Further Upside For VIS Containers Manufacturing Co. Ltd (ATH:VIS) Shares Could Introduce Price Risks After 42% Bounce

VIS Containers Manufacturing Co. Ltd (ATH:VIS) shares have continued their recent momentum with a 42% gain in the last month alone. But the last month did very little to improve the 55% share price decline over the last year.

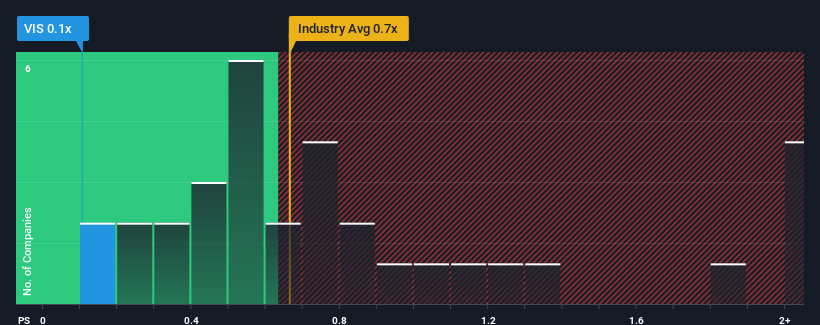

Even after such a large jump in price, given about half the companies operating in Greece's Packaging industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider VIS Containers Manufacturing as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for VIS Containers Manufacturing

How Has VIS Containers Manufacturing Performed Recently?

The revenue growth achieved at VIS Containers Manufacturing over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on VIS Containers Manufacturing will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For VIS Containers Manufacturing?

The only time you'd be truly comfortable seeing a P/S as low as VIS Containers Manufacturing's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen a 22% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 1.0% shows it's noticeably more attractive.

With this in mind, we find it intriguing that VIS Containers Manufacturing's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From VIS Containers Manufacturing's P/S?

Despite VIS Containers Manufacturing's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see VIS Containers Manufacturing currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for VIS Containers Manufacturing you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:VIS

Very low and overvalued.

Market Insights

Community Narratives