BYD (SEHK:1211): Revisiting Valuation After Latest Vehicle Delivery Update

Reviewed by Simply Wall St

BYD (SEHK:1211) shares showed modest movement today, drawing investor attention after the company posted updated figures on vehicle deliveries. Recent trends in the electric vehicle sector, along with these latest numbers, have prompted closer scrutiny of BYD’s growth prospects.

See our latest analysis for BYD.

Investor sentiment appears to be rebounding for BYD, with the latest delivery update helping to sustain momentum from earlier in the year. Although the 1-day and 7-day share price returns show short-term gains, longer-term performance remains impressive, as highlighted by a 16.31% year-to-date share price return and a 55.11% total shareholder return over three years. Recent events suggest market optimism is growing once again around BYD's outlook, especially as the company continues to deliver steady growth in a competitive sector.

If the interest in BYD's recent moves has you looking for more automotive standouts, now is the perfect time to discover See the full list for free.

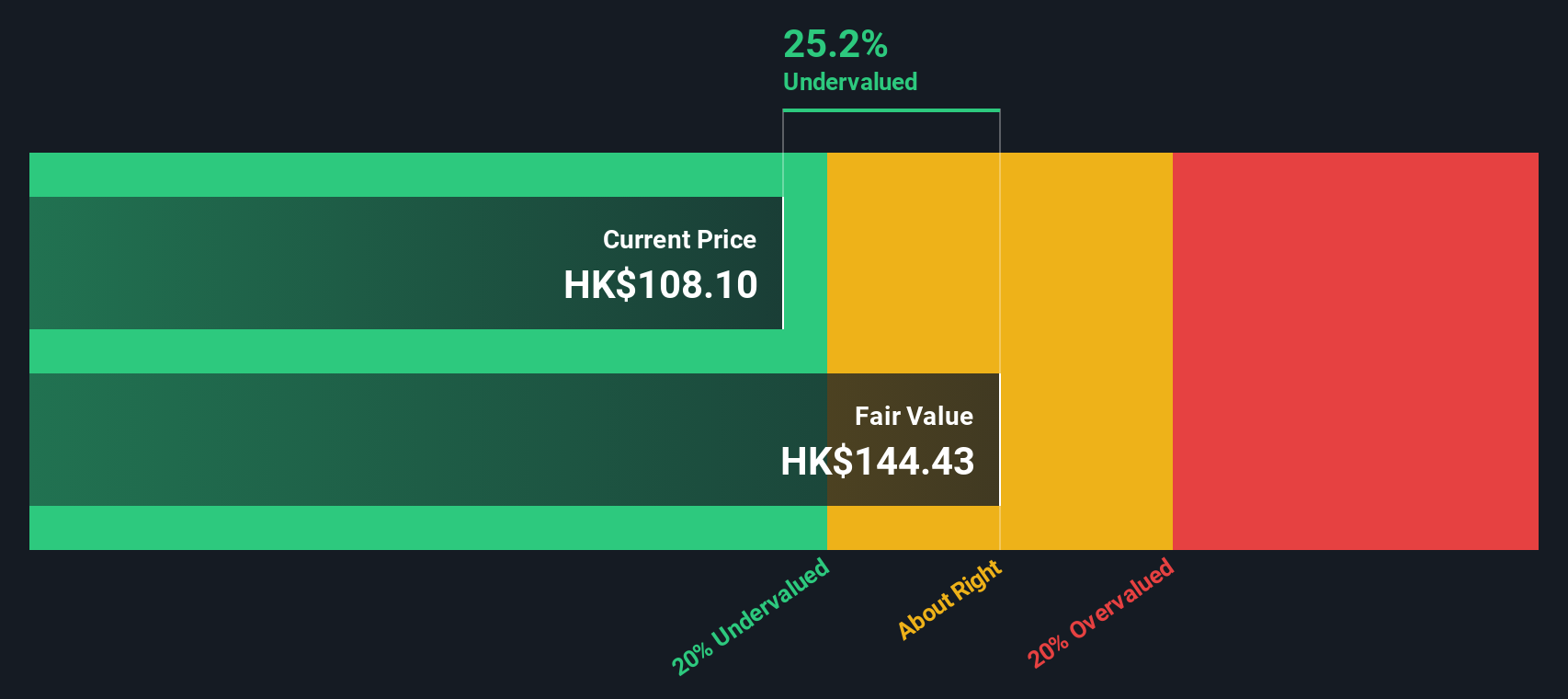

With shares still trading at a notable discount to analyst price targets and recent growth figures in mind, the question for investors is whether BYD remains undervalued or if future growth is already fully reflected in the current price.

Price-to-Earnings of 21.6x: Is it justified?

BYD’s shares currently trade at a price-to-earnings (P/E) ratio of 21.6x, a figure that places it above key peer and industry benchmarks. This elevated P/E level suggests that investors are paying a premium relative to its earnings compared to competitors in the Asian auto sector and among its direct peers.

The P/E ratio compares a company’s stock price to its per-share earnings, making it a widely referenced metric for valuing established firms like BYD. For the auto industry, where cyclicality and rapid innovation are factors, a higher P/E ratio can reflect growth expectations, brand strength, or lower perceived risks. However, it can also indicate that the stock may be overvalued if its future earnings growth does not outpace peers.

Despite BYD’s P/E of 21.6x, this valuation is expensive when stacked against both the Asian Auto industry average of 18.5x and a peer average of just 8.8x. The SWS fair price-to-earnings ratio is estimated at 14.7x, casting BYD’s current level as a potential outlier the market could eventually correct toward.

Explore the SWS fair ratio for BYD

Result: Price-to-Earnings of 21.6x (OVERVALUED)

However, slower revenue growth or sector-wide margin pressure could challenge BYD’s ability to maintain premium valuations in the months ahead.

Find out about the key risks to this BYD narrative.

Another View: What Does the SWS DCF Model Say?

While the price-to-earnings comparison suggests BYD is overvalued right now, our SWS DCF model offers a different perspective. This method indicates that shares are trading about 10.6% below their fair value, which raises the possibility that the market may be undervaluing BYD’s long-term cash generation potential. Which method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BYD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BYD Narrative

If you'd like to dig into the numbers yourself or craft a perspective that better matches your outlook, you can design your own in just a few minutes. Do it your way

A great starting point for your BYD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and stay ahead of the curve by stepping into new investment frontiers. You can find unexpected opportunities that others are missing.

- Tap into high-yield potential with these 14 dividend stocks with yields > 3%, which offers robust payouts above the market average.

- Uncover early movers in artificial intelligence by checking out these 25 AI penny stocks, as these companies are transforming industries with innovative solutions.

- Capitalize on value by targeting market underdogs using these 928 undervalued stocks based on cash flows, a tool that screens for stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026