- Greece

- /

- Real Estate

- /

- ATSE:LAMDA

Cautious Investors Not Rewarding LAMDA Development S.A.'s (ATH:LAMDA) Performance Completely

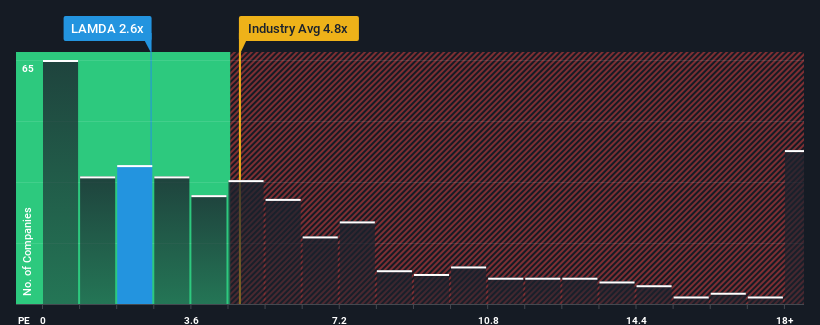

You may think that with a price-to-sales (or "P/S") ratio of 2.6x LAMDA Development S.A. (ATH:LAMDA) is definitely a stock worth checking out, seeing as almost half of all the Real Estate companies in Greece have P/S ratios greater than 10.2x and even P/S above 18x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for LAMDA Development

What Does LAMDA Development's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, LAMDA Development has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think LAMDA Development's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as LAMDA Development's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 217%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 111% during the coming year according to the two analysts following the company. That would be an excellent outcome when the industry is expected to decline by 7.5%.

In light of this, it's quite peculiar that LAMDA Development's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What Does LAMDA Development's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of LAMDA Development's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with LAMDA Development (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on LAMDA Development, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:LAMDA

LAMDA Development

Lamda Development S.A., together with its subsidiaries, engages in the investment in, development, and project management activities in the commercial real estate market in Greece and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives