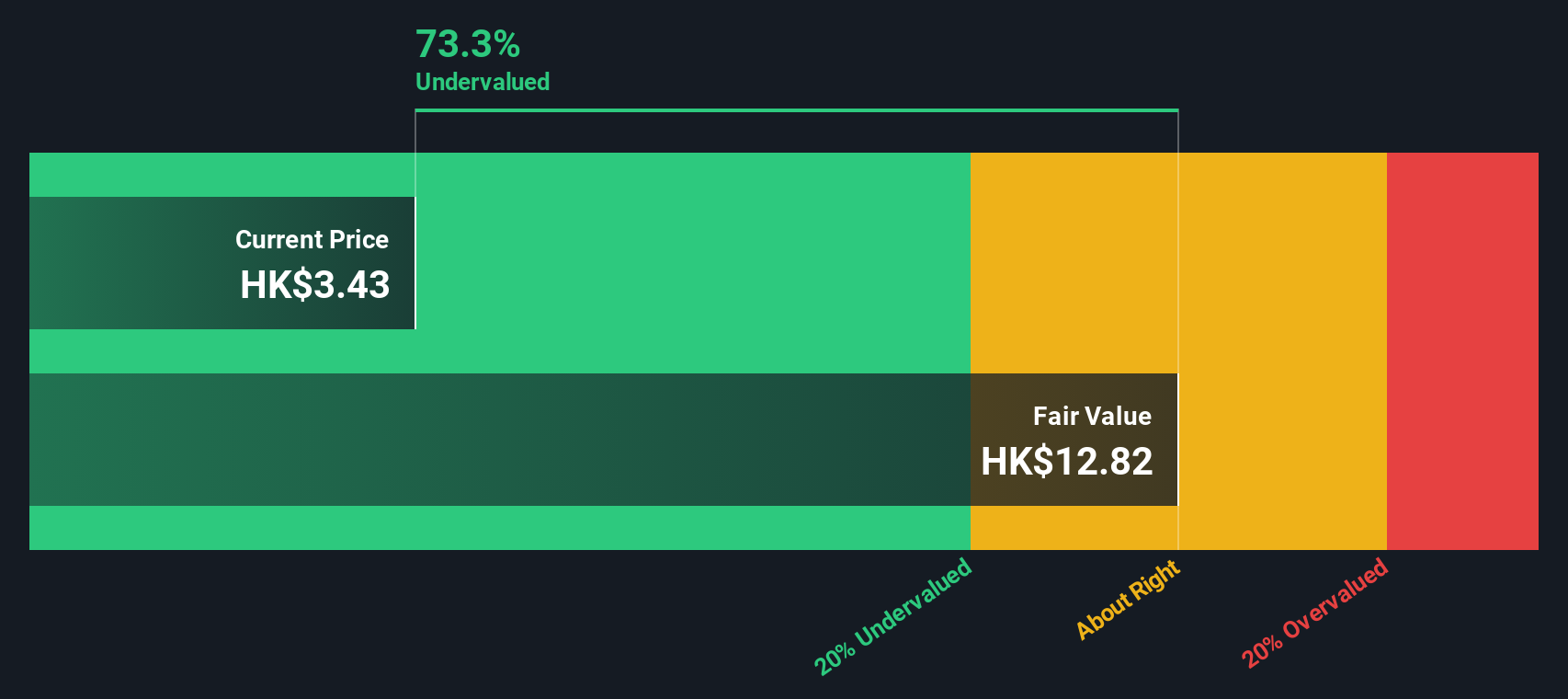

With shares already posting impressive gains, the key question now is whether the bank remains undervalued given its fundamentals or if the market has fully priced in the benefits of Huishang Bank’s sweeping governance reforms.

Price-to-Earnings of 3x: Is it justified?

Huishang Bank is currently trading at a price-to-earnings ratio of 3x, which suggests it is valued far lower than its peers. With the last close at HK$3.52, this modest multiple stands out in a sector where investors often look for earnings power and discount risk.

The price-to-earnings ratio compares the market price of a stock to its earnings per share, providing a snapshot of how much investors are willing to pay for each unit of profit. For banks, this multiple is especially relevant because it can highlight whether the market is rewarding steady and quality earnings.

The market seems to be underpricing Huishang Bank’s expected earnings. Not only is its P/E well below the Hong Kong Banks industry average of 5.9x and peer average of 7.1x, but it is also trading at less than half of its estimated fair price-to-earnings ratio of 6.1x. This is a level the market could plausibly revert toward if fundamentals hold up.

Explore the SWS fair ratio for Huishang Bank

Result: Price-to-Earnings of 3x (UNDERVALUED)

However, investors should remain cautious, as a recent negative analyst price target and slowing net income growth could quickly reverse the current positive momentum.

Find out about the key risks to this Huishang Bank narrative.

Another View: What Does the SWS DCF Model Say?

Looking at Huishang Bank through our DCF model offers a very different perspective. The SWS DCF model values the shares at HK$12.81, meaning the current price is trading 72.5% below this estimate. This suggests the market may have significantly underpriced the growth and earnings outlook.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Huishang Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Huishang Bank Narrative

If you see things differently or want to analyze the numbers firsthand, you can easily shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Huishang Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not limit your investment strategy to just one opportunity. Several standout stocks are setting up for growth in sectors shaping tomorrow’s market leaders. Make your next move with these handpicked ideas:

- Uncover explosive growth potential when you check out these 25 AI penny stocks, which are powering the AI revolution and transforming entire industries.

- Spot income opportunities and strengthen your portfolio by exploring these 15 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Catch the wave of next-level computing innovation by investigating these 27 quantum computing stocks, which is on the cutting edge of quantum breakthroughs and applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huishang Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3698

Huishang Bank

Provides various commercial banking products and services in Anhui, Jiangsu, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success