China Zheshang Bank (SEHK:2016) Net Profit Margin Fell to 35.6%, Pressuring Bullish Community Narratives

Reviewed by Simply Wall St

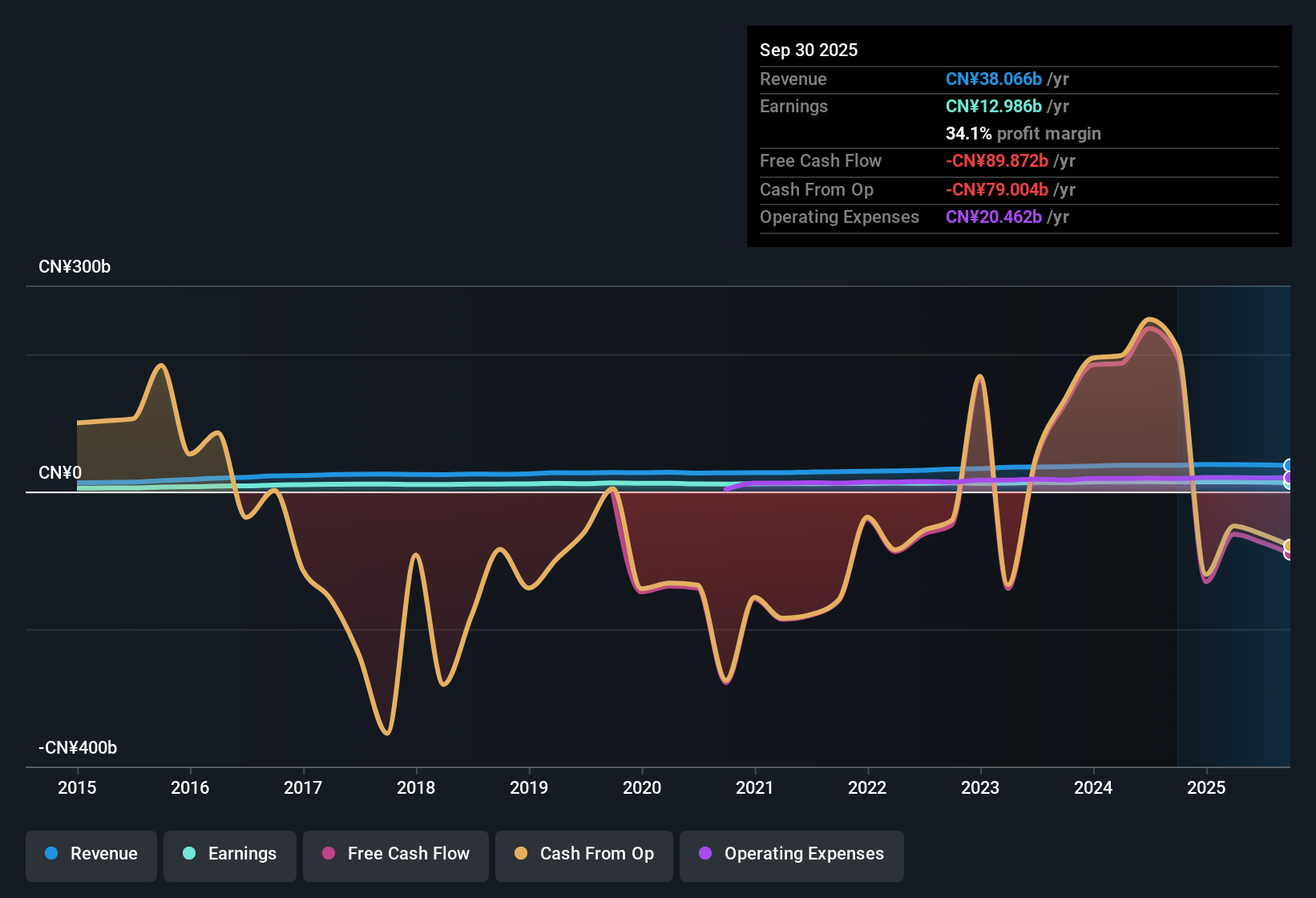

China Zheshang Bank (SEHK:2016) reported a net profit margin of 35.6% in 2016, down from the previous year's 37.3%. Earnings showed 6% annualized growth over the past five years but turned negative in the latest period. The bank’s Price-To-Earnings ratio stood at 4.6x, which is well below the peer average of 11.2x and the Hong Kong Banks industry average of 5.9x. The share price at HK$2.53 remained significantly below the estimated fair value of HK$6.87. With revenue and earnings growth forecasts both lagging the broader Hong Kong market but valuation appearing attractive, investors are navigating a balance between modest upside potential and the risk to dividend sustainability.

See our full analysis for China Zheshang Bank.The next section puts the fresh numbers head-to-head with the prevailing market narratives, highlighting exactly where the consensus aligns or gets called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Still Strong, But Slides Off Peak

- The bank’s net profit margin settled at 35.6% for 2016, declining from the previous year's 37.3%. It still stands well above most global banks, though the downward shift may draw attention.

- Despite the robust margin, the prevailing market view notes investors may scrutinize the narrowing from last year, especially as it comes alongside a period of negative earnings growth.

- The margin remains at a high level compared to industry norms, but some may question whether this represents a short-term dip or a new trend.

- It is noteworthy that, while profit margins are strong in absolute terms, their decrease coincides with diminishing earnings, which contradicts hopes for a continued operational lift off the prior five-year average.

Dividend Sustainability Flags Risk in Growth Outlook

- Only one major risk is highlighted: the sustainability of China Zheshang Bank’s dividend, which now faces more scrutiny in light of negative earnings performance and a lower net profit margin.

- The prevailing market view emphasizes that, with earnings momentum stalling and some margin pressure evident, even a single visible risk around dividends can weigh on sentiment.

- While profit or revenue growth is still forecast, the lack of recent positive earnings pushes dividend resilience to the forefront for income-focused investors.

- Consensus among investors is likely to shift toward caution until there is evidence of a clear earnings turnaround or margin stabilization.

Low P/E Signals Deep Value Versus Peers

- China Zheshang Bank’s P/E ratio at 4.6x stands sharply below both the peer average (11.2x) and the Hong Kong Banks industry average (5.9x), highlighting a significant valuation discount in the sector.

- The prevailing market view suggests that such a wide gulf between valuation and peers could attract value investors if earnings growth resumes, but cautions that the market may see this as a reflection of risk or lack of near-term catalysts.

- With the current share price at HK$2.53 versus a DCF fair value estimate of HK$6.87, the upside looks significant on paper, yet the market’s reluctance to pay a higher multiple points to underlying skepticism.

- If earnings forecasts of around 3% annual growth occur, any re-rating could depend on renewed confidence that the negative earnings phase is temporary and that margins will stabilize.

See what the community is saying about China Zheshang Bank See what the community is saying about China Zheshang Bank

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Zheshang Bank's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With dividend sustainability now in question due to slipping margins and a stalled earnings outlook, cautious investors may want to seek safer income options.

If you want more reliable dividends and less headline risk, take a look at these 1999 dividend stocks with yields > 3% to find companies with strong yields and healthier payout records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2016

China Zheshang Bank

Provides various commercial banking products and services in Mainland China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives