Thrace Plastics Holding (ATH:PLAT) Is Increasing Its Dividend To €0.17

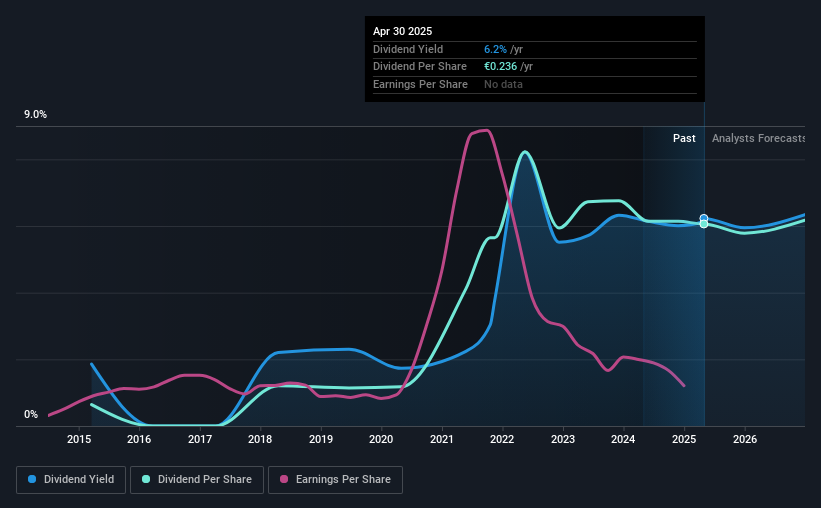

Thrace Plastics Holding Company S.A. (ATH:PLAT) has announced that it will be increasing its periodic dividend on the 16th of June to €0.17, which will be 0.7% higher than last year's comparable payment amount of €0.169. This takes the dividend yield to 6.2%, which shareholders will be pleased with.

Our free stock report includes 2 warning signs investors should be aware of before investing in Thrace Plastics Holding. Read for free now.Thrace Plastics Holding's Payment Could Potentially Have Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, the company's dividend was much higher than its earnings. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Looking forward, earnings per share is forecast to rise by 102.1% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 59%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

See our latest analysis for Thrace Plastics Holding

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was €0.025 in 2015, and the most recent fiscal year payment was €0.236. This implies that the company grew its distributions at a yearly rate of about 25% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Thrace Plastics Holding has seen EPS rising for the last five years, at 7.9% per annum. However, the company isn't reinvesting a lot back into the business, so we would expect the growth rate to slow down somewhat in the future.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments are bit high to be considered sustainable, and the track record isn't the best. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Thrace Plastics Holding (of which 1 is a bit unpleasant!) you should know about. Is Thrace Plastics Holding not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Thrace Plastics Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:PLAT

Thrace Plastics Holding

Produces and distributes polypropylene products in Greece and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026