- Hong Kong

- /

- Auto Components

- /

- SEHK:2025

What Type Of Shareholders Make Up Ruifeng Power Group Company Limited's (HKG:2025) Share Registry?

A look at the shareholders of Ruifeng Power Group Company Limited (HKG:2025) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

With a market capitalization of HK$880m, Ruifeng Power Group is a small cap stock, so it might not be well known by many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own shares in the company. Let's delve deeper into each type of owner, to discover more about Ruifeng Power Group.

See our latest analysis for Ruifeng Power Group

What Does The Lack Of Institutional Ownership Tell Us About Ruifeng Power Group?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

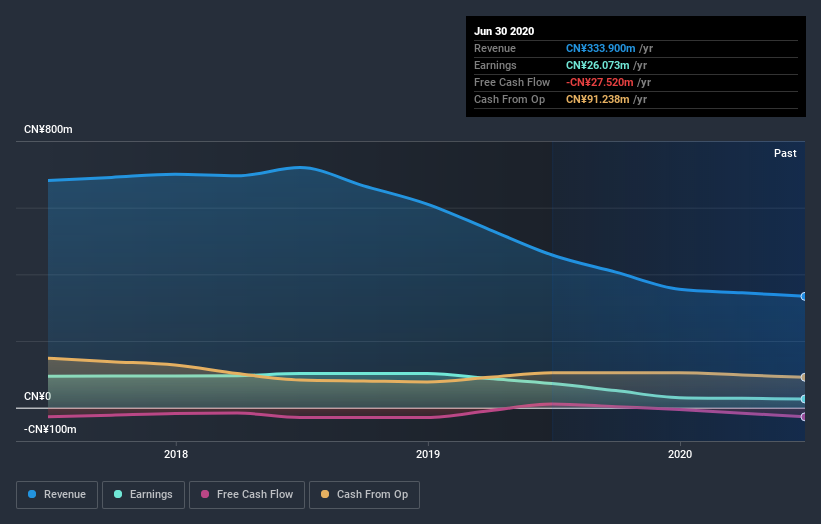

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Ruifeng Power Group's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Ruifeng Power Group is not owned by hedge funds. Dragon Rise Ventures Limited is currently the largest shareholder, with 51% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. Shiying Wang is the second largest shareholder owning 8.5% of common stock, and Meiling Liu holds about 5.9% of the company stock.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Ruifeng Power Group

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Ruifeng Power Group Company Limited. Insiders own HK$178m worth of shares in the HK$880m company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public holds a 28% stake in Ruifeng Power Group. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 51%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Ruifeng Power Group better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Ruifeng Power Group you should be aware of, and 1 of them is a bit concerning.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Ruifeng Power Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2025

Ruifeng Power Group

An investment holding company, engages in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)