BYD (SEHK:1211) Is Down 6.2% After Rising Sales But Falling Profit—What's Driving the Divergence?

Reviewed by Sasha Jovanovic

- BYD Company Limited has released earnings results for the nine months ended September 30, 2025, reporting sales and revenue of CNY 566.27 billion, an increase from CNY 502.25 billion a year earlier.

- Despite higher sales, net income for the period decreased to CNY 23.33 billion from CNY 25.24 billion, highlighting pressure on profitability as the company grows.

- We'll explore how BYD's continued revenue growth alongside declining net income shapes the company's investment narrative going forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is BYD's Investment Narrative?

For anyone considering BYD as a long-term holding, the belief centers on the company’s ability to scale its electric vehicle, battery, and related technology businesses beyond existing markets, while maintaining margin stability. The latest nine-month earnings report revealed revenue growth to CNY 566.27 billion, yet net income slid to CNY 23.33 billion. This shift puts new focus on profitability risks, especially as recent quarters had shown healthy growth. With analysts previously highlighting solid earnings momentum, the new results may challenge assumptions about short-term catalysts such as new product launches or European expansion driving profit improvements. While growth drivers like international factory rollouts and automotive partnerships remain, fading margins could temper bullish sentiment until BYD proves it can convert rising sales into stronger bottom-line results in future updates. Yet even strong revenue growth can bring questions about profit sustainability.

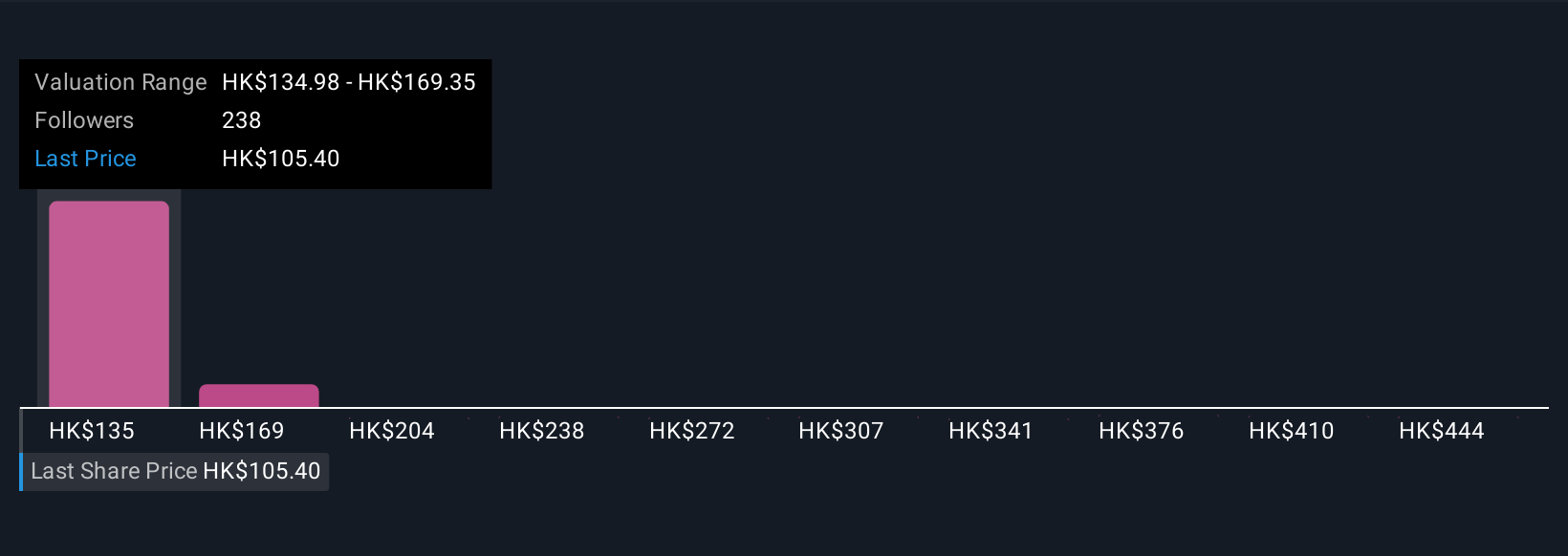

Despite retreating, BYD's shares might still be trading 17% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 26 other fair value estimates on BYD - why the stock might be worth just HK$118.73!

Build Your Own BYD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BYD research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BYD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BYD's overall financial health at a glance.

No Opportunity In BYD?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives