Examining BYD’s Value Amid 7% Weekly Drop and Growing EV Competition

Reviewed by Bailey Pemberton

- Curious whether BYD's share price truly reflects its real value? Let’s cut through the noise and dig in together.

- While BYD stock is up 10.6% so far this year and has gained 9.0% over the last 12 months, it has seen some turbulence in the short term, dropping 7.4% this week and 8.4% in the past month.

- Recent headlines around shifting electric vehicle market dynamics and evolving government policies are adding layers of complexity to BYD’s story. News of increased competition in China and international expansion plans have been front and center for investors, helping explain the recent price swings.

- On our valuation check, BYD scores 1 out of 6 for being undervalued. Now, let's take a look at the traditional ways BYD is valued in the market. Be sure to read to the end for a fresh perspective on finding a stock's true worth.

BYD scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BYD Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates a company’s intrinsic value by projecting its future cash flows and then discounting those back to today’s value. This approach aims to reflect what BYD is actually worth, based on the cash it is expected to generate over time.

BYD’s current Free Cash Flow sits at a deficit of about CN¥29 Billion, but analyst forecasts suggest a turnaround. Projections indicate BYD’s Free Cash Flow could rise to approximately CN¥72 Billion by 2027. While only five years of analyst estimates are used, projections continue out ten years by extrapolating growth trends and expecting Free Cash Flow to reach over CN¥101 Billion by 2035. All figures are in Chinese Yuan (CN¥).

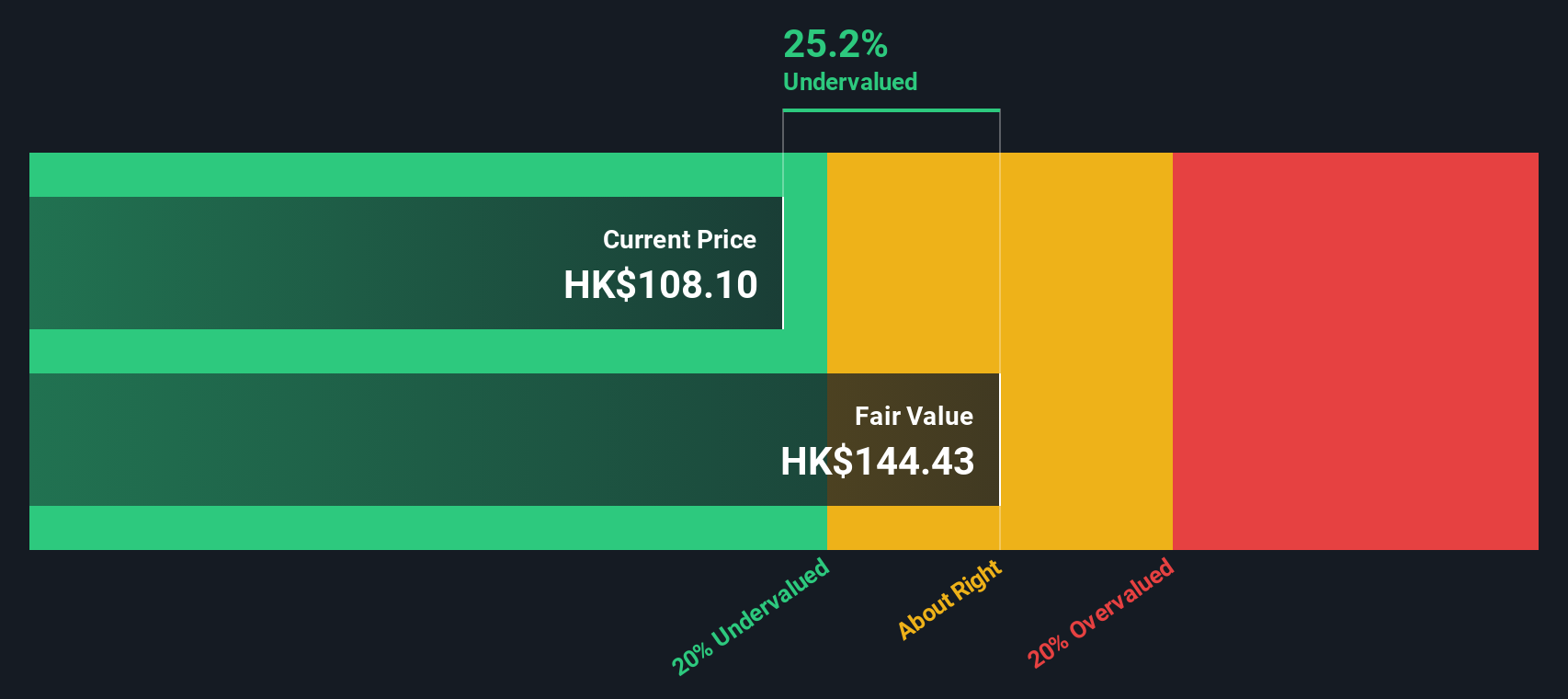

Bringing those future cash flows back to today's value, the DCF model estimates BYD’s intrinsic fair value at HK$111.39 per share. With the current share price trading about 14.5% below this level, the data suggest BYD stock is undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BYD is undervalued by 14.5%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: BYD Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for companies that are generating profits, like BYD. It shows how much investors are willing to pay for each dollar of earnings, making it a practical way to measure whether a stock’s price is reasonable given its ability to generate profit.

Interpreting a "fair" PE ratio depends on several factors. Companies with higher expected earnings growth, lower risk, and strong competitive positions generally justify higher PE ratios. On the other hand, riskier or slower-growing companies tend to trade at lower PE multiples.

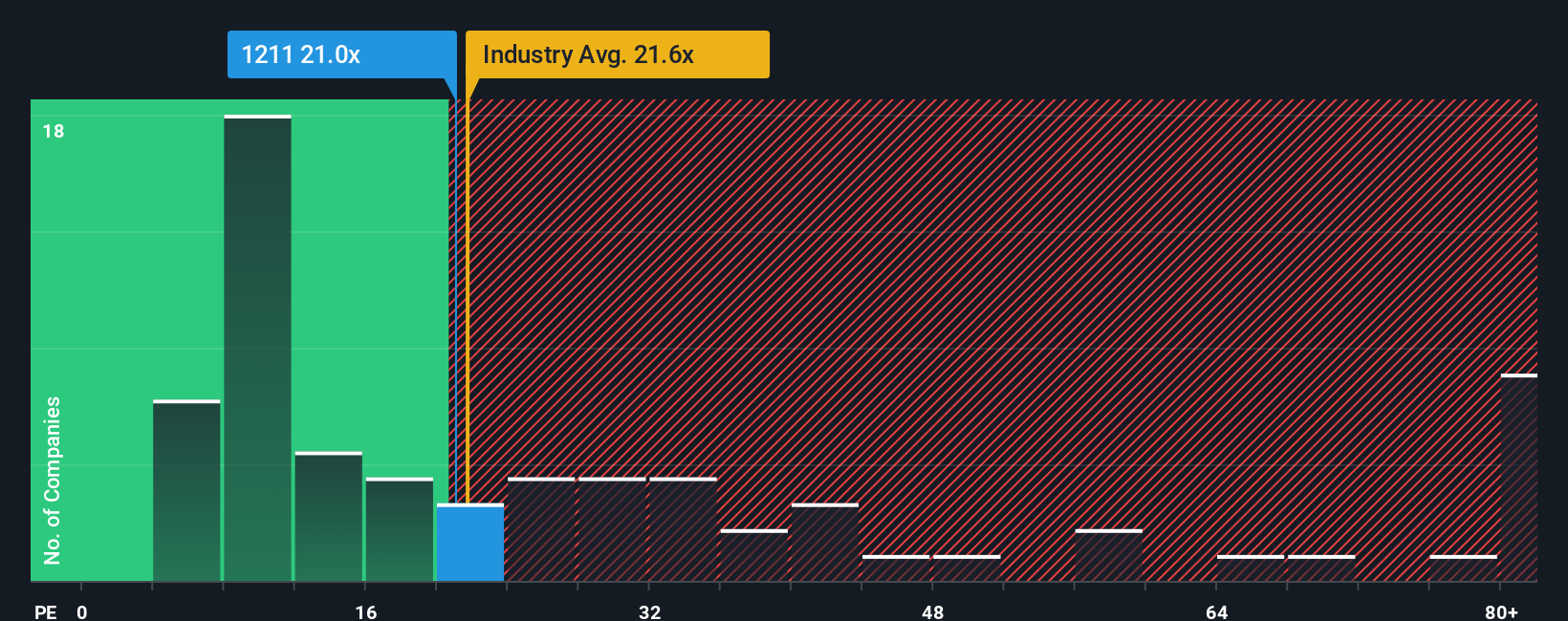

BYD’s current PE stands at 20.7x. This is above the average PE for the Auto industry of 17.8x and significantly higher than the average for its peers, which sits at 8.7x. However, simply comparing BYD’s PE to those averages can be misleading, since it does not consider BYD’s specific growth outlook, risks, or profitability.

This is where the "Fair Ratio" from Simply Wall St comes into play. The Fair Ratio (17.2x) calculates the PE multiple a stock should trade at, factoring in elements like earnings growth, market cap, profit margins, and industry nuances. It provides a more tailored benchmark compared to the one-size-fits-all industry or peer averages.

Comparing BYD’s actual PE (20.7x) with its Fair Ratio (17.2x), the stock is trading above what the company’s fundamentals currently justify. This suggests that, based on this approach, BYD may be overvalued at today’s levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BYD Narrative

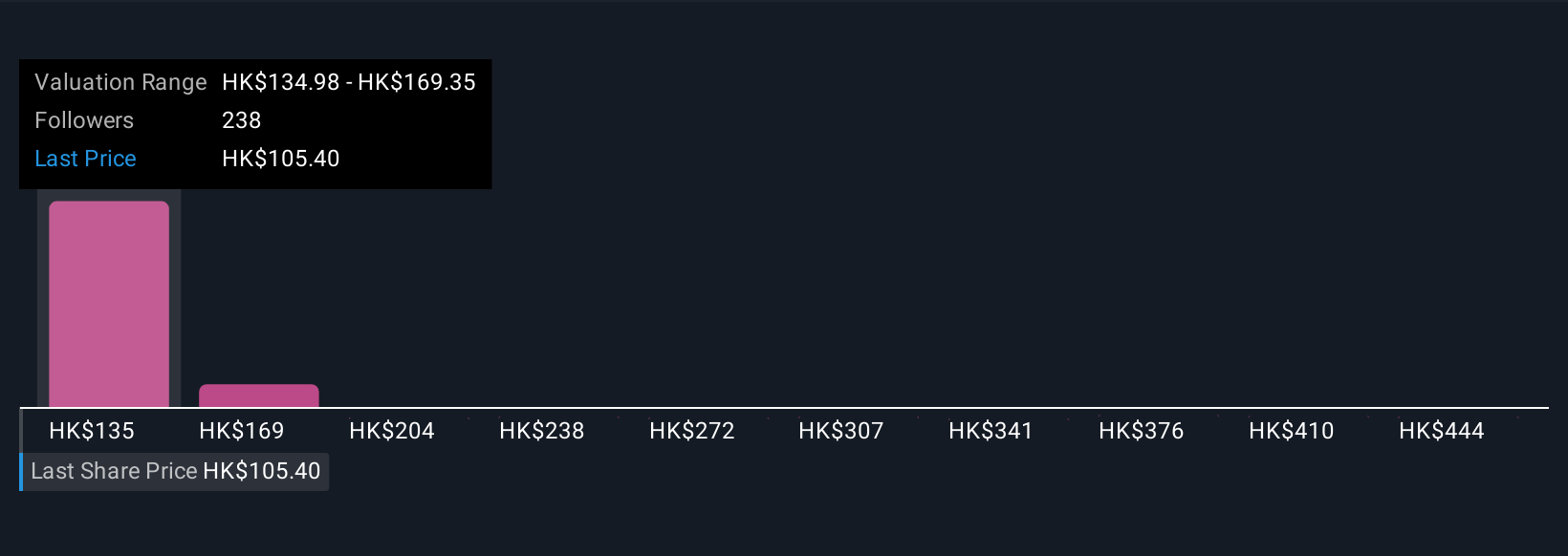

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is an investor’s personal story or perspective about a company, linking its current position and potential future to a financial forecast that arrives at a fair value. This is essentially the “why” behind the numbers. With Narratives on Simply Wall St’s Community page, millions of investors can easily create and update their own forecasts, blending insights like future revenue, earnings, and margins with a clear story about the business.

Narratives let you compare your own fair value for BYD to where the stock is trading right now, helping you decide when it might be a good time to buy or sell. Best of all, they update automatically as new information such as news or earnings emerges, keeping your investment thesis fresh and relevant. For example, one Narrative for BYD forecasts a fair value of HK$127 per share based on strong global expansion, while another estimates just HK$95 due to rising competition and regulatory changes.

Do you think there's more to the story for BYD? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives