- Hong Kong

- /

- Auto Components

- /

- SEHK:1760

Intron Technology Holdings (HKG:1760) Is Increasing Its Dividend To CN¥0.131

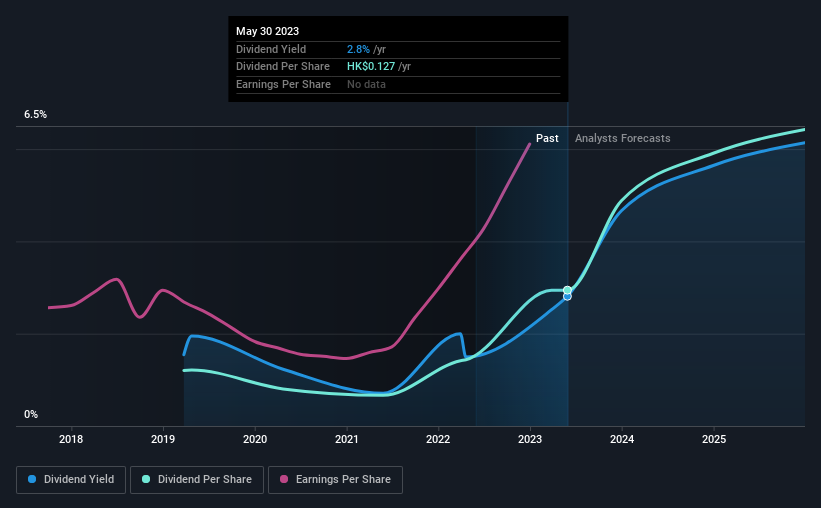

Intron Technology Holdings Limited (HKG:1760) will increase its dividend from last year's comparable payment on the 3rd of July to CN¥0.131. This takes the annual payment to 2.8% of the current stock price, which is about average for the industry.

Check out our latest analysis for Intron Technology Holdings

Intron Technology Holdings' Earnings Easily Cover The Distributions

We aren't too impressed by dividend yields unless they can be sustained over time. Intron Technology Holdings is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

The next year is set to see EPS grow by 76.7%. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

Intron Technology Holdings' Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. The annual payment during the last 4 years was CN¥0.0469 in 2019, and the most recent fiscal year payment was CN¥0.115. This works out to be a compound annual growth rate (CAGR) of approximately 25% a year over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Intron Technology Holdings has impressed us by growing EPS at 19% per year over the past five years. Intron Technology Holdings definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

Our Thoughts On Intron Technology Holdings' Dividend

Overall, we always like to see the dividend being raised, but we don't think Intron Technology Holdings will make a great income stock. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for Intron Technology Holdings (1 makes us a bit uncomfortable!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1760

Intron Technology Holdings

An investment holding company, operates as an automotive electronics solutions provider in Hong Kong, the Mainland China, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives