- Taiwan

- /

- Auto Components

- /

- TWSE:1563

Undiscovered Gems To Explore In December 2024

Reviewed by Simply Wall St

As global markets navigate a cautious Federal Reserve outlook and political uncertainties, smaller-cap indexes have faced notable challenges, with the S&P 600 experiencing significant pressure. Amidst this backdrop of fluctuating interest rates and economic indicators, investors may find potential opportunities in lesser-known stocks that exhibit strong fundamentals and resilience to broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Luyuan Group Holding (Cayman) (SEHK:2451)

Simply Wall St Value Rating: ★★★★★☆

Overview: Luyuan Group Holding (Cayman) Limited focuses on the research, design, development, manufacturing, and sale of electric two-wheeled vehicles in China with a market capitalization of approximately HK$2.51 billion.

Operations: The primary revenue stream for Luyuan Group Holding (Cayman) Limited is the development, manufacture, and sale of electric vehicles and related accessories, generating CN¥5.16 billion.

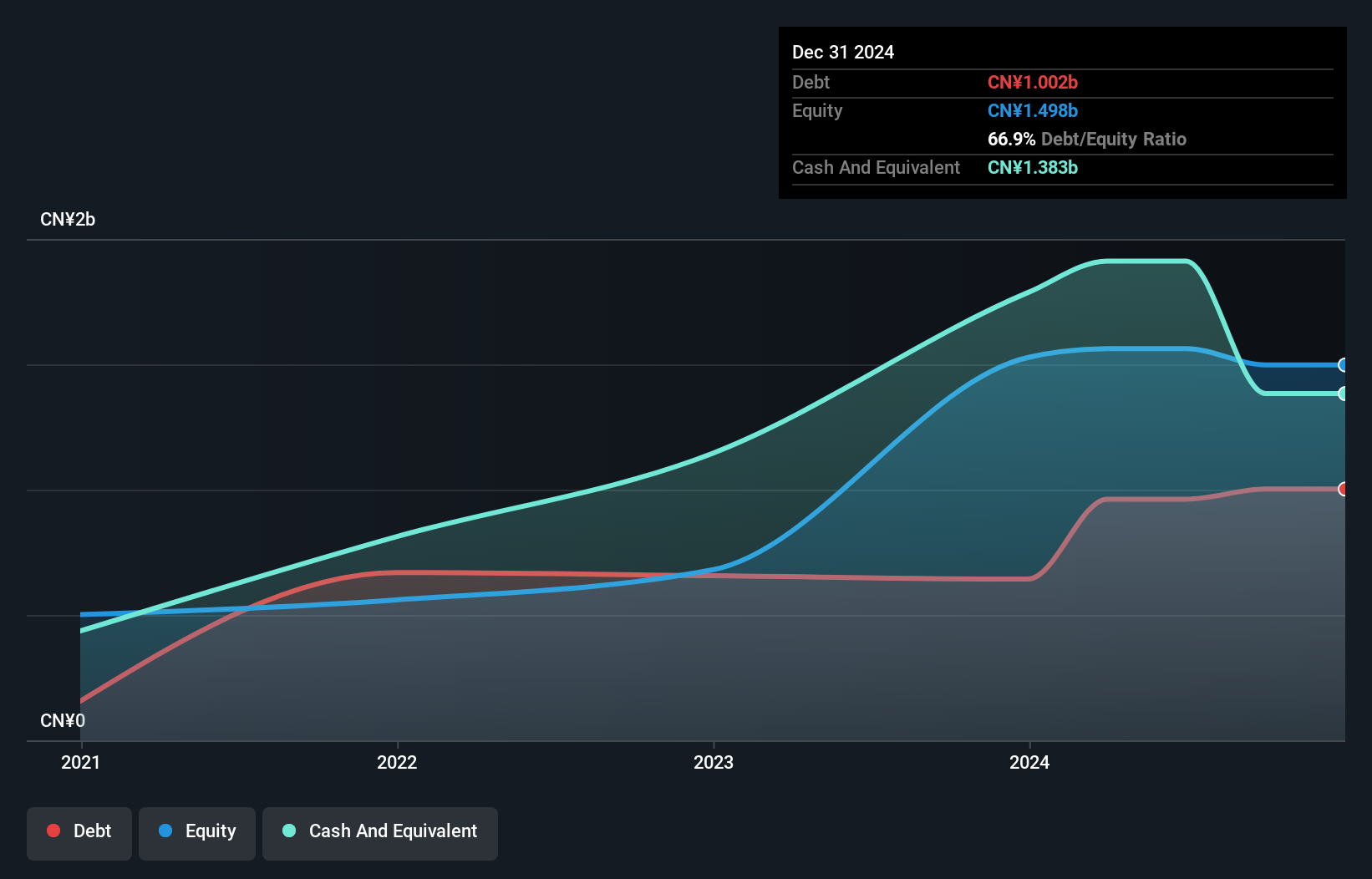

Luyuan Group Holding, a smaller player in the market, has shown a robust performance with earnings growth of 14.9% over the past year, surpassing the Auto industry's 8.2%. The company appears to have strong financial health as it earns more interest than it pays and has more cash than its total debt. Additionally, Luyuan's free cash flow turned positive recently at US$5.91 million as of June 2024, indicating improved operational efficiency. Looking ahead, revenue is projected to grow by 16.23% annually, suggesting potential for continued expansion in its niche market segment.

Ricoh Leasing Company (TSE:8566)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ricoh Leasing Company, Ltd. operates in Japan, focusing on leasing, investment, and financial services with a market capitalization of ¥157.82 billion.

Operations: The company's primary revenue comes from its Leasing & Finance Business, generating ¥289.42 billion, followed by the Service Business and Investment Business with ¥9.05 billion and ¥8.27 billion, respectively. The net profit margin for Ricoh Leasing Company is a key financial metric to consider when evaluating its profitability in these sectors.

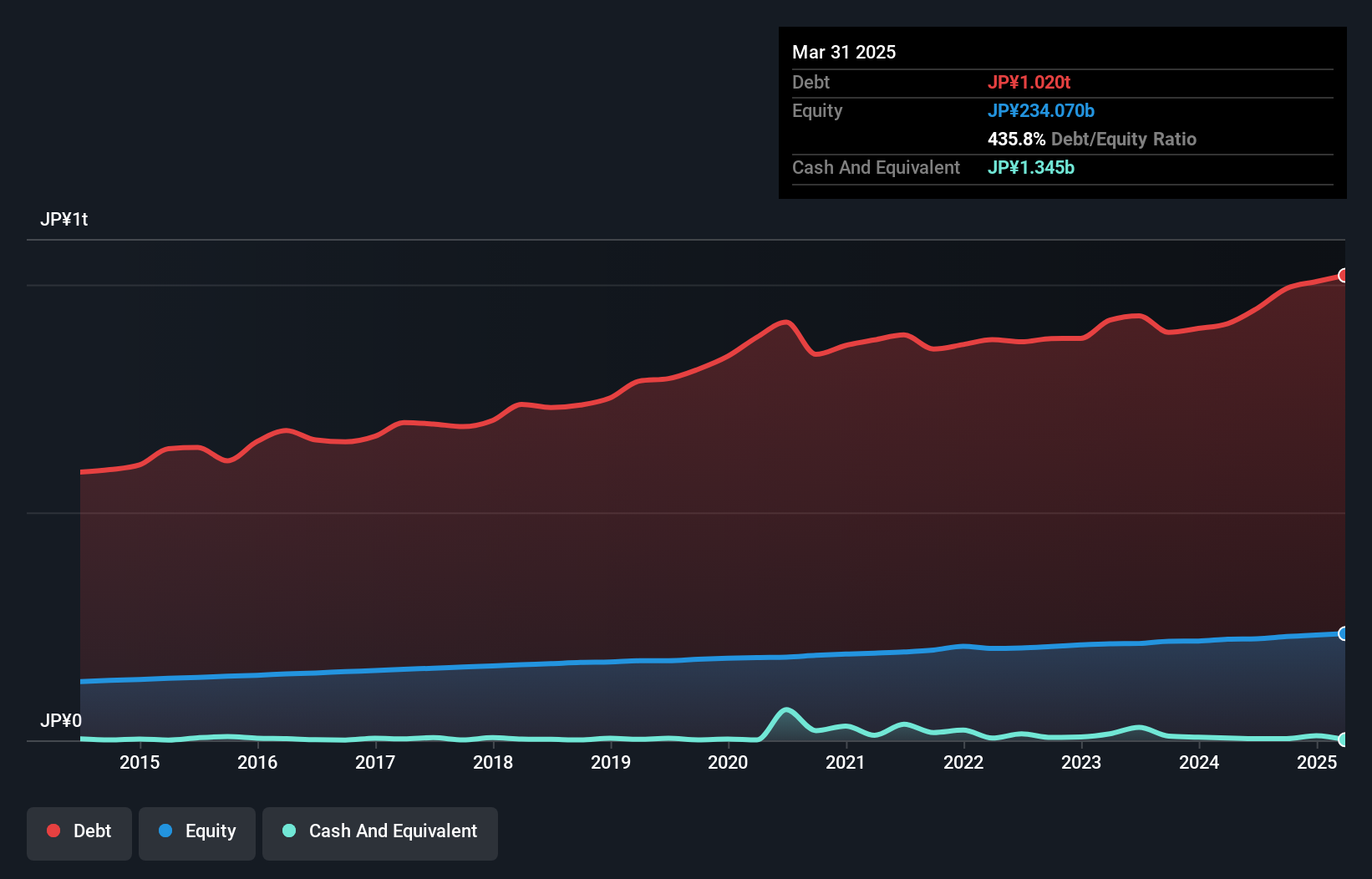

Ricoh Leasing, a nimble player in the financial sector, trades at 34.6% below its fair value estimate, presenting potential for value seekers. Despite not outpacing the industry with a 20.4% earnings growth last year compared to the sector's 28.6%, it boasts high-quality past earnings and profitably covers interest payments. The debt-to-equity ratio has improved from 458.2% to 435.5% over five years but remains high at 433.9%. Recent strategic moves include issuing ¥30 billion in unsecured bonds and increasing dividends from JPY 75 to JPY 80 per share, signaling confidence in future performance prospects.

- Navigate through the intricacies of Ricoh Leasing Company with our comprehensive health report here.

Evaluate Ricoh Leasing Company's historical performance by accessing our past performance report.

SuperAlloy Industrial (TWSE:1563)

Simply Wall St Value Rating: ★★★★★☆

Overview: SuperAlloy Industrial Co., Ltd. specializes in engineering and manufacturing lightweight metal products mainly for the automotive sector, with a market capitalization of NT$13.03 billion.

Operations: The primary revenue stream for SuperAlloy Industrial comes from the automotive rim segment, generating NT$6.76 billion. The company's market capitalization stands at NT$13.03 billion.

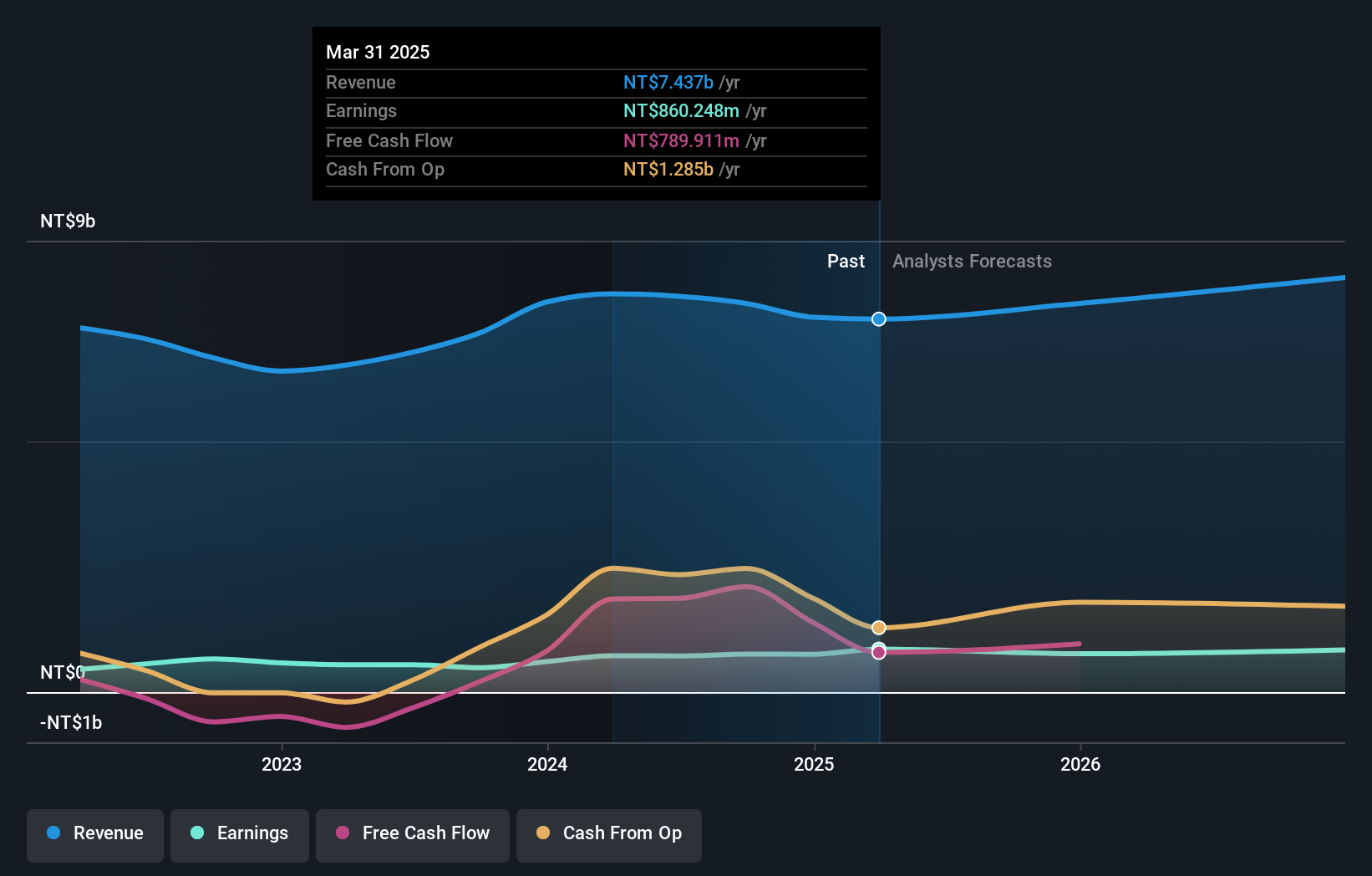

SuperAlloy Industrial, a nimble player in the market, has shown robust earnings growth of 55.9% over the past year, outpacing its industry peers' 11.7%. The company boasts high-quality earnings and a favorable price-to-earnings ratio of 18.9x compared to the TW market's 20.9x. Despite having a high net debt to equity ratio at 42.1%, interest payments are well covered by EBIT with a coverage of 6.2x, indicating solid financial management amid expansion plans like their new recycled aluminum subsidiary with TWD 500 million investment in Taiwan aimed at boosting future growth momentum.

- Delve into the full analysis health report here for a deeper understanding of SuperAlloy Industrial.

Understand SuperAlloy Industrial's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 4628 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1563

SuperAlloy Industrial

Engages in engineering and manufacturing lightweight metal products primarily for the automotive industry.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives