Bank of Chongqing (SEHK:1963) Margin Decline to 48.9% Reinforces Sector Headwinds Narrative

Reviewed by Simply Wall St

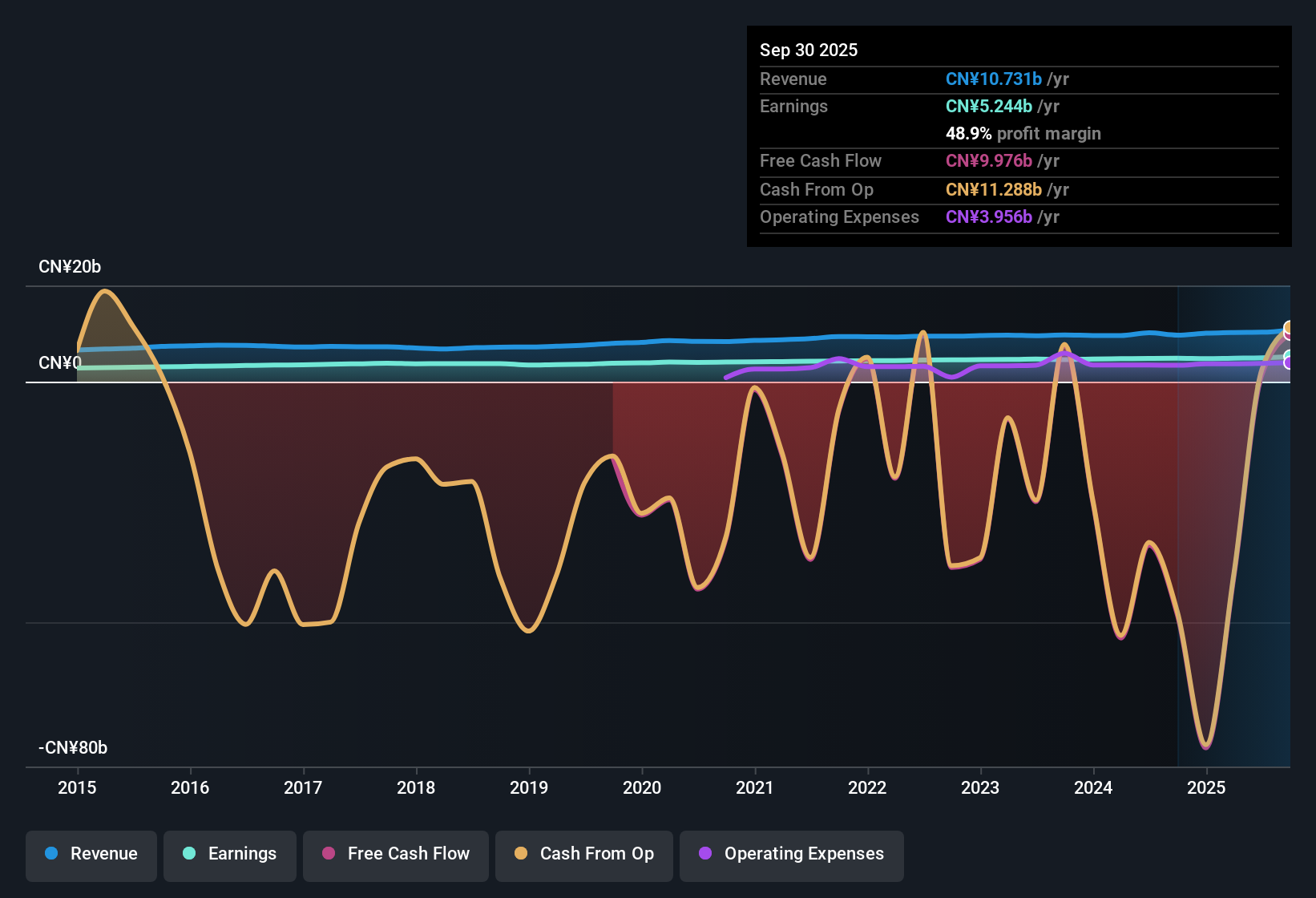

Bank of Chongqing (SEHK:1963) delivered a 7.6% gain in earnings over the last year, which outpaced its 5-year average annual growth rate of 4.2%. Net profit margins came in at 48.9%, a slight dip from the previous year’s 50.4%, but the company still maintains a reputation for high quality past earnings. With steady earnings growth, investors will be weighing this track record and positive valuation metrics against some caution on future dividend sustainability.

See our full analysis for Bank of Chongqing.The next step is comparing these latest figures with the prevailing narratives. A closer look will reveal what is aligning with expectations and what is up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Dip Below 50% Mark

- Net profit margins for the year landed at 48.9%, slipping below the previous year’s 50.4%, but still reflecting strong underlying profitability for a city commercial bank.

- The margin compression aligns with prevailing analysis that notes tighter sector conditions may be weighing on performance. However:

- Shifting sector headwinds, such as stricter regulation and non-performing loan pressures, are likely squeezing city banks, making this margin trend an indicator of overall sector challenges for 2023.

- Media and analyst commentary repeatedly state that investors should closely watch margin resilience as city banks adapt to these evolving industry pressures.

Growth Outpaces the Long-Term Trend

- Five-year average annual earnings growth sits at 4.2%, but the most recent year saw a jump to 7.6%, showcasing an acceleration beyond the bank’s typical pace.

- This stretch of above-average growth supports the view that recent digital transformation and risk control initiatives are gaining traction. Specifically:

- Media sources highlight digital upgrades and regional policy support as possible reasons the bank outpaced its historic growth averages.

- Investors will want to see if these gains can be repeated, or if this is a temporary outperformance amid shifting sector momentum.

Trading at a Discount to Industry and Fair Value

- Bank of Chongqing’s Price-to-Earnings (P/E) ratio is 4.7x, below both the Hong Kong Banks industry average of 6x and the peer group’s 6.6x, with the current share price at HK$7.68 sitting below the DCF fair value estimate of HK$9.47.

- This sizeable valuation discount supports the case that the market is undervaluing Bank of Chongqing’s resilient earnings and stable profitability. For example:

- Despite margin compression, DCF fair value and sector comparisons suggest there could be room for a re-rating if sentiment improves or digital efforts deliver clearer results.

- Income-seeking investors may see the combination of low P/E and high dividend stability as a key reason for continued interest in the stock, provided risk controls hold up.

For a closer look at how this valuation lines up with sector peers and the bank’s fundamentals, check out the broader story in the consensus narrative for Bank of Chongqing. 📊 Read the full Bank of Chongqing Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bank of Chongqing's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite resilient profits, Bank of Chongqing’s margins have slipped and ongoing sector headwinds raise questions about the consistency of future earnings growth.

If reliable performance is a priority, use our stable growth stocks screener (2100 results) to find companies that consistently deliver strong revenue and earnings growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Chongqing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1963

Bank of Chongqing

Provides various banking and services for corporate and individual customers in the People’s Republic of China.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives