Dah Sing Banking Group (SEHK:2356): Assessing Valuation Following Investor Confidence Index Launch and 24/7 US Trading Upgrade

Reviewed by Simply Wall St

Dah Sing Banking Group (SEHK:2356) has rolled out its first Investor Confidence Index, aiming to measure how Hong Kong investors feel about the market. In addition, the bank is upgrading its US securities trading to offer 24/7 access and is considering virtual asset ETF services.

See our latest analysis for Dah Sing Banking Group.

Dah Sing Banking Group’s latest innovations come as its share price momentum has steadily accelerated, climbing 22.7% over the past quarter and showing a robust year-to-date gain of 42.5%. Looking at the longer term, total shareholder return stands out even more, with an impressive 197% over three years and 74.5% in just the past year. This suggests sustained investor confidence in the bank’s growth story. Recent expansion into 24/7 US trading and digital-first wealth solutions further contributes to this positive outlook.

If moves like Dah Sing’s US trading upgrade have you curious about what else is on the rise, now’s the time to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying so strongly and investor sentiment on the rise, the real question is whether Dah Sing Banking Group is trading below its true worth or if the market has already factored in all its future growth prospects.

Price-to-Earnings of 7.3x: Is it justified?

Dah Sing Banking Group is currently trading at a price-to-earnings (P/E) ratio of 7.3x, which is notably higher than key benchmarks from its peer group and the industry. The last close price is HK$11.57.

The P/E ratio measures how much investors are willing to pay per dollar of earnings, acting as a barometer for the company’s perceived value in relation to profits. In banking, this ratio is often used to compare similar institutions and gauge whether a stock is priced attractively given its earnings profile.

At 7.3x, Dah Sing’s shares look expensive. This is true not only compared to the Hong Kong Banks industry average of 6.1x, but also versus the peer average of 5.8x. In addition, the company’s P/E sits above the estimated fair price-to-earnings of 5.2x, indicating investors have bid its stock up relative to what the market could potentially support if fundamentals or sentiment shift.

Explore the SWS fair ratio for Dah Sing Banking Group

Result: Price-to-Earnings of 7.3x (OVERVALUED)

However, slowing net income growth and the stock trading above analyst targets could signal potential headwinds for Dah Sing Banking Group as it seeks to maintain upward momentum.

Find out about the key risks to this Dah Sing Banking Group narrative.

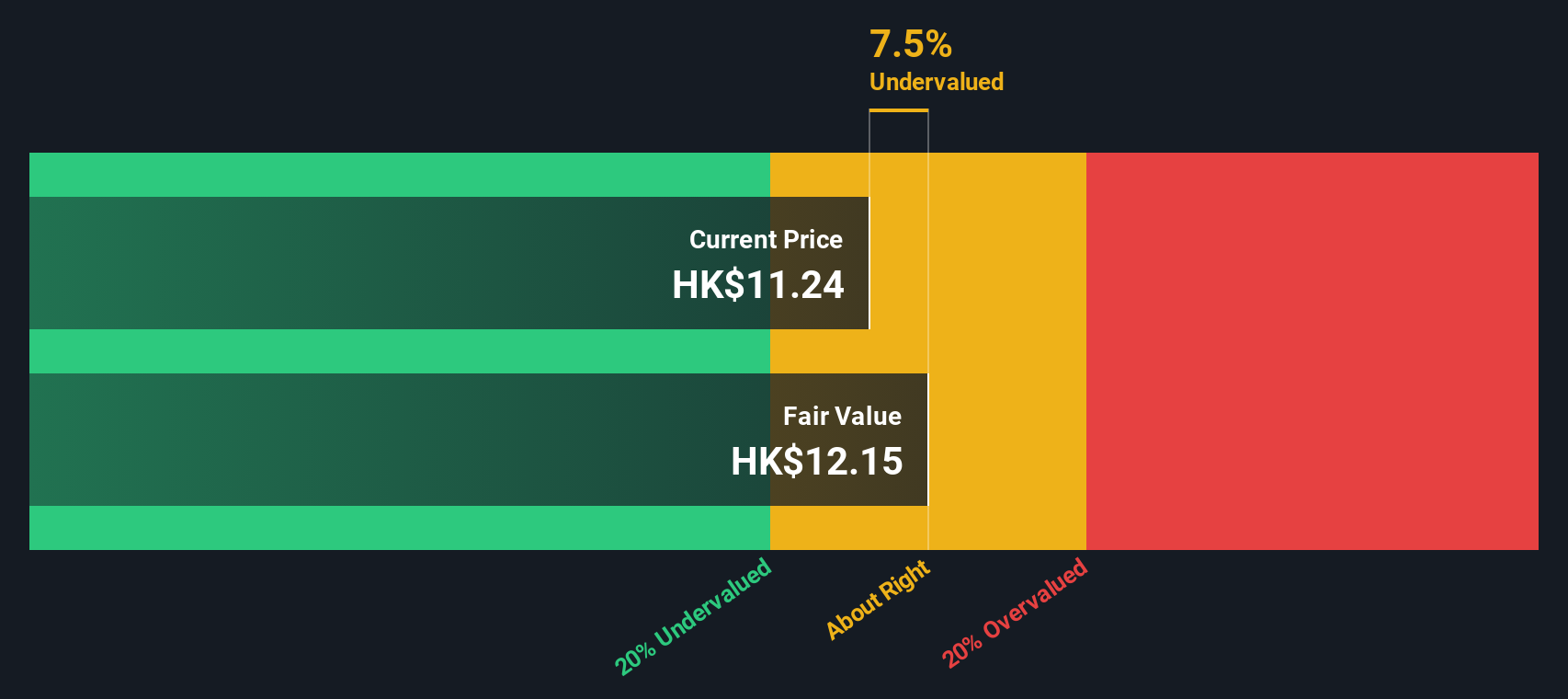

Another View: Discounted Cash Flow Offers a Different Signal

While the stock’s price-to-earnings ratio points to overvaluation, our SWS DCF model estimates Dah Sing Banking Group is actually trading 4.8% below its fair value (HK$11.57 vs. HK$12.15). Could the market be overlooking the bank’s long-term cash flow potential, or do the risks in its outlook outweigh the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dah Sing Banking Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dah Sing Banking Group Narrative

If you think there’s another angle or want to investigate the numbers firsthand, it’s easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your Dah Sing Banking Group research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities when other unique investment trends are gaining momentum. Use the Simply Wall St Screener to pinpoint stocks that could be tomorrow’s big stories.

- Boost your passive income by tracking these 16 dividend stocks with yields > 3% offering yields above 3% to strengthen your portfolio’s cash flow potential.

- Tap into the future of medicine by browsing these 31 healthcare AI stocks harnessing artificial intelligence to drive breakthroughs in healthcare.

- Seize opportunities early and position yourself ahead of the curve by reviewing these 3592 penny stocks with strong financials with strong financials and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2356

Dah Sing Banking Group

An investment holding company, provides banking, financial, and other related services in Hong Kong, Macau, and the People’s Republic of China.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives