- Hong Kong

- /

- Auto Components

- /

- SEHK:1057

Zhejiang Shibao (SEHK:1057) Revenue Growth Outlook Reinforces Bullish Sentiment Despite Margin Pressure

Reviewed by Simply Wall St

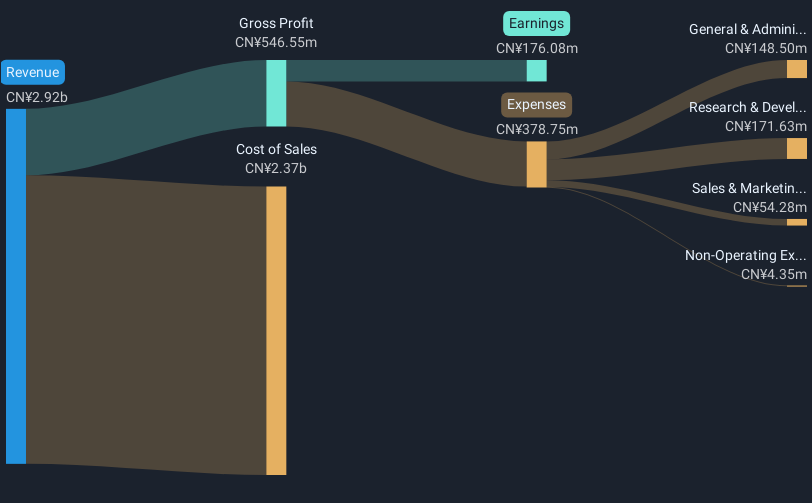

Zhejiang Shibao (SEHK:1057) delivered a 25.8% earnings growth over the past year, although this trails its impressive five-year average of 50%. Forecasts point to revenue growth of 20.3% per year, well ahead of the Hong Kong market's 8.6% average. Net profit margins softened, slipping from 6% last year to 5.6% this period, but the company’s earnings quality remains high.

See our full analysis for Zhejiang Shibao.Next, we will see how these earnings results measure up against the dominant narratives that investors have been circulating. This sharpens the focus on what is driving sentiment and what could shift expectations from here.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Earnings Ratio Above Peers, Below Sector Average

- Zhejiang Shibao trades at a Price-to-Earnings (P/E) ratio of 19.7x, which is higher than the peer group average of 11.5x but below the Asian Auto Components sector average of 22.8x.

- Investors often focus on P/E multiples as a signal for valuation. In this case,

- the company's current P/E shows the market is willing to pay a premium compared to direct competitors but not to the entire industry. This could reflect sector optimism rather than a specific company advantage, and

- those looking for re-rating potential will want to see Shibao improve profitability or secure new growth drivers to justify moving closer to the sector average.

No Significant Risks Identified for Now

- The latest filings report no material new risks flagged for Zhejiang Shibao in the most recent period, which is noteworthy given sector-wide competitive and margin pressures.

- In this context,

- the lack of flagged risks challenges bearish claims that input cost inflation or supply chain challenges would immediately threaten near-term stability, and

- the company’s strong revenue outlook of 20.3% annual growth also helps explain why bears have little new downside to point to this quarter.

Current Share Price Above DCF Fair Value

- Zhejiang Shibao’s share price is HK$4.90, which is about 27% above its estimated DCF fair value of HK$3.86.

- The prevailing market view points to

- the fact that shares are valued higher than a fundamentals-based calculation might suggest, which supports the idea that investors are either pricing in more future upside or responding to broader auto sector momentum, and

- although the P/E is below the sector average, the premium to DCF fair value could become a topic of discussion if growth underdelivers, given recent margin softening.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Zhejiang Shibao's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Zhejiang Shibao’s share price sits above its DCF fair value and recent margin softness raises questions about future growth delivery, valuation may be a concern.

If you’re seeking stocks with a stronger value case, check out these 870 undervalued stocks based on cash flows to discover companies that market fundamentals suggest are truly trading at a discount right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Shibao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1057

Zhejiang Shibao

Researches, designs, develops, manufactures, and sells automotive steering systems and accessories in the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives