- Hong Kong

- /

- Auto Components

- /

- SEHK:819

Tianneng Power International (HKG:819) Will Be Hoping To Turn Its Returns On Capital Around

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Although, when we looked at Tianneng Power International (HKG:819), it didn't seem to tick all of these boxes.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Tianneng Power International is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = CN¥2.0b ÷ (CN¥40b - CN¥20b) (Based on the trailing twelve months to December 2022).

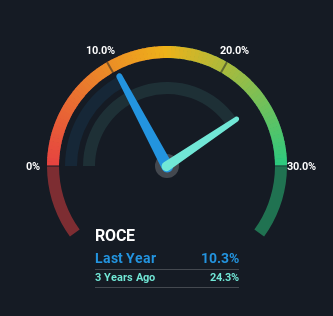

So, Tianneng Power International has an ROCE of 10%. On its own, that's a standard return, however it's much better than the 4.9% generated by the Auto Components industry.

See our latest analysis for Tianneng Power International

In the above chart we have measured Tianneng Power International's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Tianneng Power International.

What The Trend Of ROCE Can Tell Us

Unfortunately, the trend isn't great with ROCE falling from 23% five years ago, while capital employed has grown 227%. Usually this isn't ideal, but given Tianneng Power International conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. It's unlikely that all of the funds raised have been put to work yet, so as a consequence Tianneng Power International might not have received a full period of earnings contribution from it.

Another thing to note, Tianneng Power International has a high ratio of current liabilities to total assets of 51%. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Key Takeaway

We're a bit apprehensive about Tianneng Power International because despite more capital being deployed in the business, returns on that capital and sales have both fallen. It should come as no surprise then that the stock has fallen 20% over the last five years, so it looks like investors are recognizing these changes. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

One more thing: We've identified 2 warning signs with Tianneng Power International (at least 1 which is a bit unpleasant) , and understanding these would certainly be useful.

While Tianneng Power International may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Tianneng Power International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:819

Tianneng Power International

An investment holding company, engages in the research, development, manufacture, and sale of power batteries for electric vehicle market in the People’s Republic of China and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026