- Hong Kong

- /

- Auto Components

- /

- SEHK:951

We Think Chaowei Power Holdings (HKG:951) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Chaowei Power Holdings Limited (HKG:951) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Chaowei Power Holdings

What Is Chaowei Power Holdings's Net Debt?

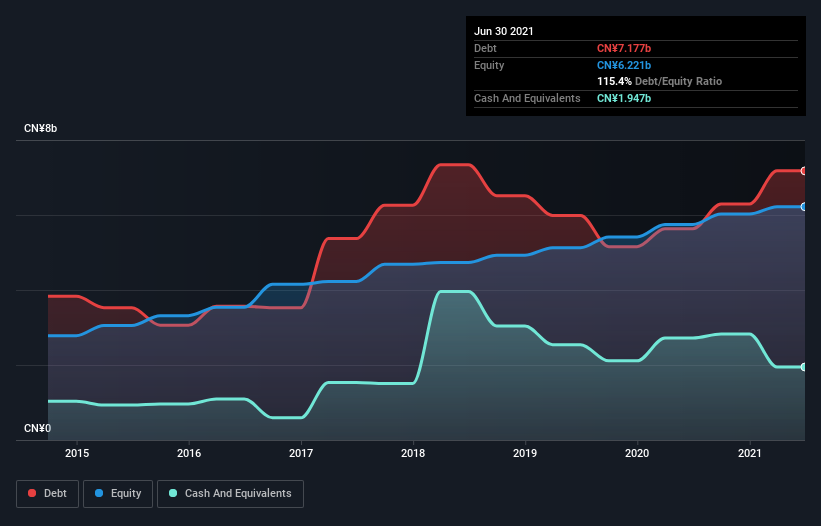

You can click the graphic below for the historical numbers, but it shows that as of June 2021 Chaowei Power Holdings had CN¥7.18b of debt, an increase on CN¥5.64b, over one year. However, because it has a cash reserve of CN¥1.95b, its net debt is less, at about CN¥5.23b.

How Strong Is Chaowei Power Holdings' Balance Sheet?

We can see from the most recent balance sheet that Chaowei Power Holdings had liabilities of CN¥12.7b falling due within a year, and liabilities of CN¥1.79b due beyond that. Offsetting this, it had CN¥1.95b in cash and CN¥3.96b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥8.57b.

This deficit casts a shadow over the CN¥2.01b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Chaowei Power Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chaowei Power Holdings has a debt to EBITDA ratio of 2.9 and its EBIT covered its interest expense 3.2 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. On a slightly more positive note, Chaowei Power Holdings grew its EBIT at 10% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Chaowei Power Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Chaowei Power Holdings actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

We'd go so far as to say Chaowei Power Holdings's level of total liabilities was disappointing. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Chaowei Power Holdings's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Chaowei Power Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:951

Chaowei Power Holdings

An investment holding company, manufactures and sells lead-acid motive batteries, lithium-ion batteries, and other related products in the People’s Republic of China.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success