Is Geely a Bargain After 20% Rally and Electric Vehicle Expansion in 2025?

Reviewed by Bailey Pemberton

- Curious whether Geely Automobile Holdings could be a hidden value opportunity or just another market favorite? Let’s walk through what the numbers and news are saying about where the stock sits today.

- After an impressive 25.7% rise over the past year, the stock hasn’t slowed much year to date, up 20.7%. However, it pulled back 10.1% in the last month.

- Geely is making headlines for its expansion into electric vehicles and new partnerships in the automotive tech space. Both of these developments are fueling optimism but also bringing volatility to its share price. Notable recent news includes collaborations focused on next-generation EV infrastructure and ambitious new model launches aimed at global markets.

- When it comes to valuation, Geely scores a solid 5 out of 6 based on undervaluation checks, which puts it ahead of many peers. We’ll unravel what drives that result using different valuation methods and suggest a smarter way to make sense of it all by the article’s end.

Approach 1: Geely Automobile Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This helps investors gauge what a company's shares might be worth based on its potential for generating cash in the coming years.

For Geely Automobile Holdings, the latest reported Free Cash Flow stands at approximately CN¥5.9 Billion. Analyst projections, combined with further estimates, suggest this figure could grow steadily to nearly CN¥45.1 Billion by 2035. As is typical, estimated projections become less certain the further into the future they go. The DCF analysis accounts for this by discounting those future amounts appropriately.

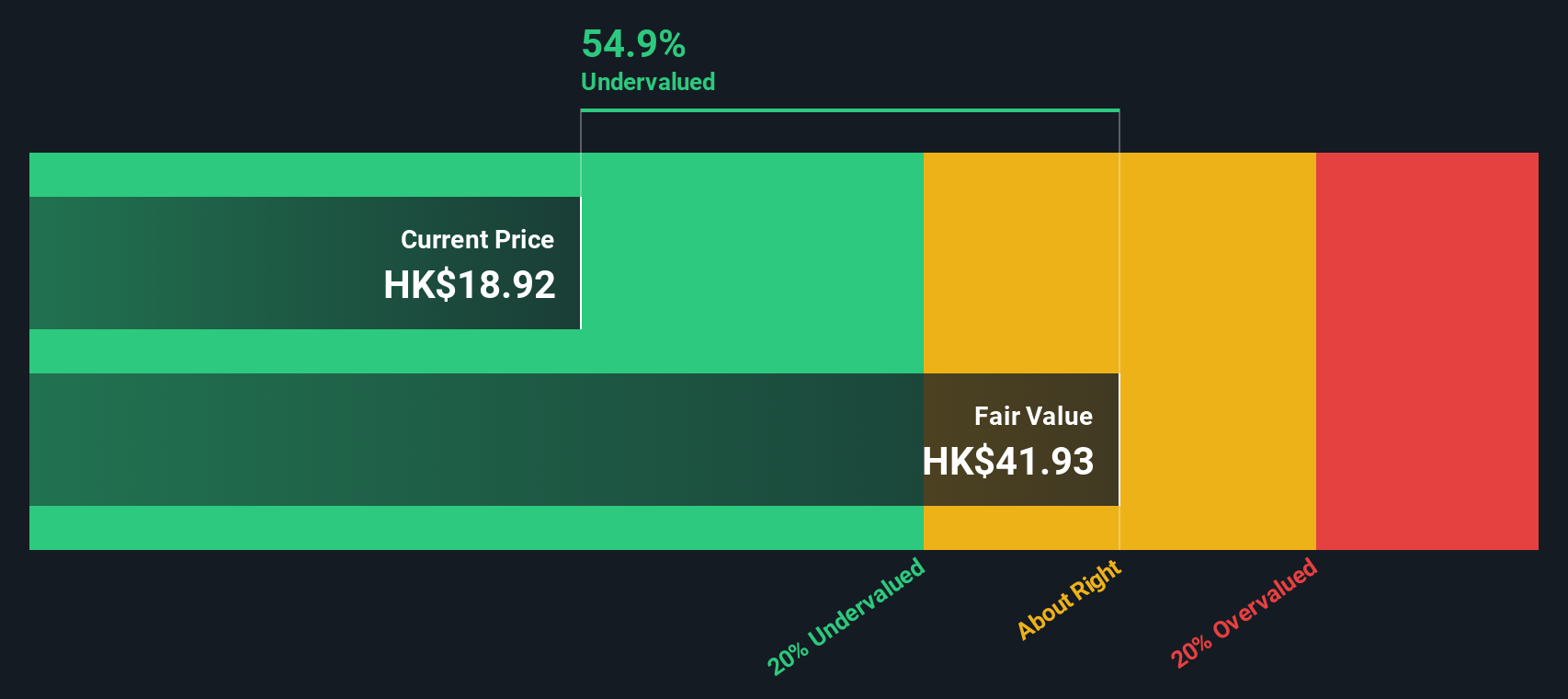

Based on the 2 Stage Free Cash Flow to Equity method, Geely's intrinsic value per share comes out to HK$46.33. This figure indicates the stock is trading at a 63.3% discount compared to the DCF fair value implied by Simply Wall St's analysis.

In summary, the current share price suggests Geely is significantly undervalued according to this approach. This may indicate a notable margin of safety for potential long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Geely Automobile Holdings is undervalued by 63.3%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Geely Automobile Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely regarded as a reliable valuation metric for profitable companies like Geely Automobile Holdings, as it reveals how much investors are willing to pay for each dollar of a company's earnings. PE is especially useful for companies with steady or growing profits, because it links the stock price directly to the underlying earnings performance.

What counts as a “fair” PE ratio can shift depending on growth expectations, levels of risk, industry prospects and the company’s financial health. Companies expected to grow faster with less risk typically justify higher PE ratios. In contrast, slower growth or higher risk would warrant lower ratios.

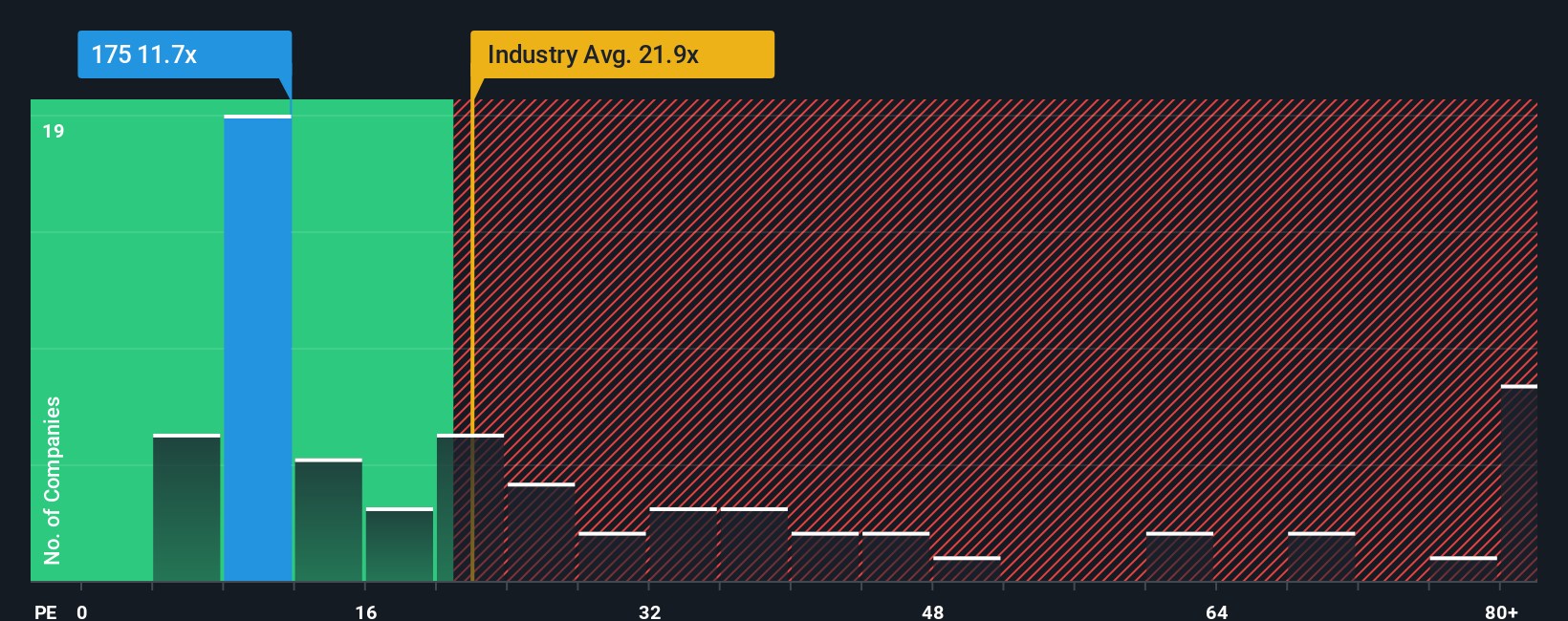

Geely currently trades at a PE ratio of 9.56x. This is notably lower than the average for its industry of 18.65x and below the average of close peers at 11.67x. That suggests the market is more cautious on Geely than on many of its competitors, at least on traditional comparisons.

Simply Wall St’s “Fair Ratio” for Geely is 13.89x. This measure is constructed by considering factors like the company’s earnings growth, industry profile, profit margin, market capitalization and risk rating, making it more tailored than simple peer or industry averages.

Comparing the Fair Ratio to Geely’s current PE, the stock trades well below what would be expected given its fundamentals. This suggests investors may be undervaluing Geely’s earnings potential at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Geely Automobile Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful concept: it is your story about a company, combining your perspective with what you believe about its future revenue growth, earnings, and profit margins. This helps you estimate what the business is really worth.

Think of a Narrative as a bridge, linking Geely Automobile Holdings’s story, such as its move into new energy vehicles and global expansion, to a concrete financial forecast and ultimately to a fair value estimate. On Simply Wall St’s platform, millions of investors build and update Narratives easily on the Community page, making this approach accessible to anyone.

Narratives help you decide when to buy or sell by comparing your own Fair Value estimate to the company’s current price, giving you a practical and structured decision-making tool. What makes Narratives so dynamic is that they are continuously updated when news or earnings are released, so your view and the market’s context remain in sync.

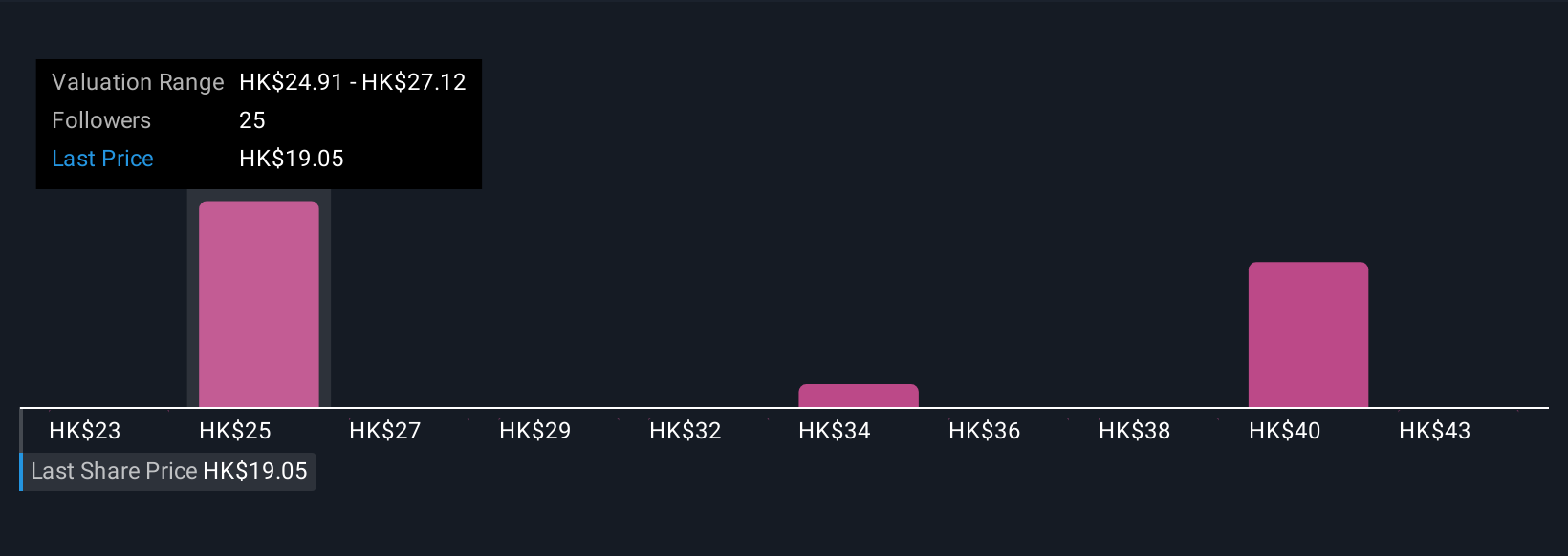

For example, some investors forecast Geely’s fair value as high as HK$42.17, expecting robust earnings and international success, while others see more downside with a fair value closer to HK$20.07. This demonstrates how Narratives turn different outlooks into actionable insights.

Do you think there's more to the story for Geely Automobile Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:175

Geely Automobile Holdings

An investment holding company, operates as an automobile manufacturer primarily in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success