- Hong Kong

- /

- Construction

- /

- SEHK:1372

Announcing: Bisu Technology Group International (HKG:1372) Stock Increased An Energizing 138% In The Last Year

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Bisu Technology Group International Limited (HKG:1372) share price has soared 138% in the last year. Most would be very happy with that, especially in just one year! Better yet, the share price has gained 393% in the last quarter. However, the longer term returns haven't been so impressive, with the stock up just 5.2% in the last three years.

View our latest analysis for Bisu Technology Group International

Bisu Technology Group International isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Bisu Technology Group International actually shrunk its revenue over the last year, with a reduction of 13%. We're a little surprised to see the share price pop 138% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

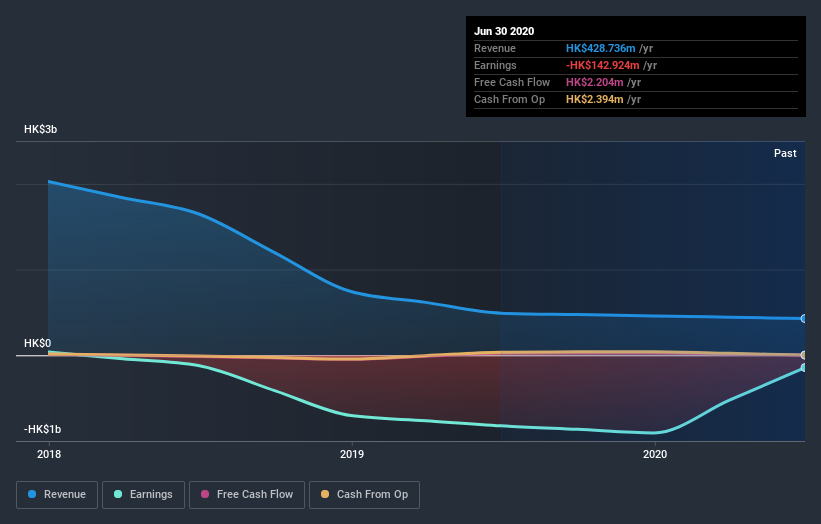

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Bisu Technology Group International stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Bisu Technology Group International shareholders have received a total shareholder return of 138% over the last year. That's better than the annualised return of 4% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Bisu Technology Group International has 4 warning signs (and 2 which are significant) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Bisu Technology Group International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1372

China Carbon Neutral Development Group

An investment holding company, engages in the civil engineering and construction business in Hong Kong, Macau, and Mainland China.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives