BYD (SEHK:1211): Evaluating Valuation Following Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for BYD.

Stepping back, BYD’s 7-day share price decline comes after a year of strong momentum. The stock is still up more than 11% year-to-date and has delivered a solid 9.8% total shareholder return over the past twelve months. Despite short-term pullbacks, the longer-term picture continues to show healthy gains and a resilient uptrend.

If you’re watching what’s happening in autos and EVs, this is a good chance to check out what’s moving among carmakers. See the full list with See the full list for free.

But with the share price still well below analyst targets and strong earnings growth behind it, the key question is whether BYD shares are undervalued at these levels or if the market has already priced in future gains.

Price-to-Earnings of 20.8x: Is it justified?

BYD shares trade at a price-to-earnings (P/E) ratio of 20.8x, which puts the current HK$96.05 price at a premium compared to both the industry and peer group.

The price-to-earnings ratio compares a company's current share price to its per-share earnings. It is widely used to gauge how the market values a business's profitability relative to competitors, especially in auto manufacturing where profits can swing sharply with the industry cycle.

With BYD's P/E ratio significantly above the regional auto industry average of 18.3x and even further above the peer average of just 8.7x, investors appear to be pricing in stronger growth prospects or a premium brand position. However, these elevated multiples may reflect ambitious expectations, particularly as the fair P/E is estimated at 17.3x. The stock could revert toward this level if future growth cools.

Explore the SWS fair ratio for BYD

Result: Price-to-Earnings of 20.8x (OVERVALUED)

However, ongoing market volatility and any potential slowdown in revenue or net income growth could quickly challenge the current optimism around BYD shares.

Find out about the key risks to this BYD narrative.

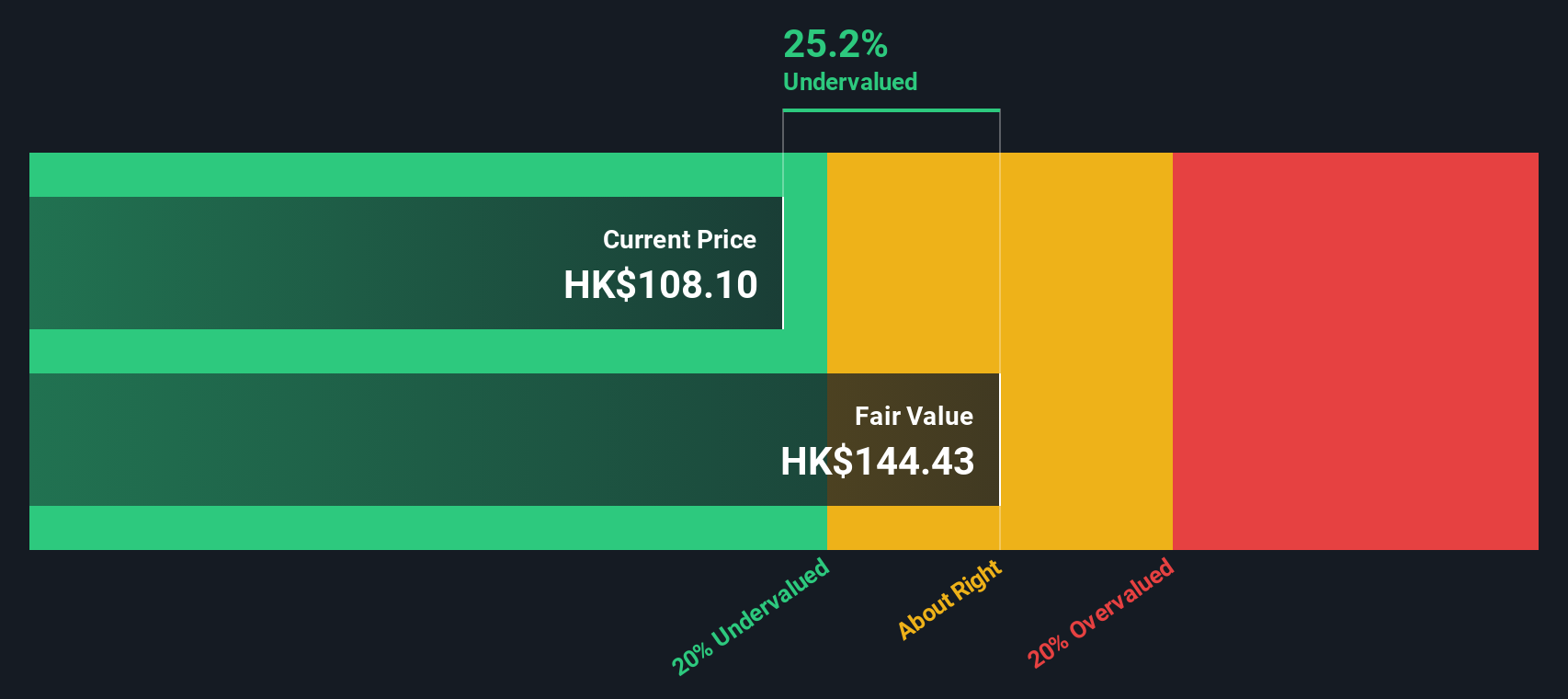

Another View: Undervalued by Our DCF Model

While BYD’s current price-to-earnings ratio appears expensive compared to the industry and its peers, our SWS DCF model provides a different perspective. It indicates the stock is trading 14% below its fair value, which could suggest potential upside. Does the longer-term cash flow outlook reveal an opportunity that traditional multiples overlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BYD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BYD Narrative

If you want to dig into the numbers yourself or approach this from a different angle, you can build your own view in just a few minutes. Do it your way

A great starting point for your BYD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next winning idea slip away. Take action today with Simply Wall Street's powerful screeners and uncover stocks set for the future.

- Unlock the potential for outperformance with these 908 undervalued stocks based on cash flows that are flying under the radar based on strong future cash flows.

- Capitalize on the digital finance movement by checking out these 81 cryptocurrency and blockchain stocks transforming global transactions and security.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3% offering yields above 3% and solid long-term prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives