I Ran A Stock Scan For Earnings Growth And Bank of Communications (HKG:3328) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Bank of Communications (HKG:3328). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Bank of Communications

How Fast Is Bank of Communications Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Bank of Communications managed to grow EPS by 6.6% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

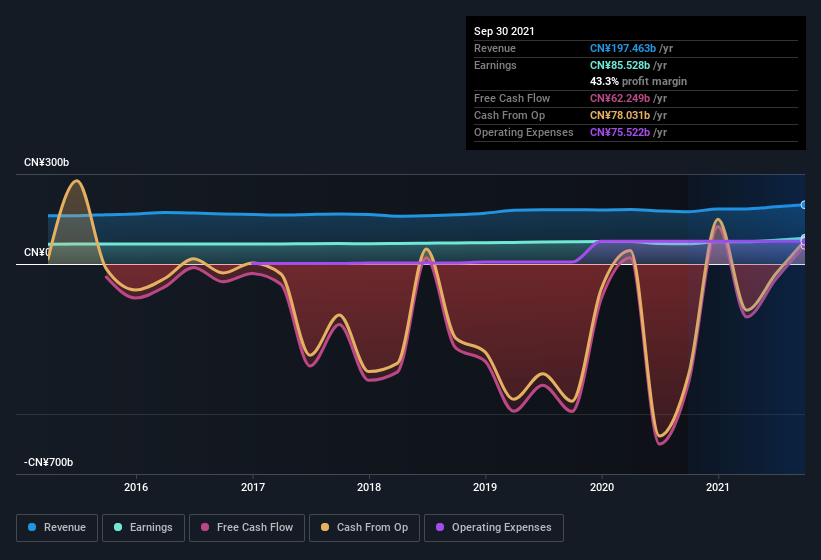

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Bank of Communications's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Bank of Communications maintained stable EBIT margins over the last year, all while growing revenue 13% to CN¥197b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Bank of Communications EPS 100% free.

Are Bank of Communications Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Bank of Communications top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the CN¥443k that Executive Chairman Deqi Ren spent buying shares (at an average price of about CN¥4.43).

It's reassuring that Bank of Communications insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like Bank of Communications, with market caps over CN¥51b, is about CN¥7.8m.

The Bank of Communications CEO received total compensation of only CN¥454k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Bank of Communications To Your Watchlist?

One important encouraging feature of Bank of Communications is that it is growing profits. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. If that doesn't automatically earn it a spot on your watchlist then I'd posit it warrants a closer look at the very least. Before you take the next step you should know about the 1 warning sign for Bank of Communications that we have uncovered.

As a growth investor I do like to see insider buying. But Bank of Communications isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3328

Bank of Communications

Provides commercial banking products and services in China and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives