Agricultural Bank of China (SEHK:1288) Net Profit Margin Tops Narrative as Growth Trails Market

Reviewed by Simply Wall St

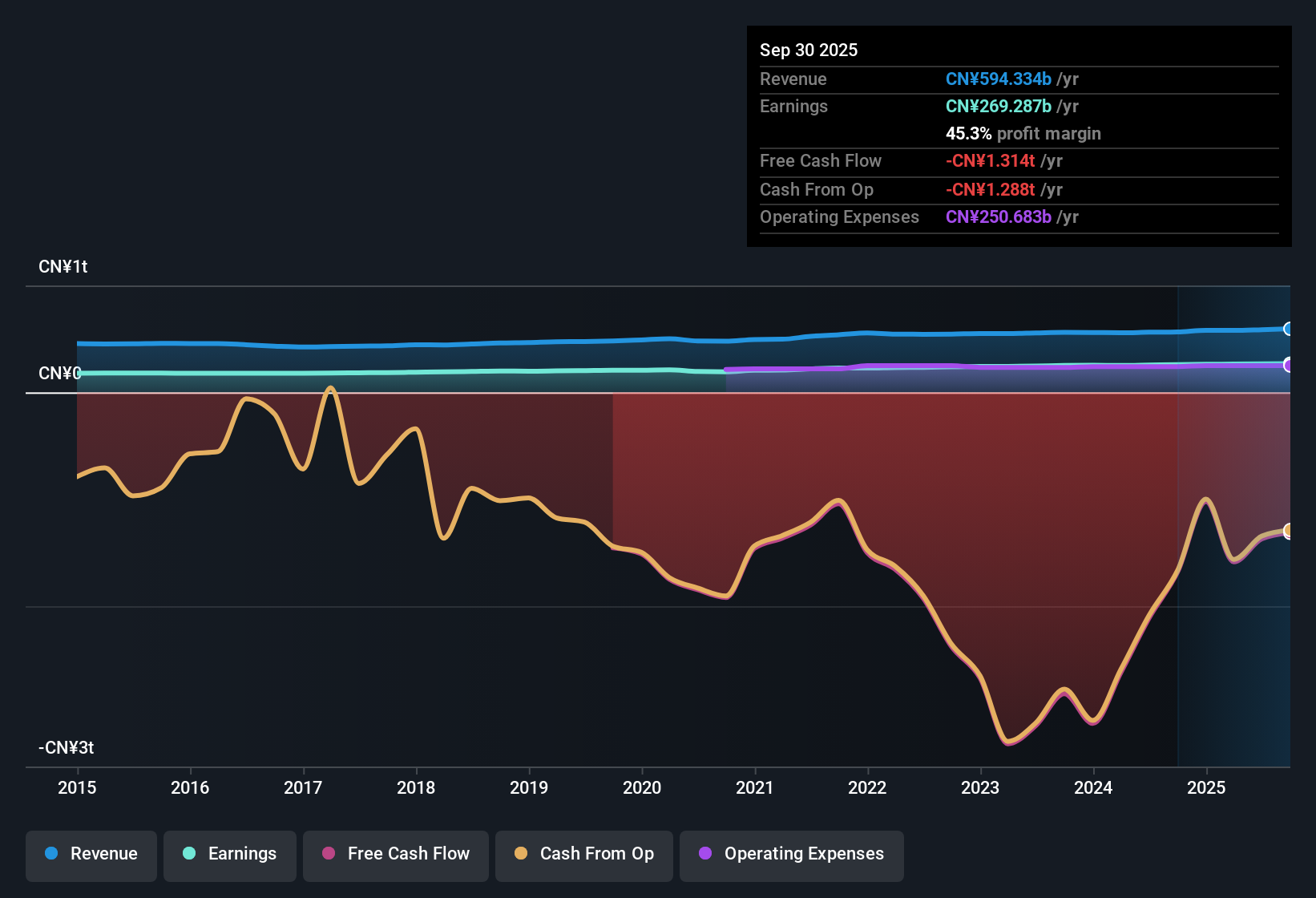

Agricultural Bank of China (SEHK:1288) posted a net profit margin of 45% for the latest period, edging ahead of last year’s 44.3%. Earnings grew 5.8% over the past year, outpacing its five-year average of 5.5% per year. The share price closed at HK$5.92, well below the estimated fair value of HK$11.21 based on discounted cash flow. Earnings are forecast to rise at 3.6% annually in the coming years. The bank stands out for its attractive dividends and high-quality past profits, even as its growth outlook trails broader Hong Kong market expectations.

See our full analysis for Agricultural Bank of China.Now let’s see how these results compare to the leading narratives for Agricultural Bank of China. Some opinions will be reinforced, while others might face new questions.

See what the community is saying about Agricultural Bank of China

Net Profit Margins Expected to Compress

- Analysts project net profit margins will narrow from 45.0% today to 36.1% in three years, even as total earnings are forecast to rise from CN¥263.8 billion to CN¥304.7 billion by 2028.

- According to the analysts' consensus view, sustained revenue gains are driven by expansion in rural banking, policy support, and demographic trends.

- However, anticipated margin compression highlights rising cost pressures and competitive challenges that could complicate the path to higher profitability.

- Consensus also notes that stabilization in non-performing loans and enhanced risk controls are key reasons that bulls cite for resilience, even as overall margin headwinds remain pronounced.

- Bulls say that policy-driven rural growth and digital innovation will help offset tightening margins, reinforcing the case for long-term earnings durability despite recent profitability pressures. 📊 Read the full Agricultural Bank of China Consensus Narrative.

Share Valuation: Discount to DCF, Premium to Peers

- The share price of HK$5.92 sits well below the DCF fair value of HK$11.21, but trades at a 7.2x price-to-earnings multiple that is higher than both the Hong Kong banks industry average of 5.9x and peer group average of 6.2x.

- Analysts' consensus view sees this tension as a function of the bank's high-quality past earnings and dividend track record.

- That quality premium may support above-peer multiples even as modest forecast growth limits upward price targets.

- Consensus narrative also highlights that with the consensus target at HK$5.91, the stock is seen as fairly priced, and future rerating will depend on successful delivery of new revenue streams and sustained profit quality.

Revenue Outlook Trails Broader Market

- Revenue is forecast to grow at 5.8% annually, notably behind the Hong Kong market average of 8.7% revenue growth and the sector's 12.4% earnings growth expectations.

- Analysts' consensus narrative views the bank's heavy tilt toward rural and priority sectors, while supported by long-term policy and demographic trends, as tying much of its future to slower-growth markets.

- While the bank is well-positioned to capture rural loan growth and government capital flows, these segments historically face weaker borrower profiles and lower profitability than rapidly urbanizing, higher-income segments.

- Consensus highlights that upside could emerge if new business lines in green finance and wealth management scale faster than anticipated, but for now, the outlook remains more subdued than peers exposed to faster-growing markets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Agricultural Bank of China on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the numbers? Share your perspective and shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Agricultural Bank of China.

See What Else Is Out There

Agricultural Bank of China’s earnings growth and profitability face pressure because of tightening margins and slower revenue gains compared to the broader market and peers.

If steady expansion matters most to you, use our stable growth stocks screener (2108 results) to target companies with a proven track record of consistent earnings and revenue growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1288

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives