Discovering None's 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a turbulent start to the year, characterized by inflation concerns and political uncertainty, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index slipping into correction territory. Despite these challenges, investors continue to seek out promising opportunities within this segment, focusing on companies that demonstrate resilience and potential for growth in an uncertain economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Yibin City Commercial Bank (SEHK:2596)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yibin City Commercial Bank Co., Ltd offers a range of banking and financial products and services to individuals, businesses, and small enterprises in China, with a market capitalization of approximately HK$12.18 billion.

Operations: The bank generates revenue primarily through interest income from loans and advances, alongside fee-based services. It faces costs related to interest expenses on deposits and borrowings. The net profit margin has shown variability, reflecting fluctuations in operational efficiency and cost management.

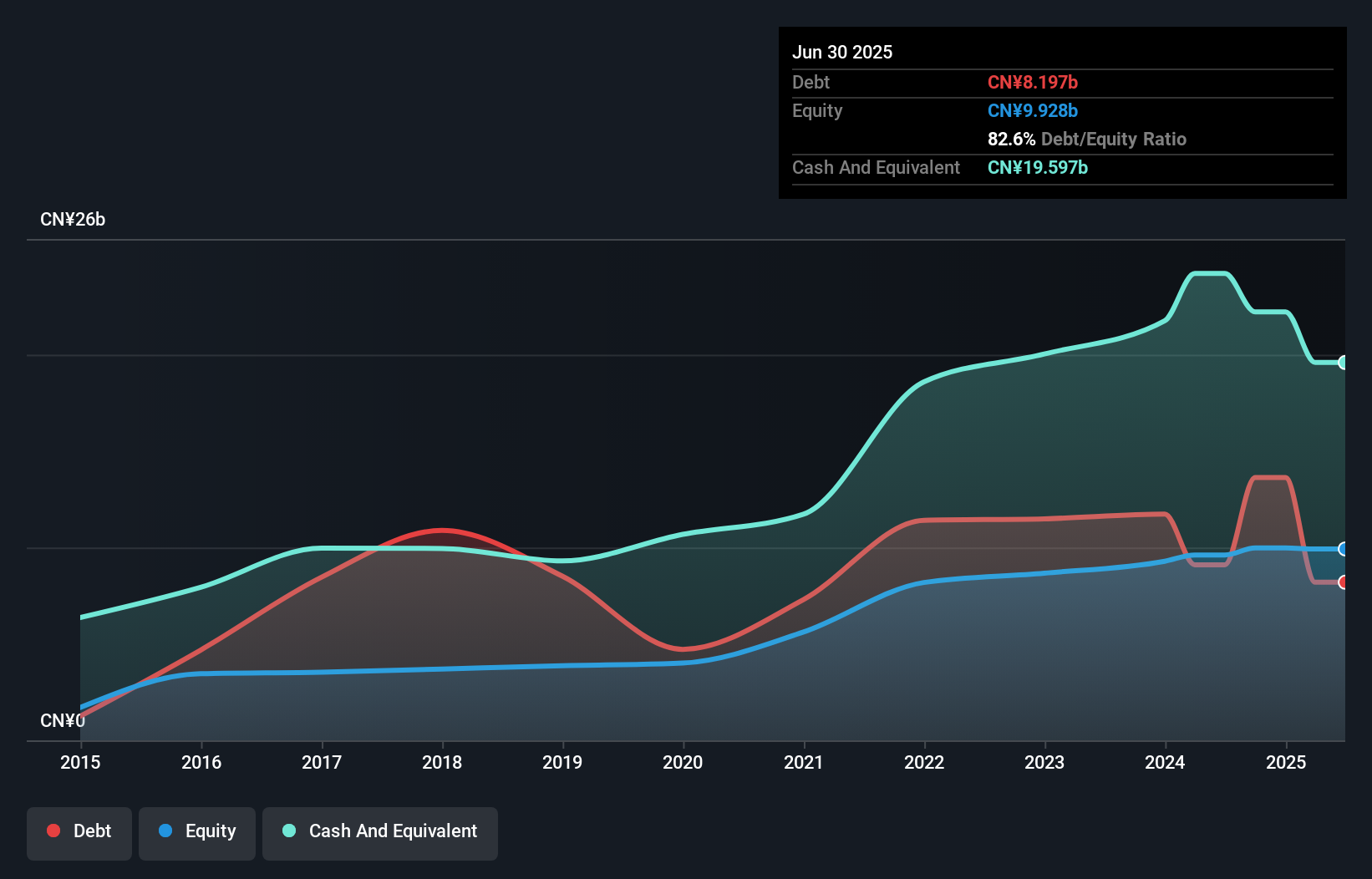

Yibin City Commercial Bank, with total assets of CN¥100.2 billion and equity of CN¥9.6 billion, is making waves after completing an IPO worth HKD 1.78 billion. It offers a robust allowance for bad loans at 178%, covering the 2.6% non-performing loan ratio effectively. The bank's earnings growth over the past year was impressive at 13%, outpacing the industry average of 1.7%. With deposits totaling CN¥78.5 billion and loans at CN¥52.7 billion, it relies on low-risk funding sources for stability, although its shares remain highly illiquid in the market.

- Navigate through the intricacies of Yibin City Commercial Bank with our comprehensive health report here.

Gain insights into Yibin City Commercial Bank's past trends and performance with our Past report.

JiangSu Changling HydraulicLtd (SHSE:605389)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Changling Hydraulic Co., Ltd engages in the research, development, production, and sale of hydraulic components both domestically in China and internationally, with a market capitalization of CN¥4.02 billion.

Operations: JiangSu Changling HydraulicLtd generates revenue primarily from the sale of hydraulic components in both domestic and international markets. The company has a market capitalization of CN¥4.02 billion.

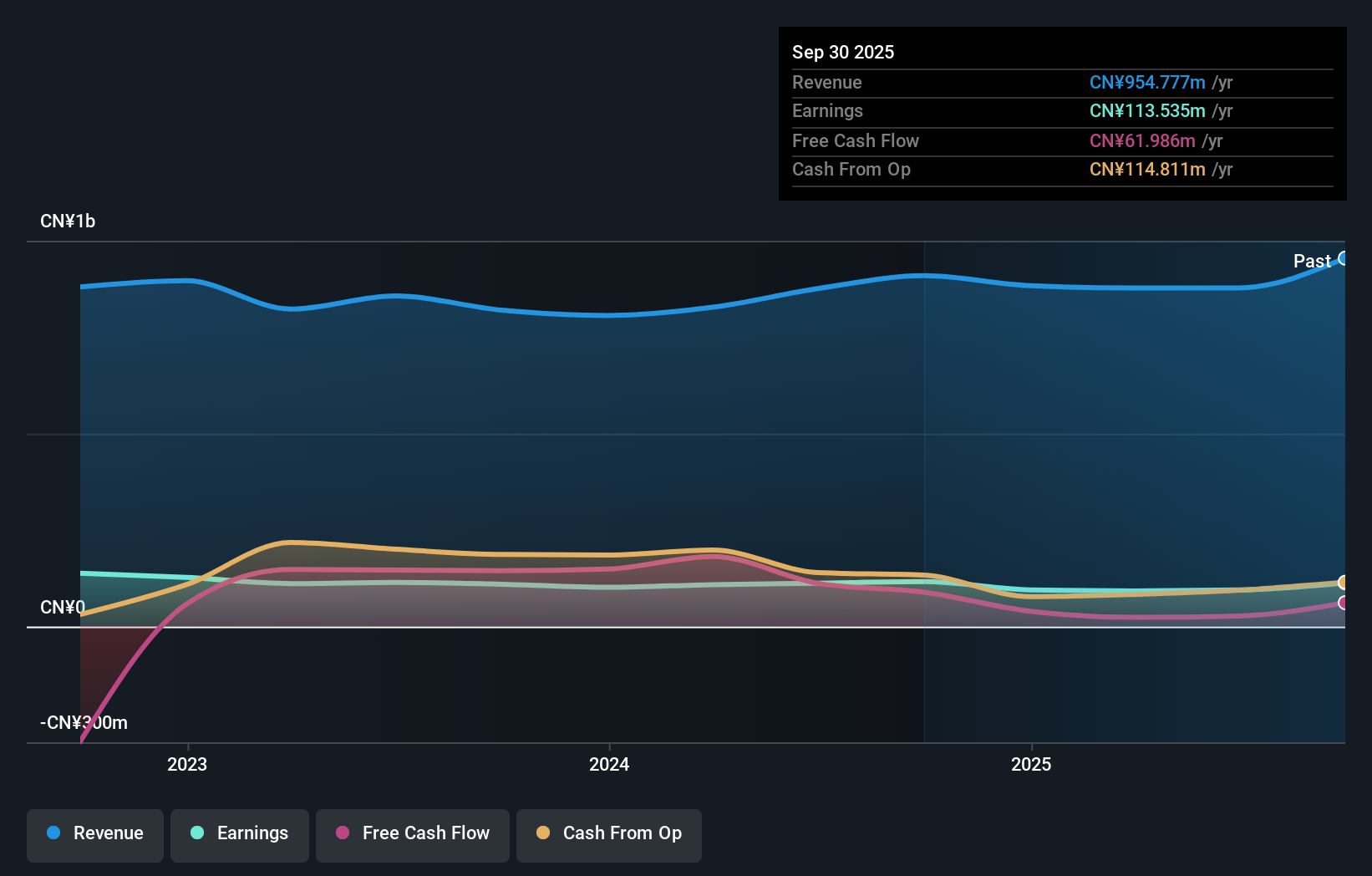

JiangSu Changling Hydraulic Ltd, a nimble player in the machinery sector, reported robust sales of CNY 678.69 million for the first nine months of 2024, up from CNY 575.72 million last year. Net income reached CNY 91.65 million compared to CNY 76.94 million previously, with basic earnings per share climbing to CNY 0.64 from CNY 0.56 a year ago. Despite facing a challenging five-year period with earnings decreasing by an average of 20% annually, recent performance shows promise as it outpaces industry growth rates and maintains high-quality earnings without any debt burden weighing it down.

Dongguan Dingtong Precision Metal (SHSE:688668)

Simply Wall St Value Rating: ★★★★★★

Overview: Dongguan Dingtong Precision Metal Co., Ltd. operates in the precision metal industry with a market capitalization of CN¥6.81 billion.

Operations: Dongguan Dingtong Precision Metal generates revenue through its precision metal operations. The company has a market capitalization of CN¥6.81 billion, reflecting its position in the industry.

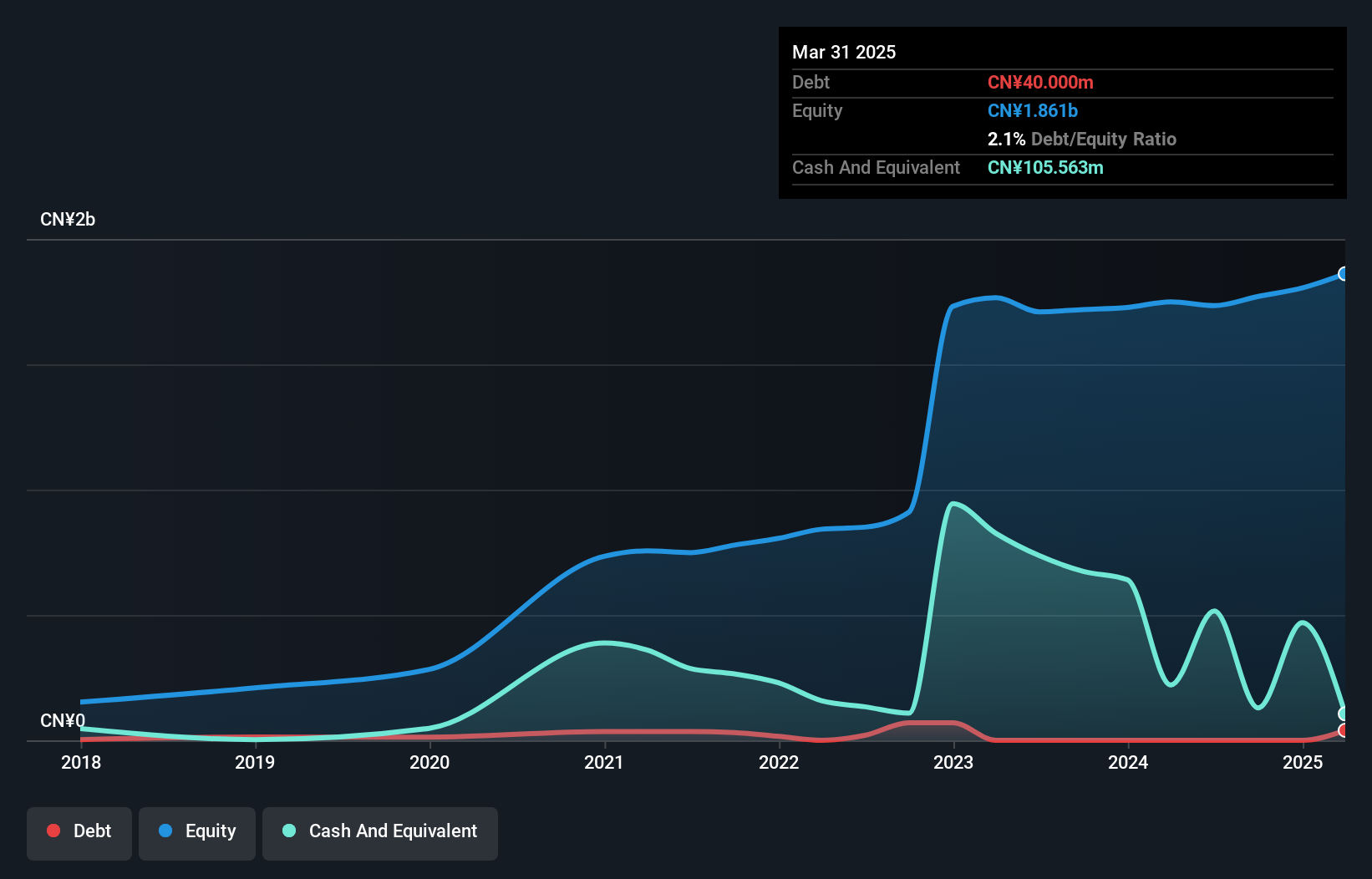

Dongguan Dingtong Precision Metal, a nimble player in the precision metal industry, showcases robust growth with earnings up 8% over the past year, outpacing the electrical industry's modest 1.1%. Despite its small size, it reported sales of CNY 703.06 million for nine months ending September 2024, a jump from CNY 490.83 million previously. Net income also rose to CNY 78.34 million from CNY 53.03 million year-on-year, reflecting high-quality earnings and no debt burden compared to five years ago when its debt-to-equity ratio was at 4.8%. However, free cash flow remains negative at -CNY146.70 million as of September 2024 due to substantial capital expenditure investments amounting to -CNY271.66 million during this period.

Make It Happen

- Investigate our full lineup of 4562 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2596

Yibin City Commercial Bank

Provides banking and financial products and services to small and micro enterprises in the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives