How Investors May Respond To Dah Sing Banking Group (SEHK:2356) Launching 24/7 US Stock Trading and Investor Index

Reviewed by Sasha Jovanovic

- Dah Sing Bank has launched its inaugural Investor Confidence Index to measure Hong Kong investor sentiment and announced enhancements to its wealth management services, including 24/7 US stock trading and exploration of virtual asset ETF offerings.

- The Index reveals heightened optimism among affluent and high net worth investors, reflecting evolving demand for sophisticated investment platforms in the region.

- To explore how these initiatives could influence Dah Sing Bank's investment narrative, we'll focus on its expansion into 24/7 US stock trading.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Dah Sing Banking Group's Investment Narrative?

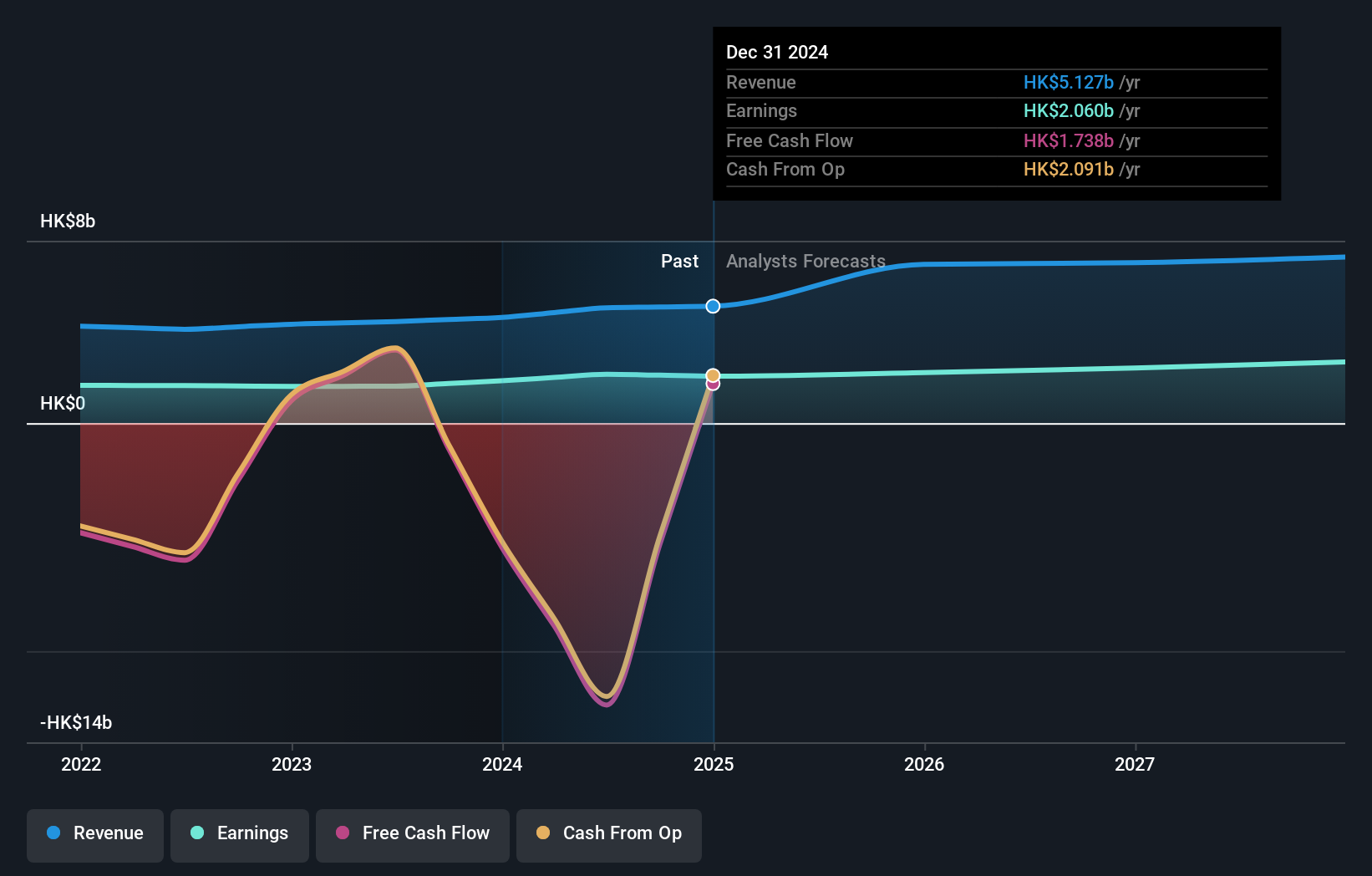

For most investors, believing in Dah Sing Banking Group now means buying into the story that the bank can capture new growth through innovation, particularly its push into 24/7 US stock trading and enhanced wealth management. The launch of its Investor Confidence Index and the signal of growing optimism among affluent clients underline attempts to stay ahead of evolving customer needs in Hong Kong’s rapidly changing financial sector. This could prove material, especially if demand for always-on trading platforms leads to an uptick in fee-generating activity and strengthens client loyalty, which are crucial short-term catalysts. However, previously, markets signaled caution on earnings growth and returns on equity, with results falling short of key benchmarks and forecasts calling for a 1% decline in annual profits over the next few years. If these new initiatives attract sizable client flows, the case for better growth and profitability could improve, but risks around profitability, unstable dividend history, high levels of bad loans, and premium valuation versus peers remain front and center.

But persistent bad loan ratios pose a risk investors should not overlook. Dah Sing Banking Group's shares have been on the rise but are still potentially undervalued by 6%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Dah Sing Banking Group - why the stock might be worth 8% less than the current price!

Build Your Own Dah Sing Banking Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dah Sing Banking Group research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Dah Sing Banking Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dah Sing Banking Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2356

Dah Sing Banking Group

An investment holding company, provides banking, financial, and other related services in Hong Kong, Macau, and the People’s Republic of China.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives