Even though Vietnam Manufacturing and Export Processing (Holdings) (HKG:422) has lost HK$45m market cap in last 7 days, shareholders are still up 57% over 3 years

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Vietnam Manufacturing and Export Processing (Holdings) Limited (HKG:422) shareholders have seen the share price rise 57% over three years, well in excess of the market return (35%, not including dividends).

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

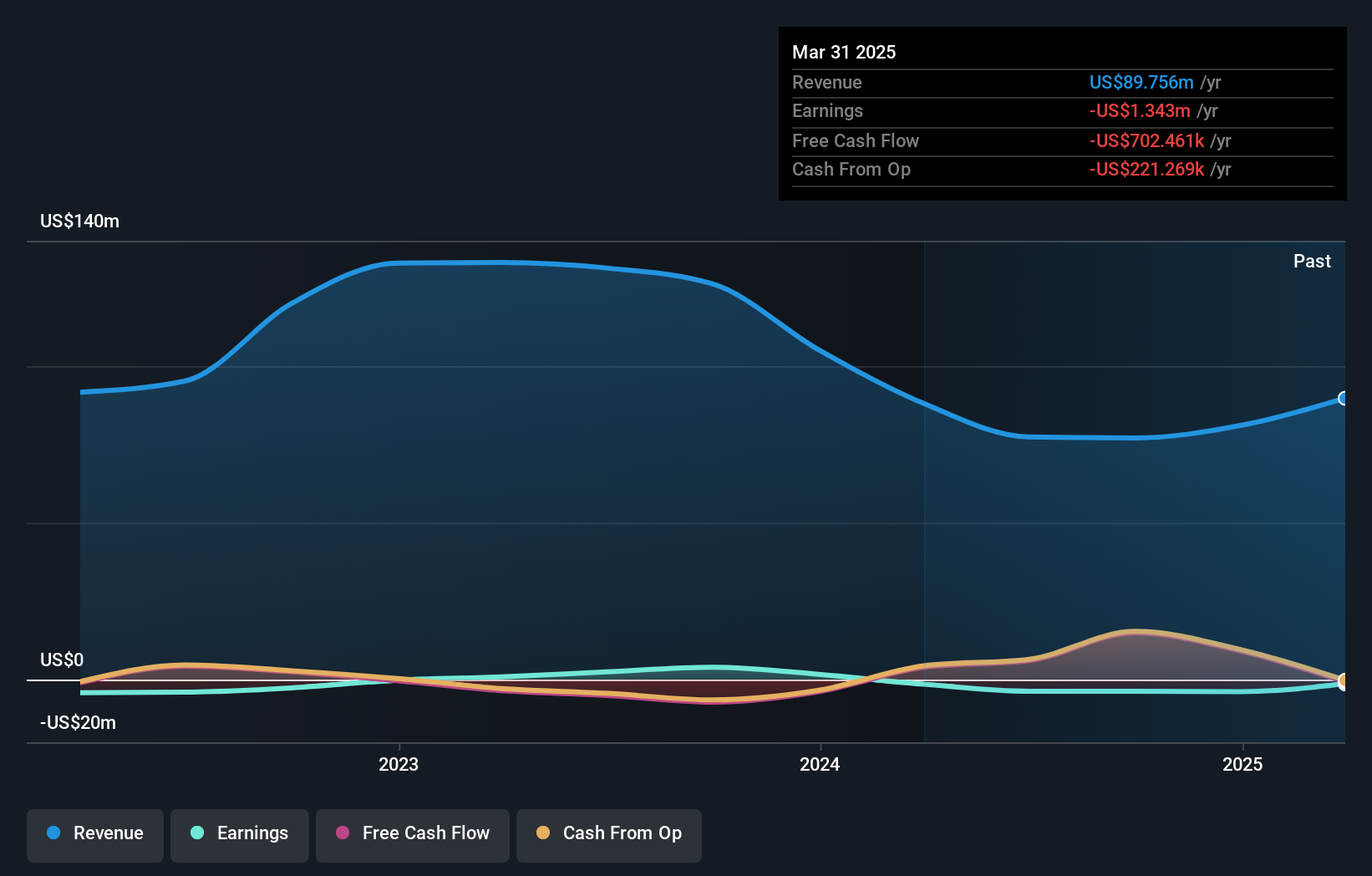

Because Vietnam Manufacturing and Export Processing (Holdings) made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Vietnam Manufacturing and Export Processing (Holdings) actually saw its revenue drop by 11% per year over three years. Despite the lack of revenue growth, the stock has returned 16%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Vietnam Manufacturing and Export Processing (Holdings)'s earnings, revenue and cash flow.

A Different Perspective

Vietnam Manufacturing and Export Processing (Holdings) shareholders are down 27% for the year, but the market itself is up 48%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 0.9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Vietnam Manufacturing and Export Processing (Holdings) .

But note: Vietnam Manufacturing and Export Processing (Holdings) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:422

Vietnam Manufacturing and Export Processing (Holdings)

An investment holding company, manufactures and sells motorbikes and scooters, and related spare parts and engines in Vietnam.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives