As global markets continue to react to policy shifts and economic indicators, major indices like the S&P 500 have reached record highs, fueled by optimism over potential trade deals and AI investment initiatives. Despite large-cap stocks leading the charge, small-cap companies remain a fertile ground for discovering undervalued opportunities with significant growth potential. In this dynamic environment, identifying stocks with strong fundamentals and unique market positions can uncover hidden gems that may offer promising prospects amidst broader market movements.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Shanghai Haixin Group | 0.77% | 1.60% | 8.25% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Luyuan Group Holding (Cayman) (SEHK:2451)

Simply Wall St Value Rating: ★★★★★☆

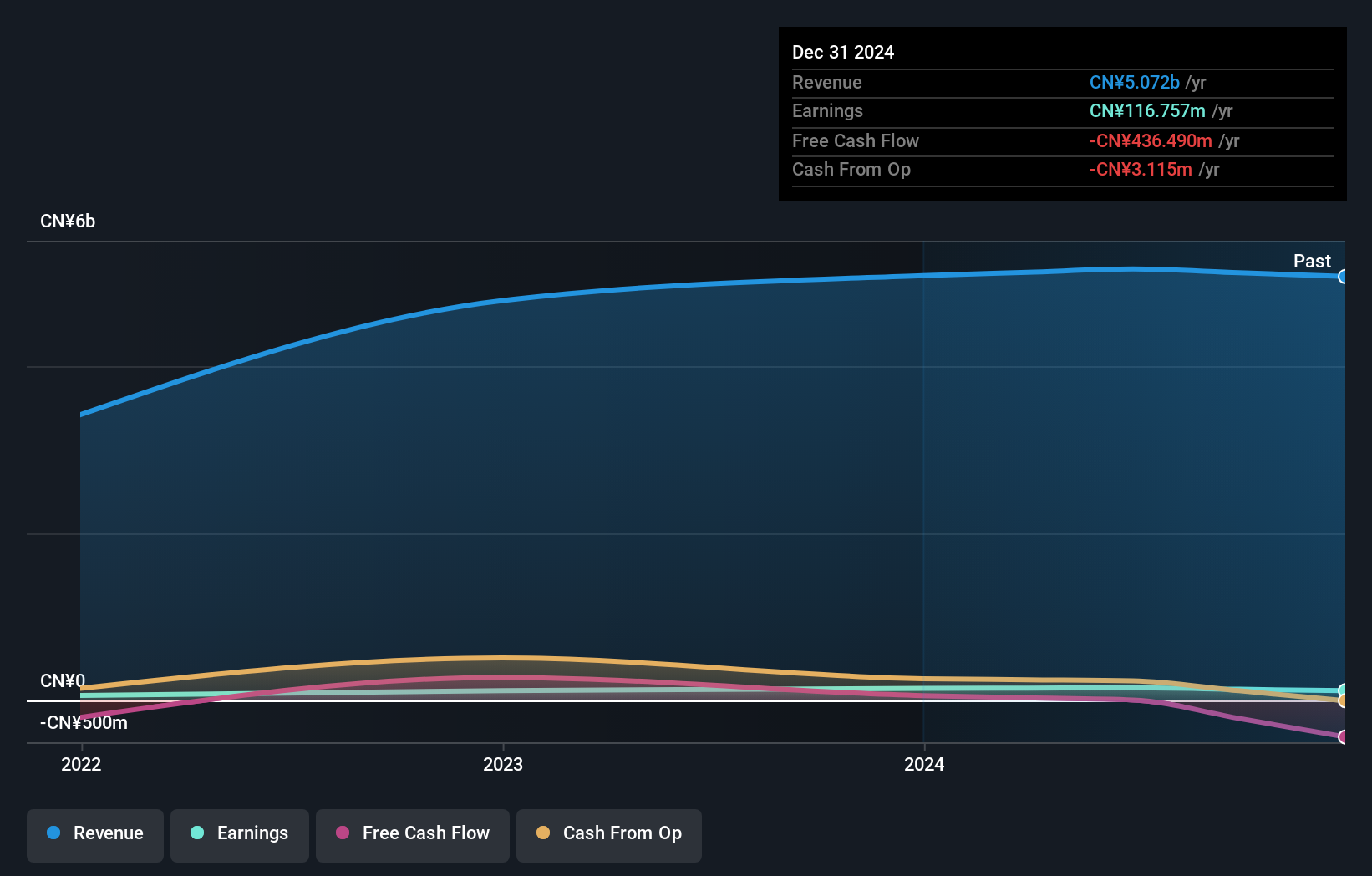

Overview: Luyuan Group Holding (Cayman) Limited focuses on the research, design, development, manufacturing, and sale of electric two-wheeled vehicles in China, with a market capitalization of HK$2.67 billion.

Operations: The company generates revenue primarily from the development, manufacture, and sale of electric vehicles and related accessories, totaling CN¥5.16 billion.

Luyuan Group Holding, a small player in the auto industry, has shown promising growth with earnings increasing by 15% over the past year. Despite its size, it remains profitable and boasts a strong cash position exceeding its total debt. The company also reported levered free cash flow of US$57 million at the end of 2023, which is notable given previous negative figures. With revenue expected to grow by 16% annually and high non-cash earnings quality, Luyuan seems well-positioned within its sector despite limited data on debt reduction over five years.

- Click here to discover the nuances of Luyuan Group Holding (Cayman) with our detailed analytical health report.

Learn about Luyuan Group Holding (Cayman)'s historical performance.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Value Rating: ★★★★★★

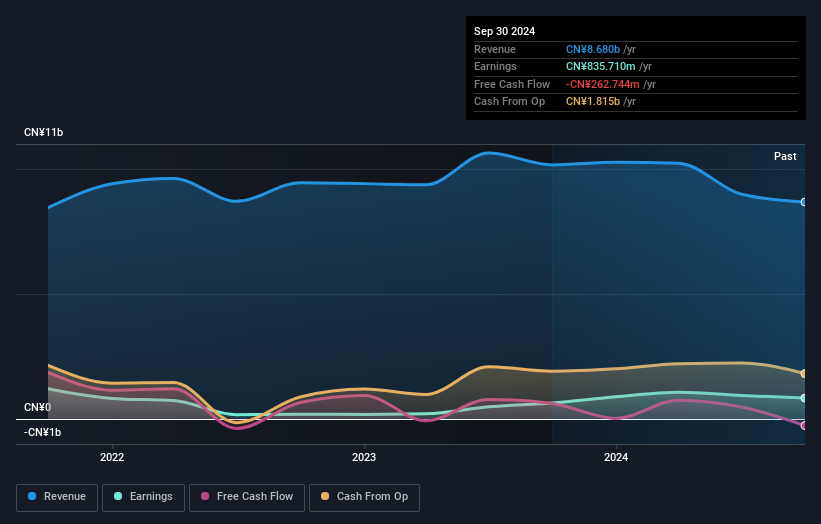

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the renewable energy sector and has a market capitalization of CN¥9.20 billion.

Operations: The company generates revenue primarily from its operations in the renewable energy sector. It has a market capitalization of CN¥9.20 billion, reflecting its valuation in the industry.

Guangdong Baolihua New Energy, a smaller player in the renewable energy sector, shows potential despite mixed results. Trading at 41.8% below its estimated fair value, it seems undervalued currently. Over the past year, earnings rose by 31%, outpacing the industry's growth of 6.8%, highlighting strong performance relative to peers. However, sales for nine months ended September 2024 were CNY 6.11 billion compared to CNY 7.70 billion last year, indicating some challenges in revenue generation. The net debt to equity ratio is satisfactory at 22.3%, suggesting manageable leverage levels amidst these fluctuations in earnings and revenue figures.

SNP Schneider-Neureither & Partner (XTRA:SHF)

Simply Wall St Value Rating: ★★★★★☆

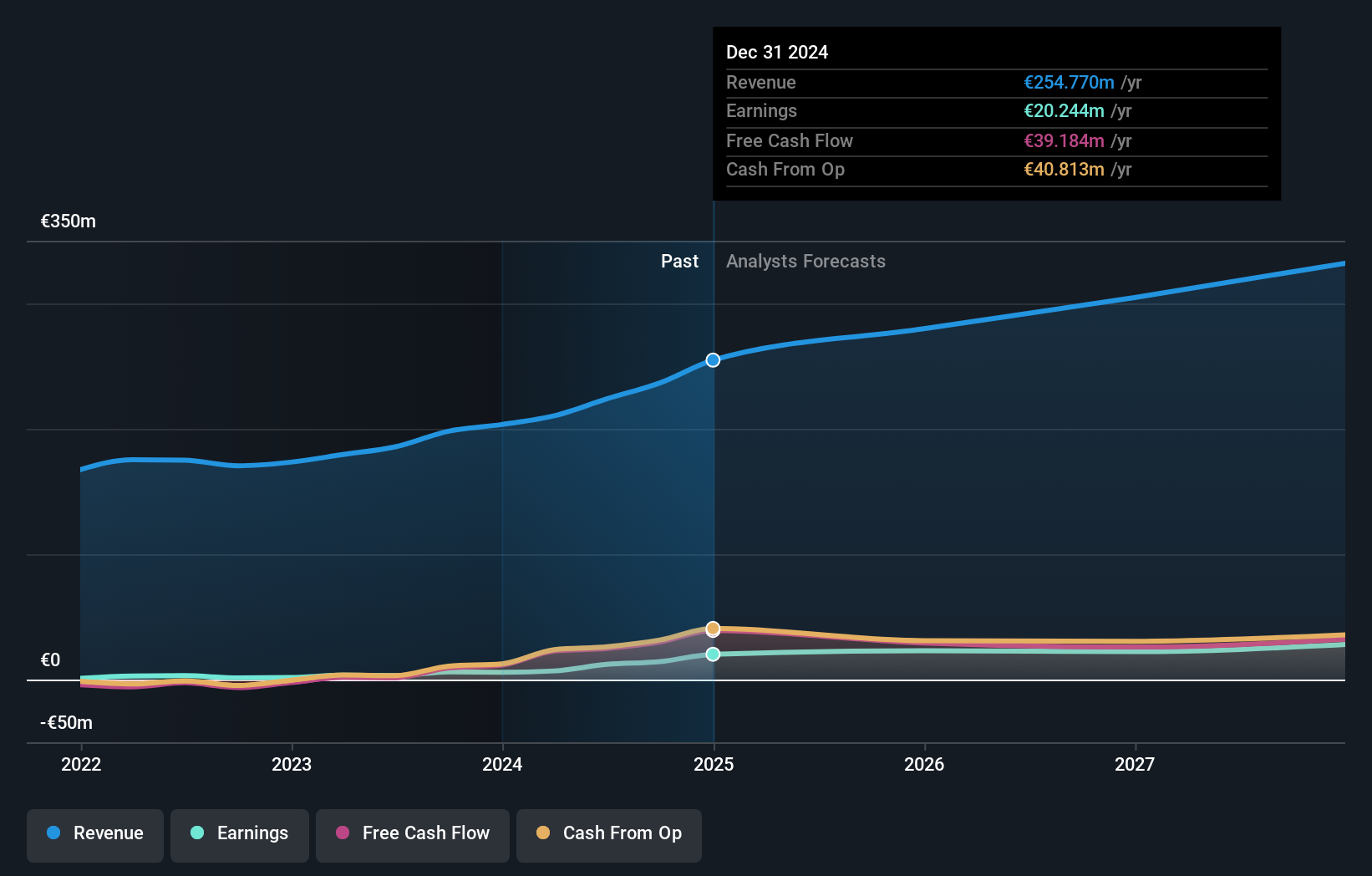

Overview: SNP Schneider-Neureither & Partner SE provides software solutions for managing digital transformation processes and has a market capitalization of €485.06 million.

Operations: SNP Schneider-Neureither & Partner SE generates revenue primarily from its Service segment (€145.14 million) and Software segment (€79.42 million), with a smaller contribution from EXA (€13.24 million). The company's financial structure includes a Segment Adjustment of -€1.20 million, impacting overall revenue figures.

SNP Schneider-Neureither & Partner, a dynamic player in the IT sector, has seen impressive earnings growth of 129% over the past year, outpacing the industry average of 8.5%. The company's financial health is underscored by its satisfactory net debt to equity ratio of 32%, and robust interest coverage at 7.7 times EBIT. Recent developments include a strategic partnership with Carlyle Group, which aims to acquire SNP for €440 million, offering €61 per share—a premium over recent trading prices. This move is supported by key stakeholders and positions SNP for potential delisting post-acquisition completion.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4671 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SHF

SNP Schneider-Neureither & Partner

Provides software for management of digital transformation processes in Germany.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion