- Greece

- /

- Metals and Mining

- /

- ATSE:IKTIN

Are Iktinos Hellas Greek Marble Industry Technical and Touristic's (ATH:IKTIN) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Iktinos Hellas Greek Marble Industry Technical and Touristic's (ATH:IKTIN) statutory profits are a good guide to its underlying earnings.

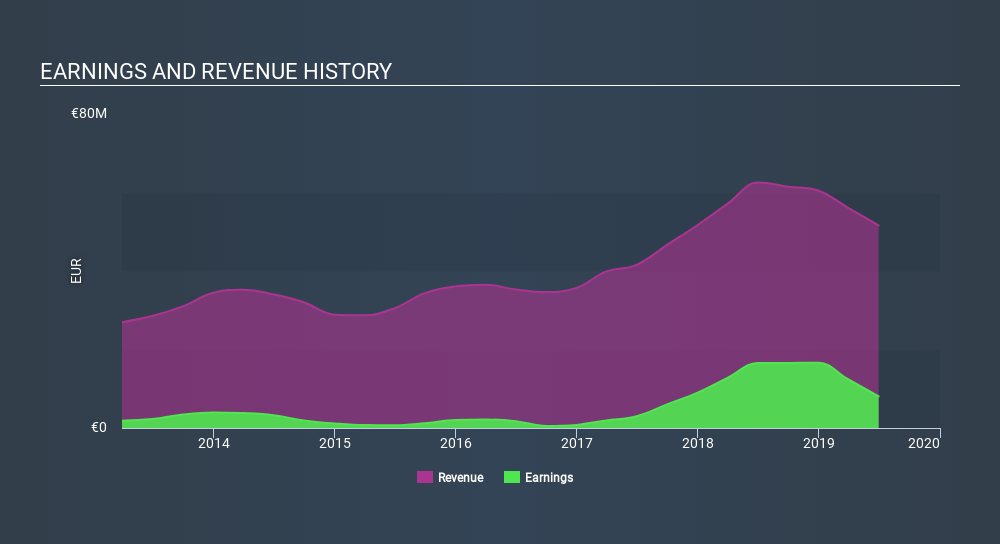

We like the fact that Iktinos Hellas Greek Marble Industry Technical and Touristic made a profit of €8.08m on its revenue of €51.6m, in the last year. Happily, it has grown both its profit and revenue over the last three years (but not in the last year), as you can see in the chart below.

View our latest analysis for Iktinos Hellas Greek Marble Industry Technical and Touristic

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. So today we'll look at what Iktinos Hellas Greek Marble Industry Technical and Touristic's cashflow tells us about the quality of its earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Iktinos Hellas Greek Marble Industry Technical and Touristic's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Iktinos Hellas Greek Marble Industry Technical and Touristic has an accrual ratio of 0.22 for the year to June 2019. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had negative free cash flow of €8.0m, in contrast to the aforementioned profit of €8.08m. It's worth noting that Iktinos Hellas Greek Marble Industry Technical and Touristic generated positive FCF of €16m a year ago, so at least they've done it in the past.

Our Take On Iktinos Hellas Greek Marble Industry Technical and Touristic's Profit Performance

Iktinos Hellas Greek Marble Industry Technical and Touristic's accrual ratio for the last twelve months signifies cash conversion is less than ideal, which is a negative when it comes to our view of its earnings. Because of this, we think that it may be that Iktinos Hellas Greek Marble Industry Technical and Touristic's statutory profits are better than its underlying earnings power. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. To help with this, we've discovered 7 warning signs (2 shouldn't be ignored!) that you ought to be aware of before buying any shares in Iktinos Hellas Greek Marble Industry Technical and Touristic.

Today we've zoomed in on a single data point to better understand the nature of Iktinos Hellas Greek Marble Industry Technical and Touristic's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:IKTIN

Iktinos Hellas Greek Marble Industry Technical and Touristic

Engages in the quarrying, processing, and trading in marbles and granites in Greece, the Euro Area, and internationally.

Slight risk with worrying balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success