The House of Agriculture Spiroy S.A. (ATH:SPIR) Might Not Be As Mispriced As It Looks After Plunging 26%

The House of Agriculture Spiroy S.A. (ATH:SPIR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

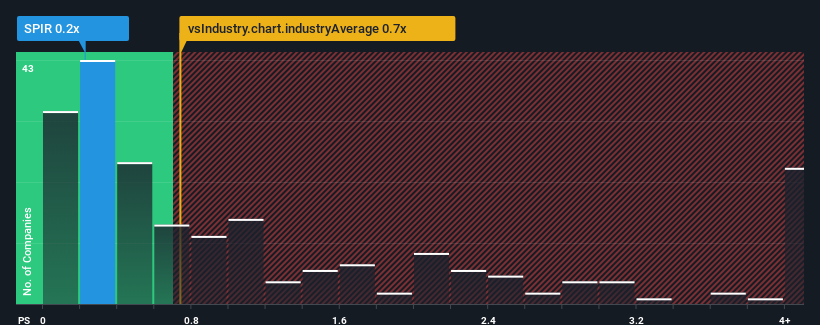

Although its price has dipped substantially, it's still not a stretch to say that House of Agriculture Spiroy's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Food industry in Greece, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for House of Agriculture Spiroy

How House of Agriculture Spiroy Has Been Performing

House of Agriculture Spiroy has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on House of Agriculture Spiroy will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on House of Agriculture Spiroy will help you shine a light on its historical performance.How Is House of Agriculture Spiroy's Revenue Growth Trending?

In order to justify its P/S ratio, House of Agriculture Spiroy would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 5.9% gain to the company's revenues. The latest three year period has also seen a 21% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.6% shows it's noticeably more attractive.

With this information, we find it interesting that House of Agriculture Spiroy is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does House of Agriculture Spiroy's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for House of Agriculture Spiroy looks to be in line with the rest of the Food industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that House of Agriculture Spiroy currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for House of Agriculture Spiroy that you need to be mindful of.

If these risks are making you reconsider your opinion on House of Agriculture Spiroy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if House of Agriculture Spiroy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:SPIR

House of Agriculture Spiroy

Engages in the research, production, and marketing of vegetable and crop seeds and seedlings.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026