Surging October Sales Could Be a Game Changer for Geely Automobile Holdings (SEHK:175)

Reviewed by Sasha Jovanovic

- Geely Automobile Holdings reported unaudited group vehicle sales for October 2025, delivering 307,133 units for the month and 2.48 million units year-to-date, both substantially higher than the corresponding periods last year.

- This sharp rise in sales volume highlights strong demand and could be seen as a reflection of Geely's expansion efforts and product appeal in an increasingly competitive market.

- We'll examine how Geely's record monthly and year-to-date sales performance informs its investment narrative and future earnings outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Geely Automobile Holdings Investment Narrative Recap

To be a Geely shareholder, you need to believe in the company's ability to deliver sustained sales growth in a fiercely competitive automotive sector, particularly in new energy vehicles and international markets. October’s record sales offer evidence supporting Geely's expansion ambitions, reinforcing the short-term catalyst of stronger execution and rising volumes, though rising competition and potential pricing pressure remain the biggest risk, with this latest sales data not fully offsetting those concerns for now.

Among Geely’s latest developments, the July upward revision of its 2025 sales target to 3 million units stands out as most relevant here. The sharp increase in October and year-to-date sales indicates positive momentum towards that ambitious goal, with volume execution continuing to be a core driver for near-term optimism as quarterly results approach.

However, despite surging sales, investors should also be aware of margin pressure from intensifying industry competition and what it could mean for...

Read the full narrative on Geely Automobile Holdings (it's free!)

Geely Automobile Holdings is projected to generate CN¥463.1 billion in revenue and CN¥22.5 billion in earnings by 2028. This outlook relies on a 19.5% annual revenue growth rate and a CN¥7.4 billion increase in earnings from the current level of CN¥15.1 billion.

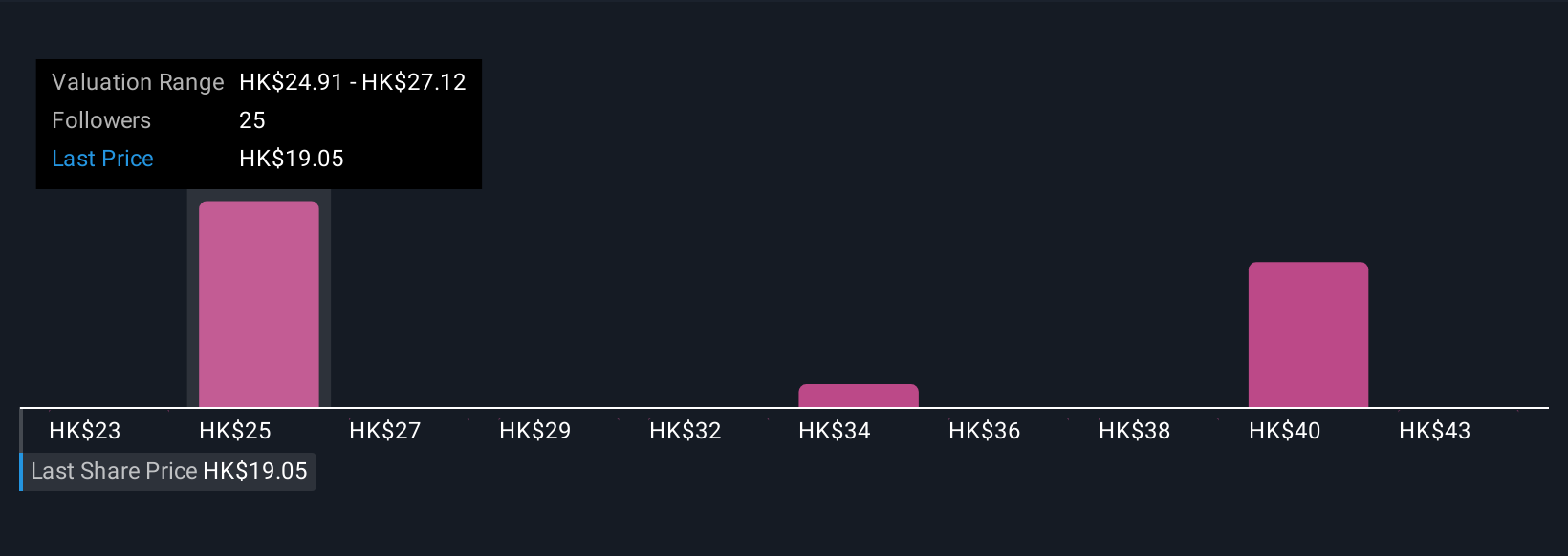

Uncover how Geely Automobile Holdings' forecasts yield a HK$26.28 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Six member estimates from the Simply Wall St Community place fair value between HK$22.70 and HK$45.16. While many see upside, intensifying competition may weigh on profit margins and future earnings performance, consider how your view stacks up.

Explore 6 other fair value estimates on Geely Automobile Holdings - why the stock might be worth just HK$22.70!

Build Your Own Geely Automobile Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Geely Automobile Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Geely Automobile Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Geely Automobile Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:175

Geely Automobile Holdings

An investment holding company, operates as an automobile manufacturer primarily in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives