- Greece

- /

- Oil and Gas

- /

- ATSE:ELPE

Analysts' Revenue Estimates For Hellenic Petroleum Holdings Societe Anonyme (ATH:ELPE) Are Surging Higher

Hellenic Petroleum Holdings Societe Anonyme (ATH:ELPE) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. Investor sentiment seems to be improving too, with the share price up 7.8% to €7.09 over the past 7 days. Could this big upgrade push the stock even higher?

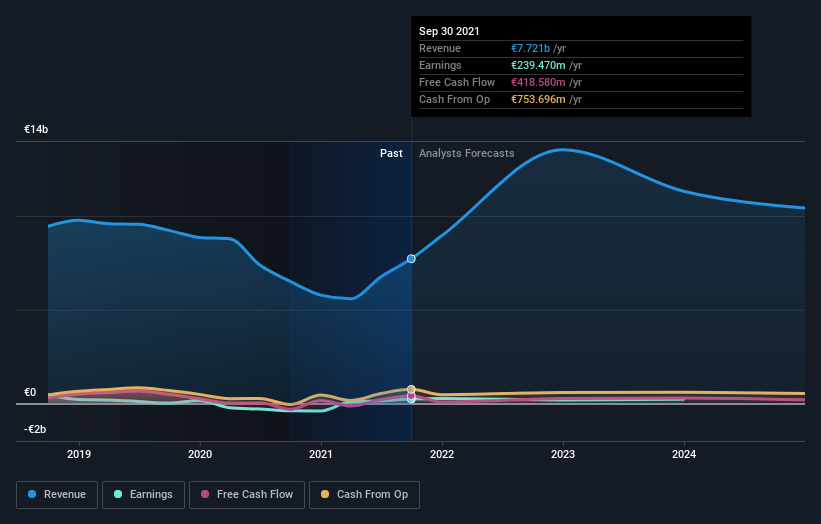

Following the upgrade, the latest consensus from Hellenic Petroleum Holdings Societe Anonyme's four analysts is for revenues of €14b in 2022, which would reflect a sizeable 75% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing €11b of revenue in 2022. The consensus has definitely become more optimistic, showing a sizeable gain to revenue forecasts.

Check out our latest analysis for Hellenic Petroleum Holdings Societe Anonyme

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. One thing stands out from these estimates, which is that Hellenic Petroleum Holdings Societe Anonyme is forecast to grow faster in the future than it has in the past, with revenues expected to display 75% annualised growth until the end of 2022. If achieved, this would be a much better result than the 1.5% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 2.6% annually. Not only are Hellenic Petroleum Holdings Societe Anonyme's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. The analysts also expect revenues to grow faster than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Hellenic Petroleum Holdings Societe Anonyme.

Analysts are clearly in love with Hellenic Petroleum Holdings Societe Anonyme at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as a weak balance sheet. For more information, you can click through to our platform to learn more about this and the 1 other warning sign we've identified .

We also provide an overview of the Hellenic Petroleum Holdings Societe Anonyme Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Valuation is complex, but we're here to simplify it.

Discover if HELLENiQ ENERGY Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ELPE

HELLENiQ ENERGY Holdings

Operates in the energy sector in Greece, the Southeastern Europe, and the East Mediterranean.

Good value with moderate growth potential.

Market Insights

Community Narratives