- Hong Kong

- /

- Auto Components

- /

- SEHK:1760

Market Cool On Intron Technology Holdings Limited's (HKG:1760) Earnings Pushing Shares 26% Lower

Unfortunately for some shareholders, the Intron Technology Holdings Limited (HKG:1760) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

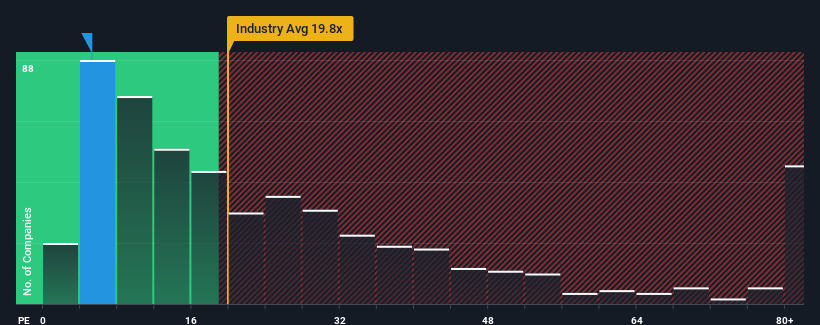

Even after such a large drop in price, Intron Technology Holdings' price-to-earnings (or "P/E") ratio of 5.2x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 9x and even P/E's above 19x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Intron Technology Holdings has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Intron Technology Holdings

Is There Any Growth For Intron Technology Holdings?

There's an inherent assumption that a company should underperform the market for P/E ratios like Intron Technology Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 44% last year. The strong recent performance means it was also able to grow EPS by 294% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 15% per year growth forecast for the broader market.

In light of this, it's peculiar that Intron Technology Holdings' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Intron Technology Holdings' P/E?

Intron Technology Holdings' recently weak share price has pulled its P/E below most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Intron Technology Holdings currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Intron Technology Holdings has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of Intron Technology Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1760

Intron Technology Holdings

An investment holding company, operates as an automotive electronics solutions provider in Hong Kong, the Mainland China, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives