- Greece

- /

- Hospitality

- /

- ATSE:OPAP

Organization of Football Prognostics (ATH:OPAP) Could Easily Take On More Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Organization of Football Prognostics S.A. (ATH:OPAP) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Organization of Football Prognostics

What Is Organization of Football Prognostics's Debt?

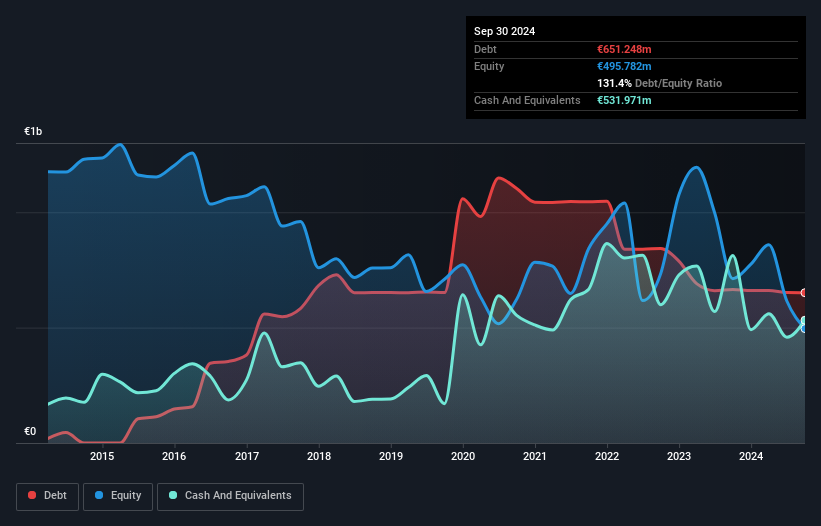

The chart below, which you can click on for greater detail, shows that Organization of Football Prognostics had €651.2m in debt in September 2024; about the same as the year before. However, it does have €532.0m in cash offsetting this, leading to net debt of about €119.3m.

How Strong Is Organization of Football Prognostics' Balance Sheet?

We can see from the most recent balance sheet that Organization of Football Prognostics had liabilities of €790.6m falling due within a year, and liabilities of €767.6m due beyond that. On the other hand, it had cash of €532.0m and €82.9m worth of receivables due within a year. So it has liabilities totalling €943.2m more than its cash and near-term receivables, combined.

Of course, Organization of Football Prognostics has a market capitalization of €5.64b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Organization of Football Prognostics has a low debt to EBITDA ratio of only 0.15. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. And we also note warmly that Organization of Football Prognostics grew its EBIT by 14% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Organization of Football Prognostics can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Organization of Football Prognostics recorded free cash flow worth a fulsome 100% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Organization of Football Prognostics's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Looking at the bigger picture, we think Organization of Football Prognostics's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Organization of Football Prognostics (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:OPAP

Organization of Football Prognostics

Organization of Football Prognostics S.A., along with its subsidiaries, operates and manages numerical lottery and sports betting games in Greece and Cyprus.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives