BYD (SEHK:1211) Margin Compression Raises Fresh Doubts on Quality of Earnings Growth Narrative

Reviewed by Simply Wall St

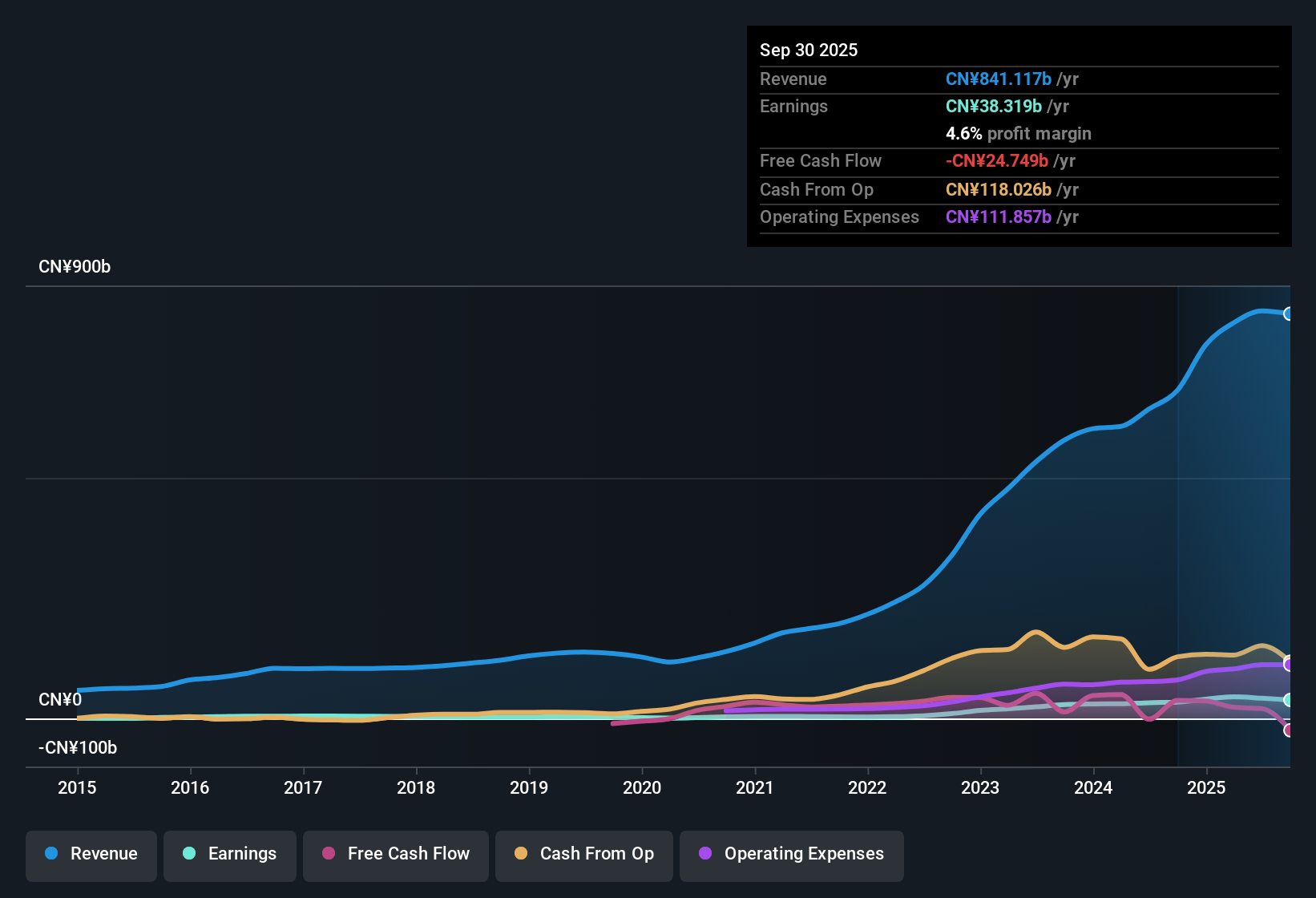

BYD (SEHK:1211) reported five-year annualized earnings growth of 47.1%, while more recent annual growth sits at 13.1%. With earnings projected to climb 18.84% per year and revenue expected to increase by 12.4% annually, both outpacing Hong Kong market averages, investors are watching these growth metrics closely. Net profit margins came in at 4.6%, down a touch from last year’s 5%, reflecting ongoing pressure but leaving room for optimism about forward momentum.

See our full analysis for BYD.Next up, we’ll put these results in the context of the market’s top narratives about BYD. We will look at where the data confirms the story, and where it might prompt a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Edge Lower as Competition Intensifies

- Net profit margins declined to 4.6%, slightly below last year’s 5%. This highlights how competitive pressures in the auto sector are weighing on profitability even as sales expand.

- Market analysis points out that, despite robust revenue growth forecasts, the ongoing domestic price war and aggressive discounting in China continue to pressure earnings durability.

- Peers are resorting to discounts and price wars, making it harder for BYD to sustain previous margin levels.

- Even with BYD’s operational scale, narrowing margins may challenge bullish expectations for profit quality if competitive pricing continues.

High Non-Cash Earnings Add Risk to Profit Quality

- BYD’s only flagged material risk from the filings is a high level of non-cash earnings, which can cause investors to scrutinize the sustainability and reliability of reported profits.

- Prevailing investor discussion centers on how persistent reliance on non-cash items, even against a backdrop of projection-beating growth rates, might undermine the strength of future cash flows.

- Critics highlight that if non-cash earnings form a large part of profits, headline growth could be less valuable to shareholders than it appears.

- The company’s projected 18.8% annual earnings growth could see its quality questioned until non-cash elements are addressed or clarified in future disclosures.

Trading at a Discount to DCF Fair Value, but Premium to Peers

- At HK$100.60, BYD trades below its DCF fair value of HK$119.14 and well under the analyst price target of HK$132.66. However, its price-to-earnings ratio of 21.9x remains more than double the peer average of 9.6x.

- Analysts note that, while the stock offers apparent value against its modeled fair value and targets, investors must reconcile the industry premium on earnings multiples with the risk that further margin compression could justify lower valuations.

- The gap between market price and fair value supports a positive valuation story, but the premium PE suggests any disappointments on profitability or growth could prompt a rapid re-rating.

- Context within the Asian auto sector signals that BYD’s leadership status supports higher multiples, but questions linger about whether current growth rates can persist amid structural margin headwinds.

📊 Read the full BYD Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BYD's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust revenue growth projections, BYD’s slipping profit margins and reliance on non-cash earnings cast doubt on the quality and stability of its future profits.

If you’re looking to avoid uncertain profit quality and margin pressure, focus on steadier investments by seeking out companies with consistent results and reliable growth using our stable growth stocks screener (2103 results) today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives