Should Leapmotor’s Addition to the Hang Seng TECH Index Prompt Action From SEHK:9863 Investors?

Reviewed by Sasha Jovanovic

- Zhejiang Leapmotor Technology recently announced its inclusion as a constituent stock of the Hang Seng TECH Index, effective December 8, 2025, marking an important recognition of its innovations in the technology and new energy vehicle space.

- This development is anticipated to expand the company's investor base, improve trading liquidity, and increase market visibility among global investors.

- We'll examine how Leapmotor's upcoming addition to the Hang Seng TECH Index could reinforce its investment narrative and broader investor appeal.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zhejiang Leapmotor Technology Investment Narrative Recap

To own Zhejiang Leapmotor Technology, an investor must have conviction in the company’s ability to scale global electric vehicle adoption through innovation and rapid sales execution in both core and emerging markets. The recent inclusion in the Hang Seng TECH Index may provide a short-term boost in visibility and trading activity, yet does not materially address the primary catalyst, aggressive overseas growth, or the most immediate risk, which remains execution challenges in international expansion and sustained margin pressure from heightened competition at home.

Among recent announcements, the private placement that raised CNY 2.6 billion stands out. This fundraising event supports Leapmotor’s expansion initiatives but also highlights the capital intensity and execution risk attached to overseas market entry, which remains a central concern for those tracking near-term profitability and the effectiveness of partnerships like Stellantis.

Still, for all the opportunities, investors should pay close attention to the fact that while inclusion in a major index increases attention, the international expansion, and its many moving parts, remains an area that ...

Read the full narrative on Zhejiang Leapmotor Technology (it's free!)

Zhejiang Leapmotor Technology's narrative projects CN¥113.4 billion in revenue and CN¥6.8 billion in earnings by 2028. This requires 33.6% yearly revenue growth and a CN¥7.4 billion earnings increase from the current CN¥-576.0 million.

Uncover how Zhejiang Leapmotor Technology's forecasts yield a HK$82.75 fair value, a 64% upside to its current price.

Exploring Other Perspectives

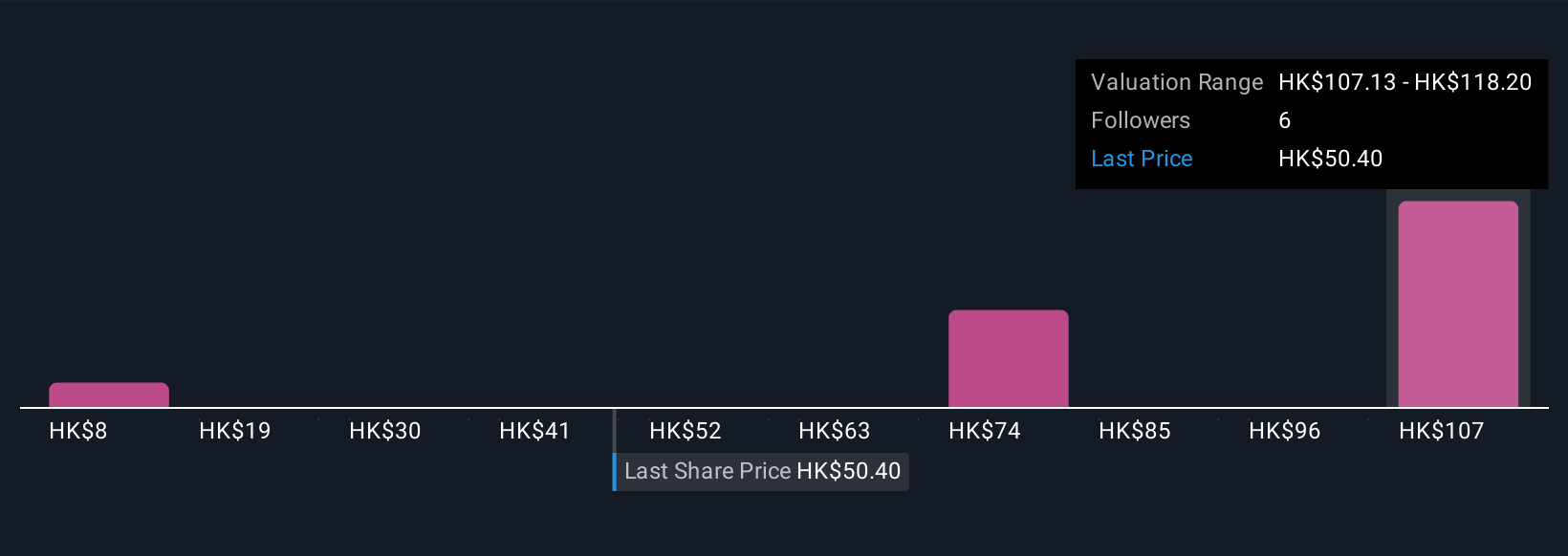

Three Simply Wall St Community fair value estimates for Leapmotor range from CN¥7.52 to CN¥118.03. This contrasts with analyst consensus that points to rapid international growth as both an opportunity and a key risk for future performance. Explore these differing outlooks to inform your own view.

Explore 3 other fair value estimates on Zhejiang Leapmotor Technology - why the stock might be worth less than half the current price!

Build Your Own Zhejiang Leapmotor Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zhejiang Leapmotor Technology research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zhejiang Leapmotor Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zhejiang Leapmotor Technology's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Leapmotor Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9863

Zhejiang Leapmotor Technology

Engages in the research and development, production, and sale of new energy vehicles in Mainland China and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success