These 4 Measures Indicate That Aegean Airlines (ATH:AEGN) Is Using Debt Reasonably Well

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Aegean Airlines S.A. (ATH:AEGN) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Aegean Airlines

What Is Aegean Airlines's Debt?

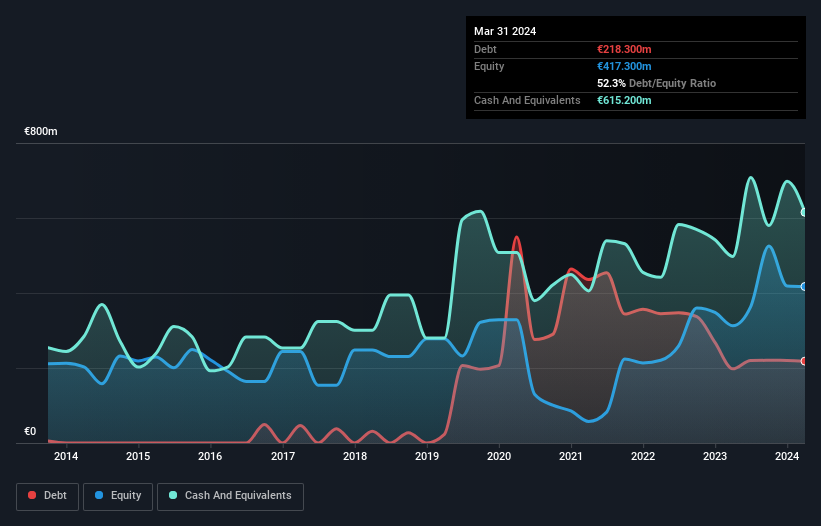

As you can see below, at the end of March 2024, Aegean Airlines had €218.3m of debt, up from €197.7m a year ago. Click the image for more detail. However, its balance sheet shows it holds €615.2m in cash, so it actually has €396.9m net cash.

A Look At Aegean Airlines' Liabilities

The latest balance sheet data shows that Aegean Airlines had liabilities of €833.3m due within a year, and liabilities of €1.31b falling due after that. Offsetting these obligations, it had cash of €615.2m as well as receivables valued at €107.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €1.42b.

When you consider that this deficiency exceeds the company's €990.5m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Given that Aegean Airlines has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

It is well worth noting that Aegean Airlines's EBIT shot up like bamboo after rain, gaining 42% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Aegean Airlines can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Aegean Airlines may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Aegean Airlines actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

Although Aegean Airlines's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €396.9m. The cherry on top was that in converted 222% of that EBIT to free cash flow, bringing in €328m. So we are not troubled with Aegean Airlines's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Aegean Airlines is showing 2 warning signs in our investment analysis , and 1 of those is significant...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ATSE:AEGN

Aegean Airlines

Operates as an airline company that engages in the provision of public airline transportation services in Greece and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives