ICBC (SEHK:1398) Margin Compression Challenges Bullish Value Narratives Despite Profitable Growth

Reviewed by Simply Wall St

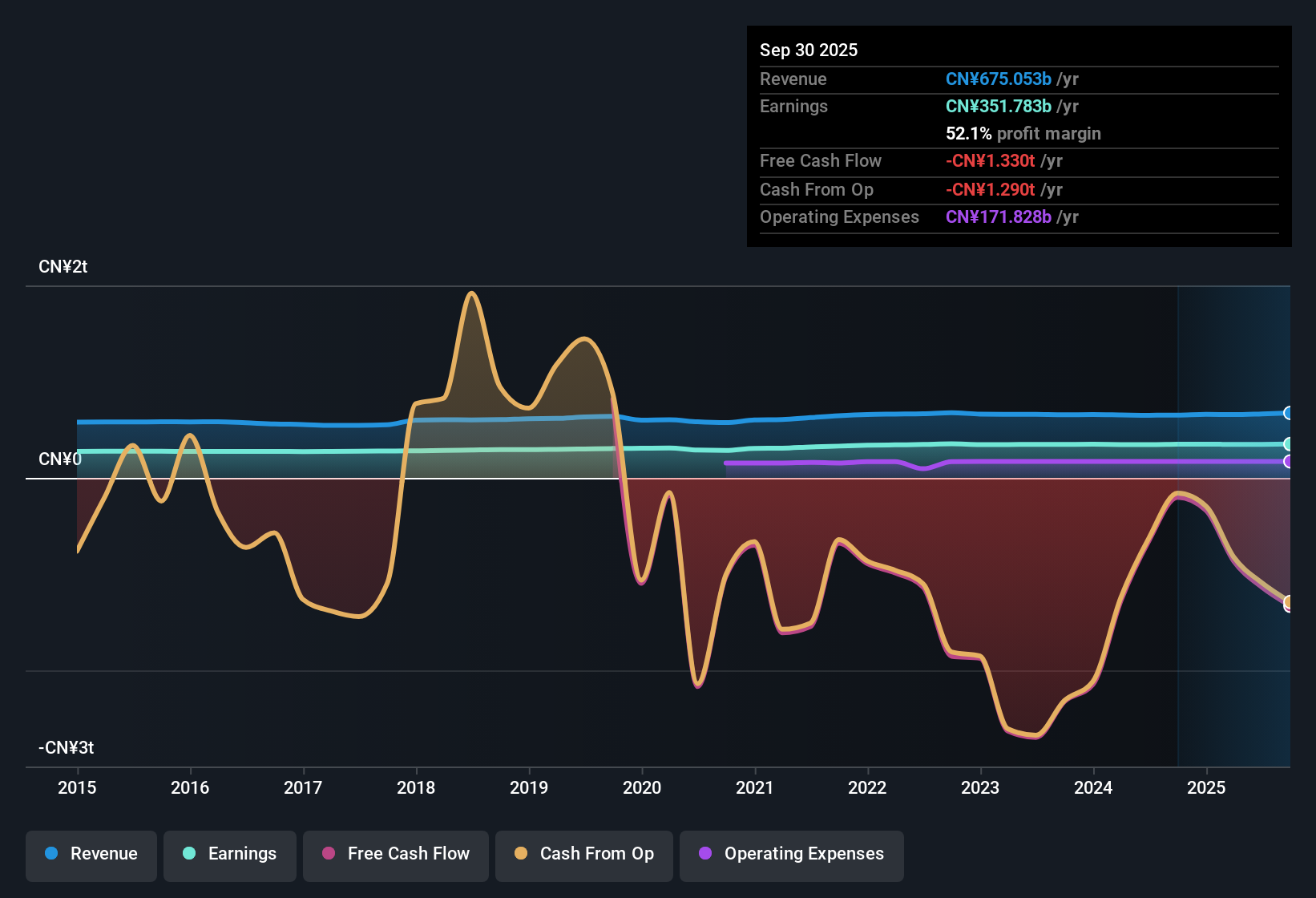

Industrial and Commercial Bank of China (SEHK:1398) posted annual earnings growth of 2.6% over the last five years and is now forecast to grow earnings at 3.4% per year going forward. Revenue is projected to climb at 8.8% per year, slightly outpacing the wider Hong Kong market, with net profit margins holding at a healthy 51.6%. This is down from 54.2% last year, highlighting some pressure on profitability despite solid ongoing profits. Investors may note that ICBC's earnings growth is expected to lag the broader market, but the stock's below-average price-to-earnings multiple and attractive rewards, such as strong dividends and high quality earnings, set up an interesting value proposition amid widely watched margin headwinds.

See our full analysis for Industrial and Commercial Bank of China.Now, let’s see how these headline results stack up against the current market narratives and community perspective. Sometimes the data reinforces expectations, while in other areas, it may challenge the story so far.

See what the community is saying about Industrial and Commercial Bank of China

Margin Resilience Amid Pressure

- Net profit margins are currently at 51.6%, reflecting a notable drop from last year's 54.2% and extending a multi-year trend of continued, but narrowing, profitability.

- Analysts' consensus view highlights that despite the margin compression, robust asset quality and expansion into digital, technology, and green finance have helped ICBC cushion earnings.

- ICBC’s Non-Performing Loan (NPL) ratio sits at 1.33% alongside a provision coverage of 217.71%, which analysts see as a crucial backstop for profits even as margins tighten.

- Consensus narrative notes ongoing diversification efforts, such as green loans growing 16.4%, may help offset pressures. However, analysts warn that policy-driven lending could keep returns below industry highs.

- The central debate in the consensus narrative is whether margin headwinds will continue to erode ICBC’s ability to out-earn peers via new revenue engines and disciplined risk control.

📊 Read the full Industrial and Commercial Bank of China Consensus Narrative.

Digital Transformation Drives New Revenue

- Mobile banking users have surpassed 265 million, and open banking transaction volumes hit CN¥249 trillion, indicating successful digital rollouts and a push toward efficiency and diversified revenues.

- Analysts' consensus view sees digital and product innovation as crucial to differentiation.

- The integration of AI and expansion in personal loans and wealth management are forecast to support long-term cost efficiency and revenue diversity, counterbalancing some traditional margin risks.

- Leadership in cross-border finance, such as ICBC’s role as a RMB clearing bank in 12 countries, positions the bank to benefit from rising international trade. Consensus views this as adding resilience to topline growth.

Valuation Gap to Peers Remains Wide

- ICBC trades at a price-to-earnings multiple of 5.6x, which is lower than both the peer group average (6.4x) and the Hong Kong banks industry (5.9x), signaling ongoing discount by investors despite steady profits.

- Analysts' consensus view frames ICBC’s valuation as attractive but not fully risk-free.

- Consensus sees solid capital adequacy (19.54%) and stable dividends as supporting share value. Nevertheless, analysts warn that slow earnings growth and heavy exposure to government mandates justify some discount versus faster-growing banks.

- With the current share price at 6.02 and consensus price target at 7.01, the implied upside is about 16%. However, analysts stress these projections rely on margins stabilizing and revenue diversification paying off soon.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Industrial and Commercial Bank of China on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the figures from a new angle? Share your unique take on the data and shape your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Industrial and Commercial Bank of China.

See What Else Is Out There

ICBC’s slow earnings growth and tightening profit margins are weighing on its ability to keep pace with faster-growing peers in the banking sector.

If you want steady revenue, reliable profits, and less uncertainty, search for companies delivering consistent results through cycles with stable growth stocks screener (2102 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1398

Industrial and Commercial Bank of China

Provides banking products and services in the People's Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives